DeFiWarhol

No content yet

DeFiWarhol

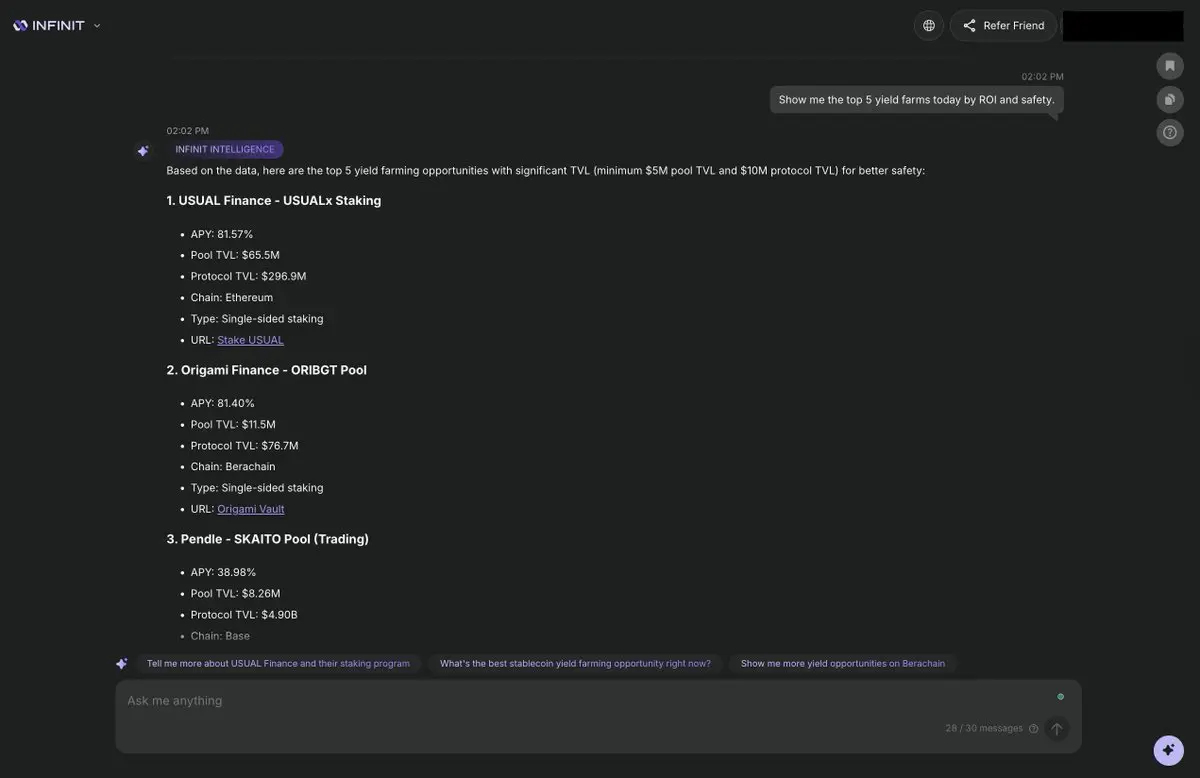

Why I put @QuaiNetwork in the Bear category:

- Unproven consensus design

Quai uses a multithreaded, merge-mined Proof-of-Work system that hasn't been stress-tested in practice, their decentralization and security claims are still theoretical.

- Heavy token concentration

The top 1% of wallets hold over 40% of $QUAI, which puts a huge risk on price and DAO manipulations.

- Very low dev activity

Onchain and GitHub metrics show minimal developer contributions post-launch.

- Regulatory red flags around “Energy-Backed Dollar”

Their energy-backed dollar may face serious pushback from regulators. It's

- Unproven consensus design

Quai uses a multithreaded, merge-mined Proof-of-Work system that hasn't been stress-tested in practice, their decentralization and security claims are still theoretical.

- Heavy token concentration

The top 1% of wallets hold over 40% of $QUAI, which puts a huge risk on price and DAO manipulations.

