GateUser-2a021513

A Few Facts and Advise for Those Who Want to Be Traders

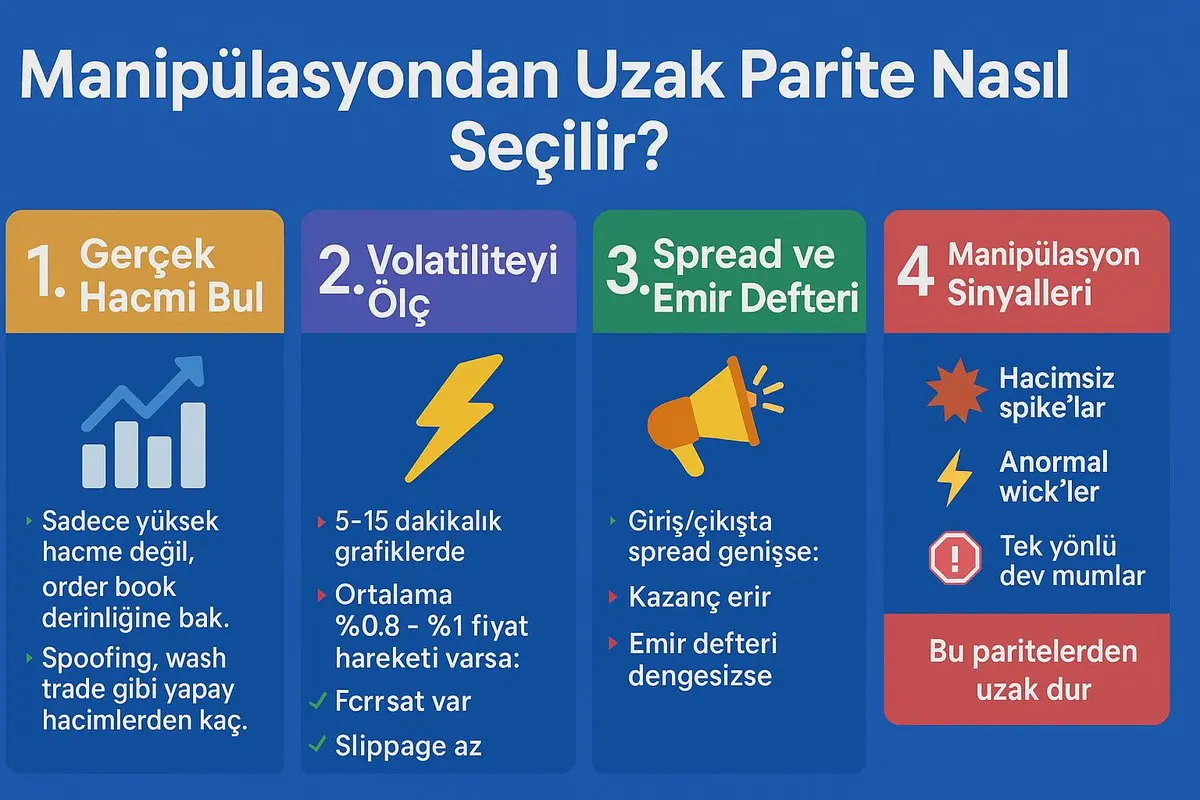

If you have not received any technical analysis training so far, and you do not understand how financial markets work, what liquidity, volatility, artificial orders, and algorithms mean, to put it clearly and straightforwardly, it would be healthier for you not to step into this market.

"If you're going to do it, do it knowing the truths"

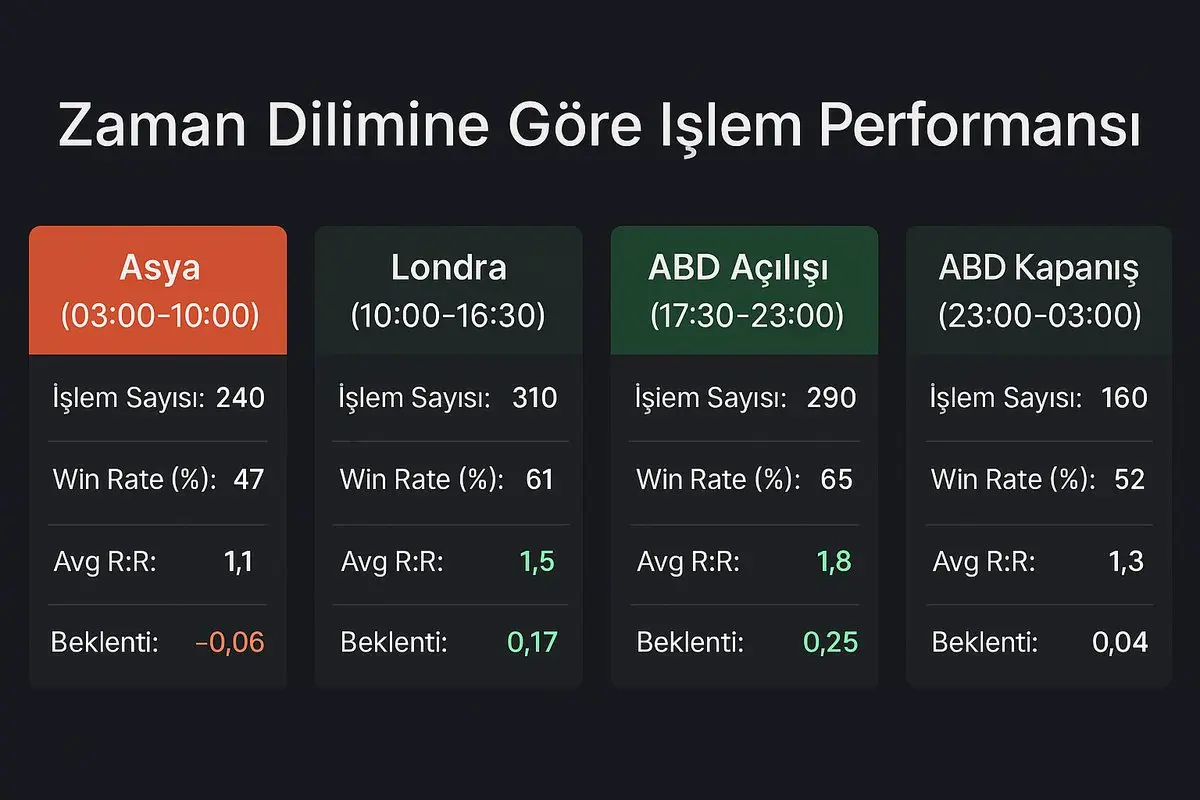

🔹 According to various research conducted on exchanges and crypto platforms:

76% of retail traders completely lose their capital or lose more than 70% within the first year.

The proportion of traders wh

View OriginalIf you have not received any technical analysis training so far, and you do not understand how financial markets work, what liquidity, volatility, artificial orders, and algorithms mean, to put it clearly and straightforwardly, it would be healthier for you not to step into this market.

"If you're going to do it, do it knowing the truths"

🔹 According to various research conducted on exchanges and crypto platforms:

76% of retail traders completely lose their capital or lose more than 70% within the first year.

The proportion of traders wh