More

AxelAdlerJr

No content yet

AxelAdlerJr

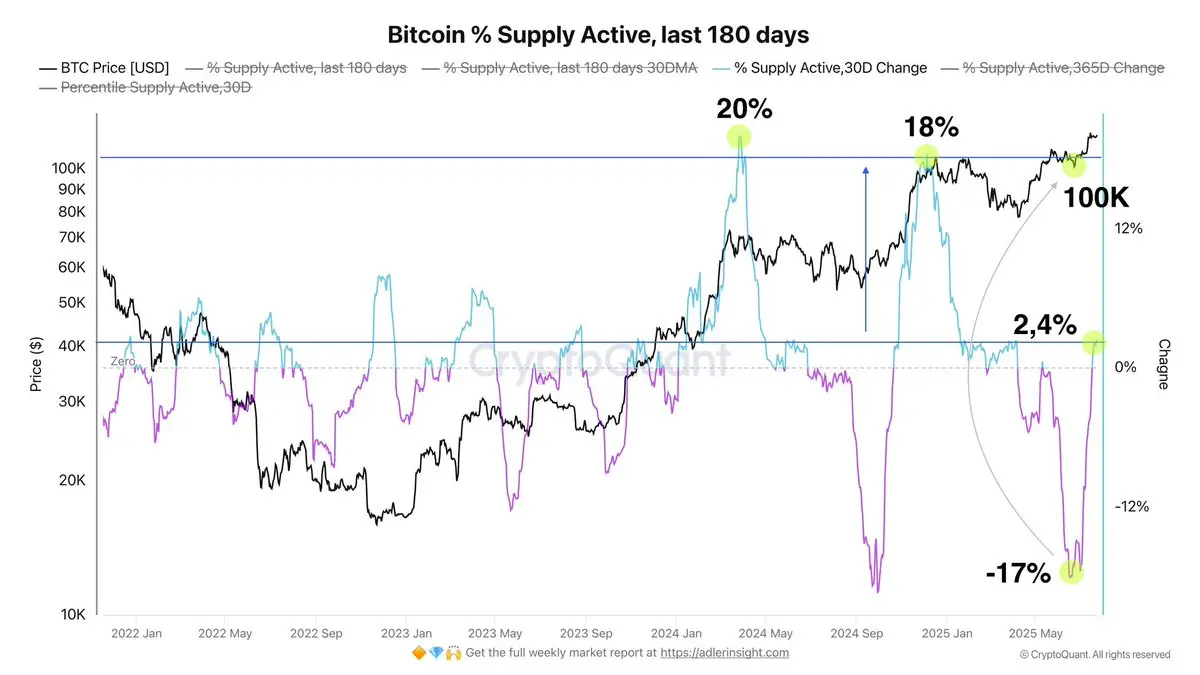

The share of coins active over the last 180 days (% Supply Active) sharply increased twice in past macro cycles: first to 20 % when BTC climbed to $70,000 in spring 2024, and then in December 2024 to 18 % upon the first breach of the psychological $100,000 mark. This reflected the movement of sleeping coins out of storage and their redistribution onto the market.

In June 2025 at the $100,000 level, supply activity began to rise and has so far climbed from negative territory to +2.4 % over 30 days. This increase indicates that holders have begun distribution; the lag of the 30‑day change compar

In June 2025 at the $100,000 level, supply activity began to rise and has so far climbed from negative territory to +2.4 % over 30 days. This increase indicates that holders have begun distribution; the lag of the 30‑day change compar