- Very low dev activity

Onchain and GitHub metrics show minimal developer contributions post-launch.

- Regulatory red flags around “Energy-Backed Dollar”

Their energy-backed dollar may face serious pushback from regulators. It's

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

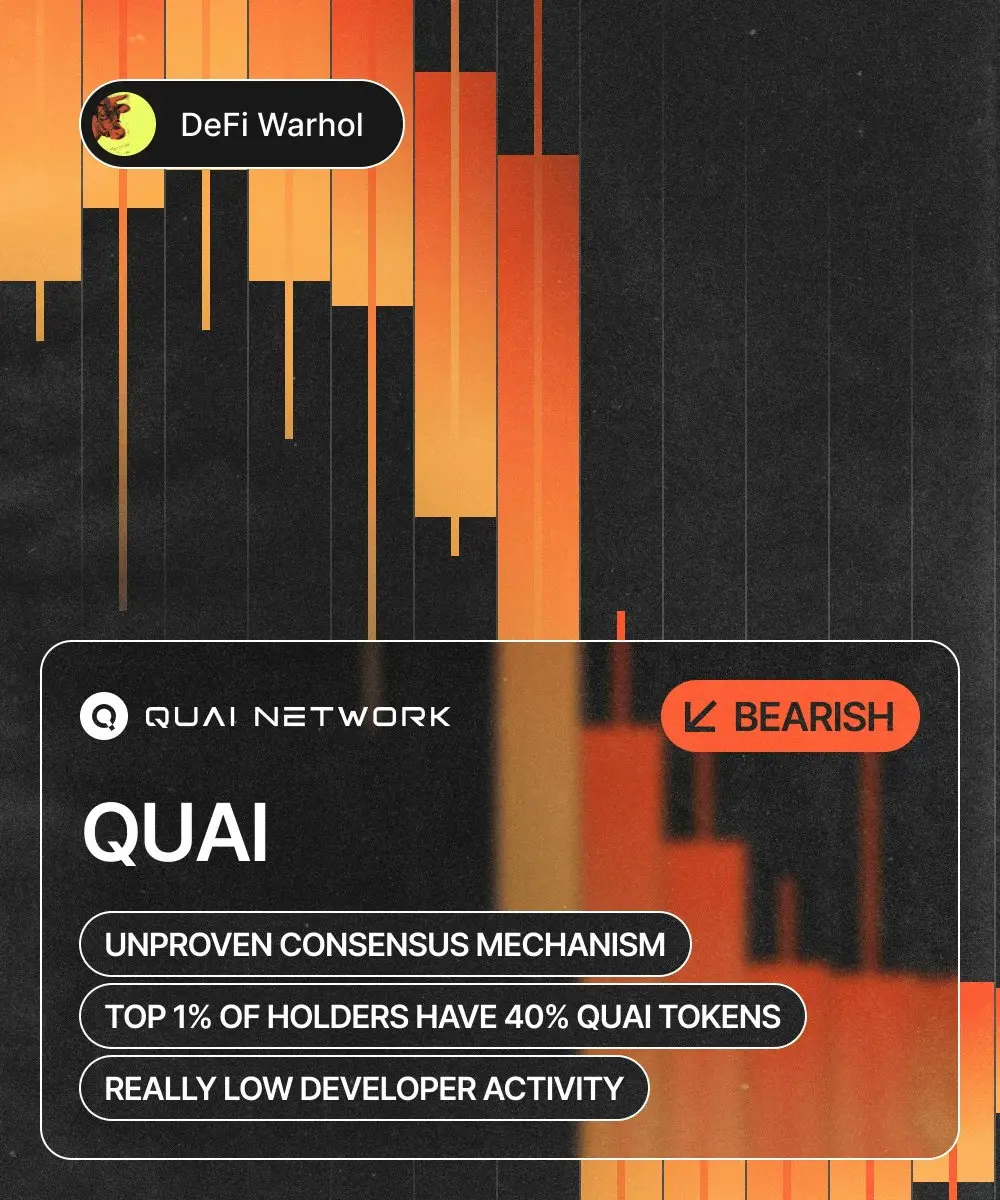

Why I’m bullish on @MagicNewton?

