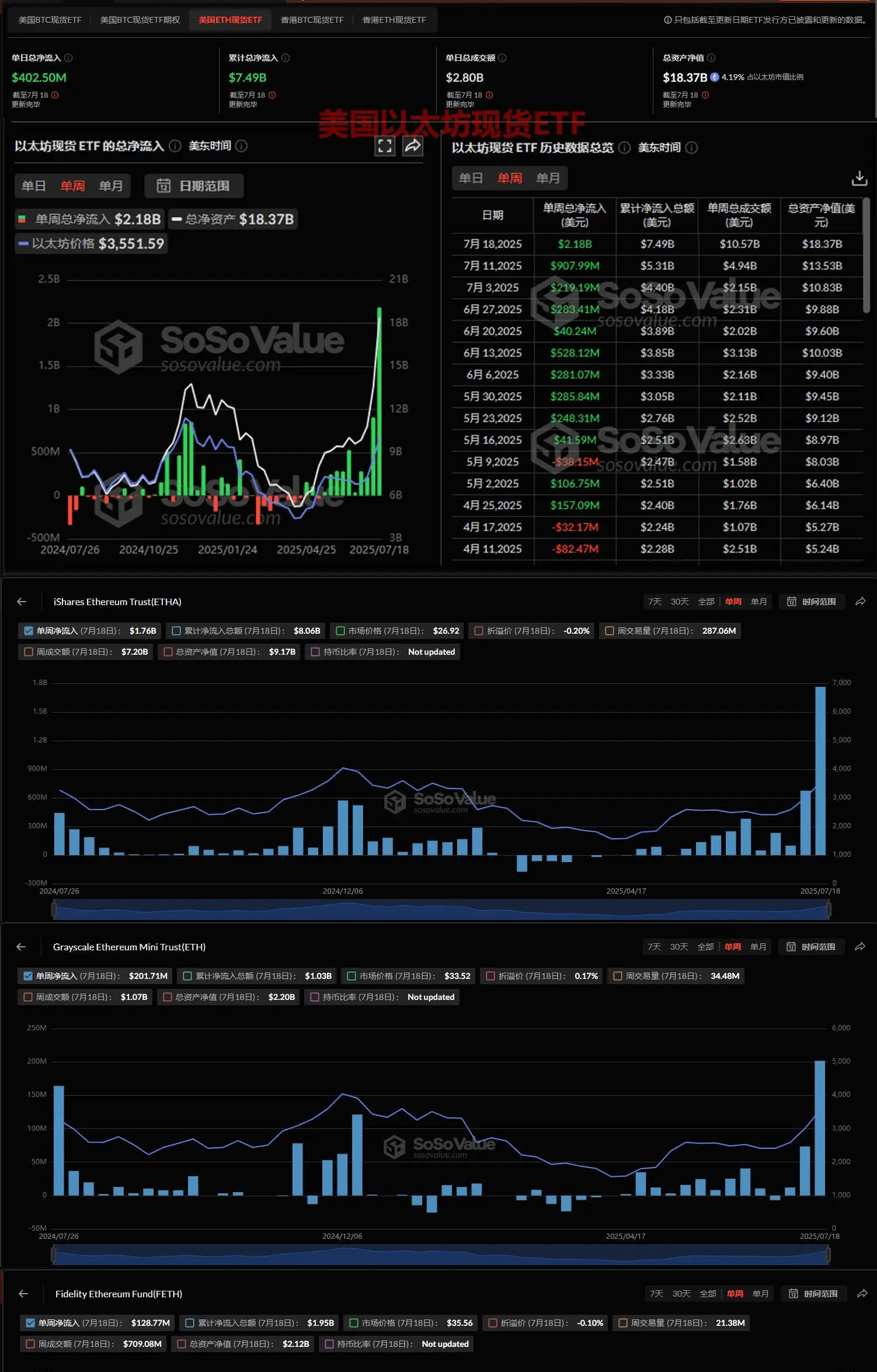

Over the past weekend, the cryptocurrency market showed new trends. The price of Ethereum (ETH) broke through the $3,770 mark, reflecting that investors are moving funds from Bitcoin to other major digital currencies.

At the same time, Solana (SOL) has also reached its highest point since February, hitting $203. This surge is mainly attributed to the block assembly market launched by Jito, which has injected new vitality into the Solana ecosystem.

The decentralized finance (DeFi) sector has also shown impressive performance. DeFi tokens represented by Uniswap and Aave have recorded significant

View OriginalAt the same time, Solana (SOL) has also reached its highest point since February, hitting $203. This surge is mainly attributed to the block assembly market launched by Jito, which has injected new vitality into the Solana ecosystem.

The decentralized finance (DeFi) sector has also shown impressive performance. DeFi tokens represented by Uniswap and Aave have recorded significant