Newton isn’t just another AI project, it has real infra built around it:

- AI Automation

- Decentralized Computing

- Onchain Service Registry

- Community Building

- S-Tier Backers

Let's break down every point 🧵

➣ AI Automation

Most AI crypto projects are just vague LLM wrappers or created to pump their token.

@MagicNewton allows users to deploy autonomous agents to execute DeFi actions like swapping, bridging, and staking, fully automated and seamless.

You just give a prompt: “Rebalance my assets weekly”

- An agent executes it.

It serves as an AI abstraction l

Newton isn’t just another AI project, it has real infra built around it:

- AI Automation

- Decentralized Computing

- Onchain Service Registry

- Community Building

- S-Tier Backers

Let's break down every point 🧵

➣ AI Automation

Most AI crypto projects are just vague LLM wrappers or created to pump their token.

@MagicNewton allows users to deploy autonomous agents to execute DeFi actions like swapping, bridging, and staking, fully automated and seamless.

You just give a prompt: “Rebalance my assets weekly”

- An agent executes it.

It serves as an AI abstraction l

- Reward

- like

- 1

- Share

Lily89563 :

:

Just say how much was received.- Reward

- like

- Comment

- Share

Opening my DM requests was the worst mistake I've made this month

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

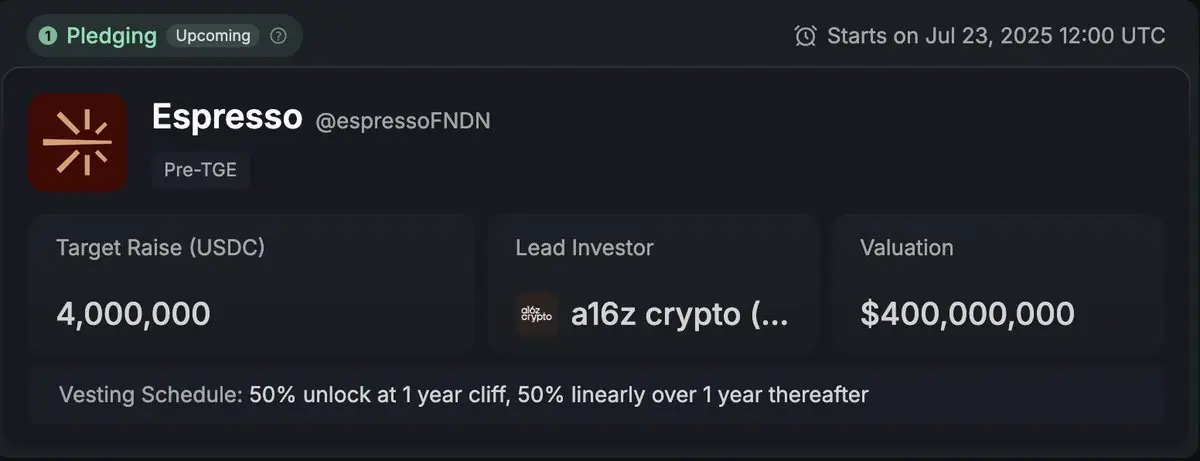

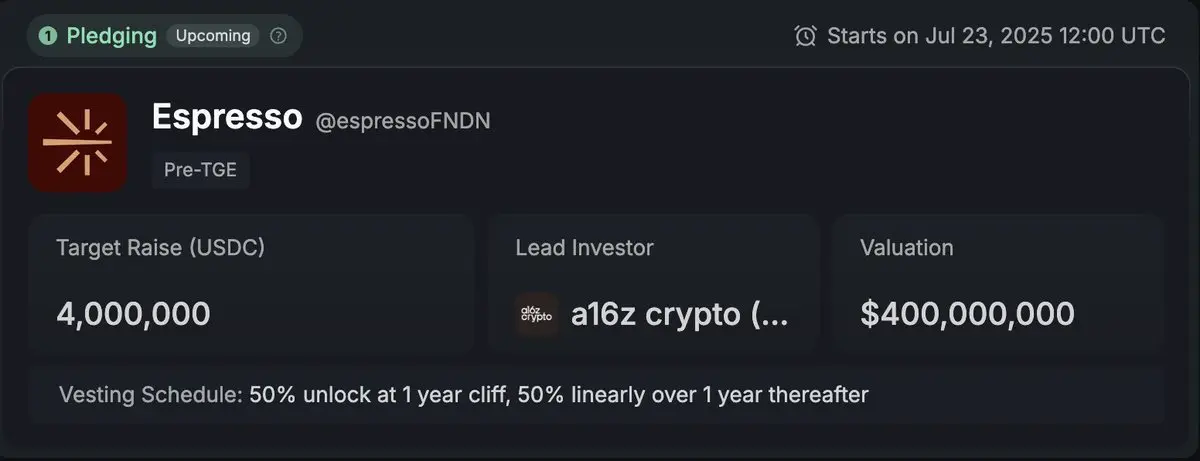

WTF are these sale terms from Espresso?

- $4m raise at $400,000,000 VALUATION

- No TGE unlock

- 2-year vesting with 1-year cliff

My guess is that it will most likely launch with a 15% circulating supply after the sale.

Who's even participating in this?

- $4m raise at $400,000,000 VALUATION

- No TGE unlock

- 2-year vesting with 1-year cliff

My guess is that it will most likely launch with a 15% circulating supply after the sale.

Who's even participating in this?

- Reward

- like

- Comment

- Share

WTF are these sale terms from Espresso?

- $4m raise at $400,000,000 VALUATION

- No TGE unlock

- 2-year vesting with 1-year cliff

And it's most likely to launch with a 15% circulating supply after the sale.

Who's even participating in this?

- $4m raise at $400,000,000 VALUATION

- No TGE unlock

- 2-year vesting with 1-year cliff

And it's most likely to launch with a 15% circulating supply after the sale.

Who's even participating in this?

- Reward

- like

- Comment

- Share

"Our project is building a disruptive technology to revolutionize cross-chain interactions"

CROSS1.49%

- Reward

- like

- Comment

- Share

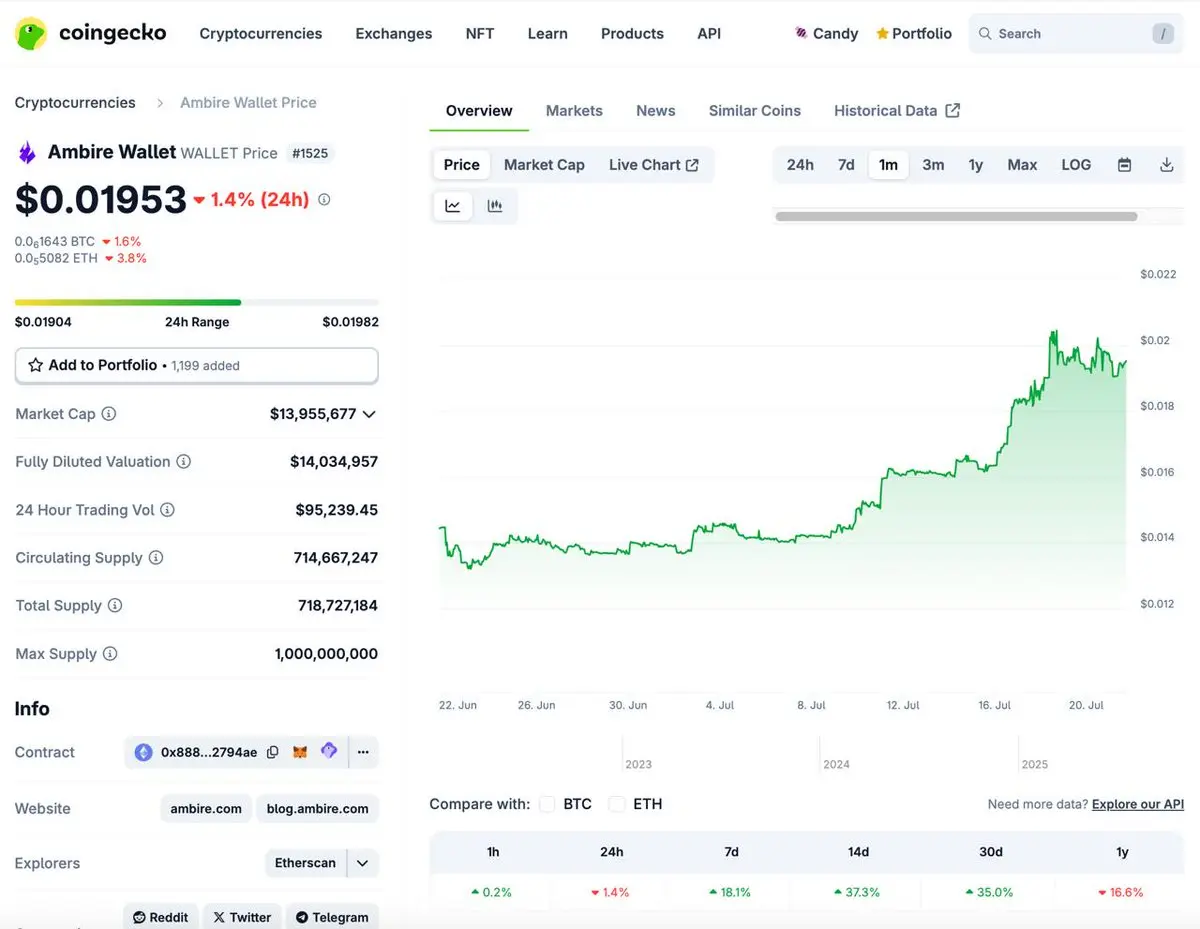

It's the best UX wallet I've used, and surprisingly, it's only at a $14m market cap despite numerous bullish triggers:

- It leads EIP-7702 delegations and supports it on all chains

- 50m $WALLET (5% of supply) acquired in buybacks

- 100% supply vested

The potential is immense here.

- It leads EIP-7702 delegations and supports it on all chains

- 50m $WALLET (5% of supply) acquired in buybacks

- 100% supply vested

The potential is immense here.

- Reward

- like

- Comment

- Share

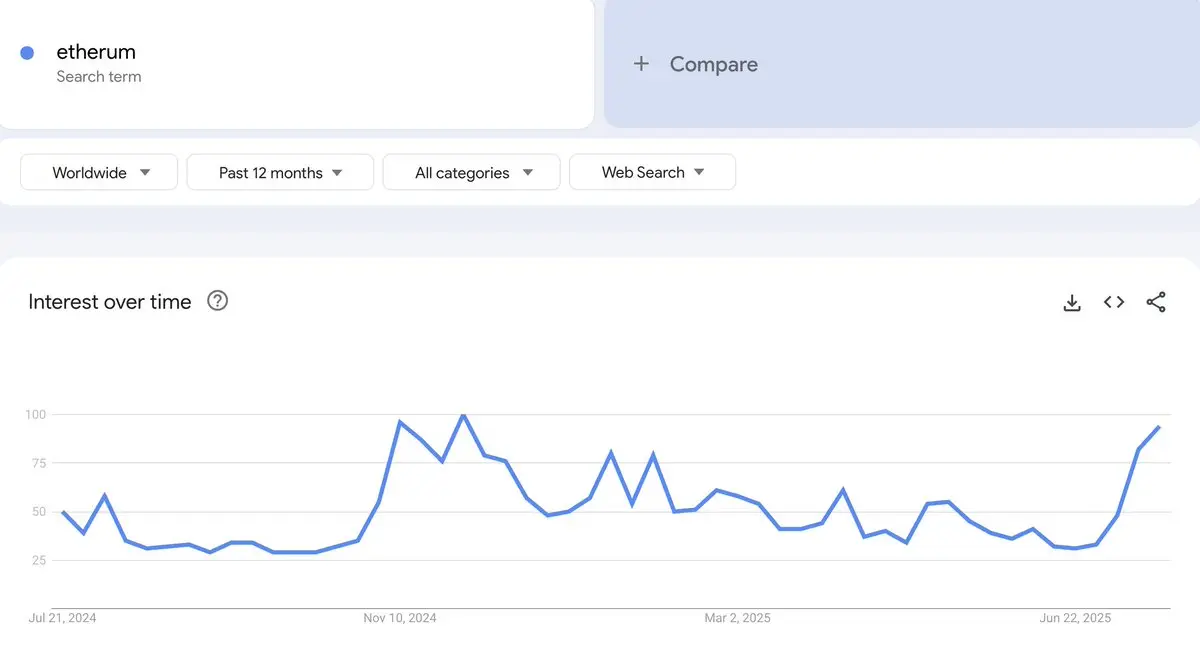

Google searches for "etherum" are at the highest level since December.

Retail is here.

Retail is here.

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

If you could only hold ONE asset for the next five years, what would it be?

HOLD-7.83%

- Reward

- like

- Comment

- Share

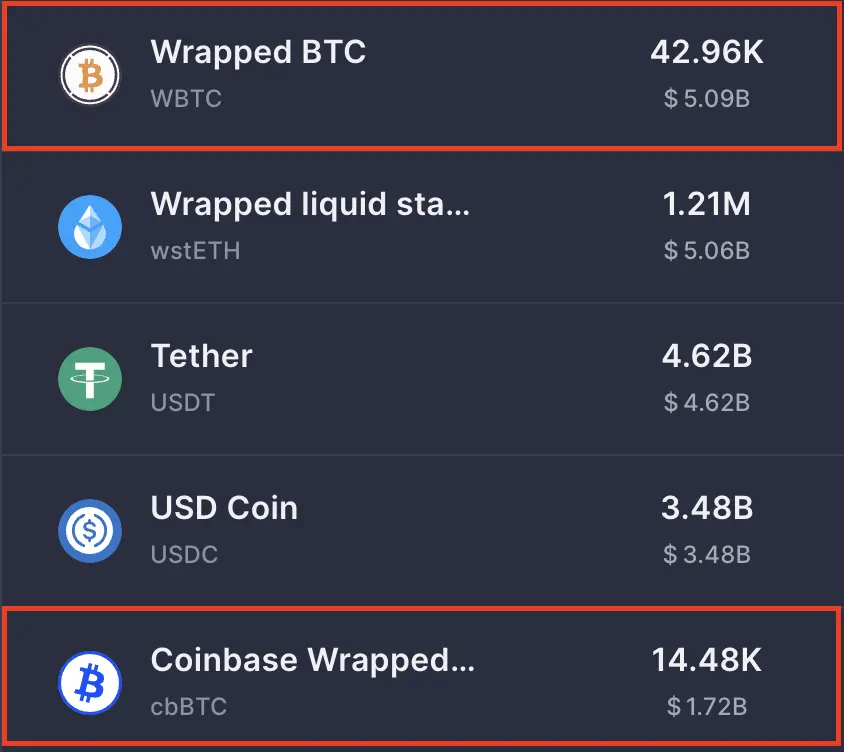

- WBTC: $5b

- cbBTC: $1.7B

- tBTC: $213m

- LBTC: $200m

- eBTC: 126m

- fBTC: $64m

This unironically makes Aave the most popular BTCfi destination.

The silent killer.

- cbBTC: $1.7B

- tBTC: $213m

- LBTC: $200m

- eBTC: 126m

- fBTC: $64m

This unironically makes Aave the most popular BTCfi destination.

The silent killer.

WBTC1.94%

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share