- Reward

- like

- Comment

- Share

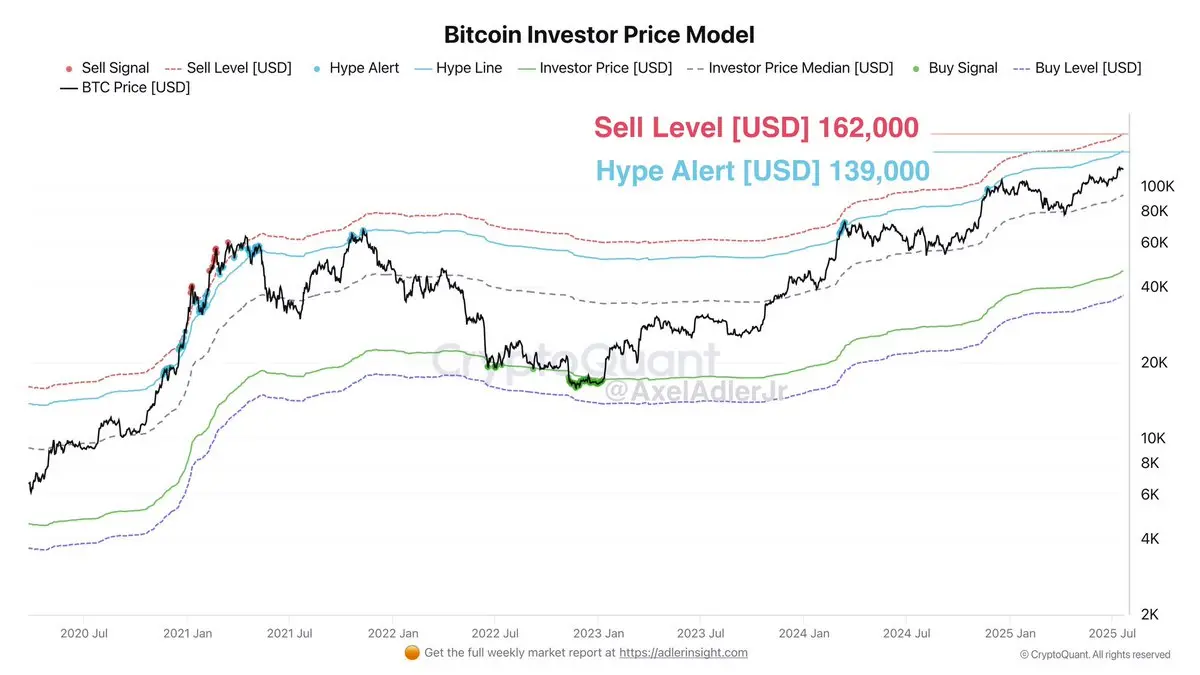

As of today’s price of $117 K, Bitcoin is in the growth zone between the Investor Price Median ($92 K) and the Hype Alert level ($139 K).

This suggests that buying activity is still supported by market participants: they’re willing to hold or add to their positions as long as the price remains above their comfort zone.

At the same time, we haven’t yet entered a phase of excessive optimism there’s still room for further upside toward $139 K without a serious risk of overheating.

This suggests that buying activity is still supported by market participants: they’re willing to hold or add to their positions as long as the price remains above their comfort zone.

At the same time, we haven’t yet entered a phase of excessive optimism there’s still room for further upside toward $139 K without a serious risk of overheating.

- Reward

- like

- Comment

- Share

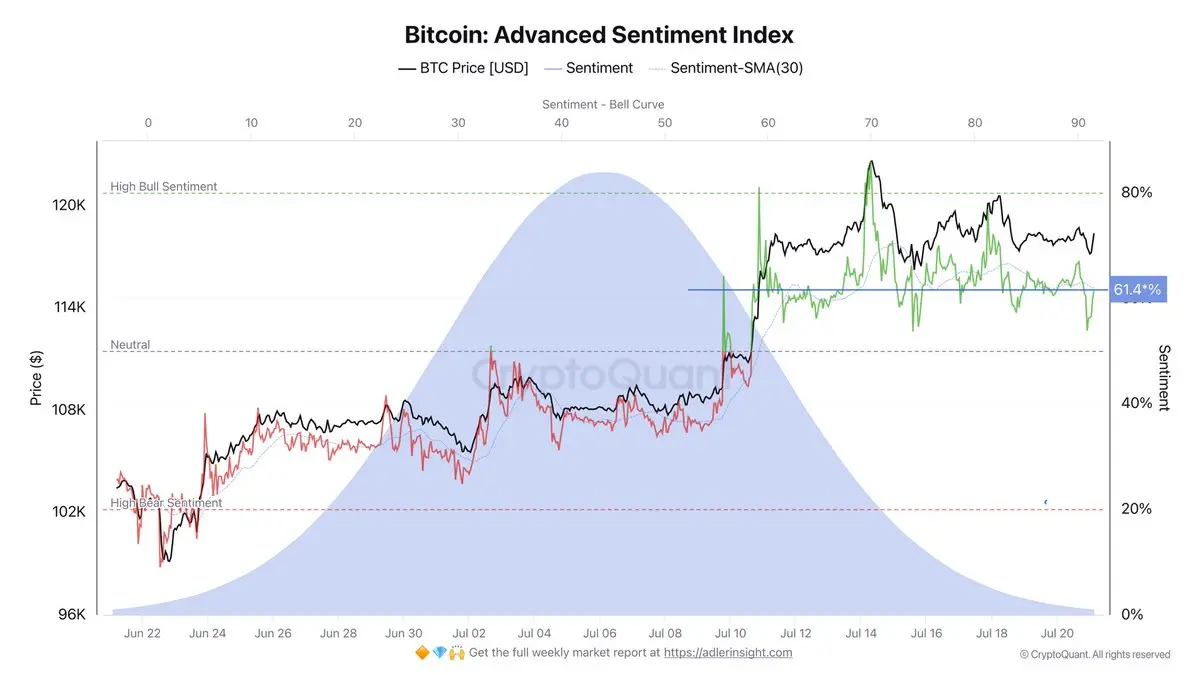

The market is dominated by bullish sentiment, but the bulls lack aggression.

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

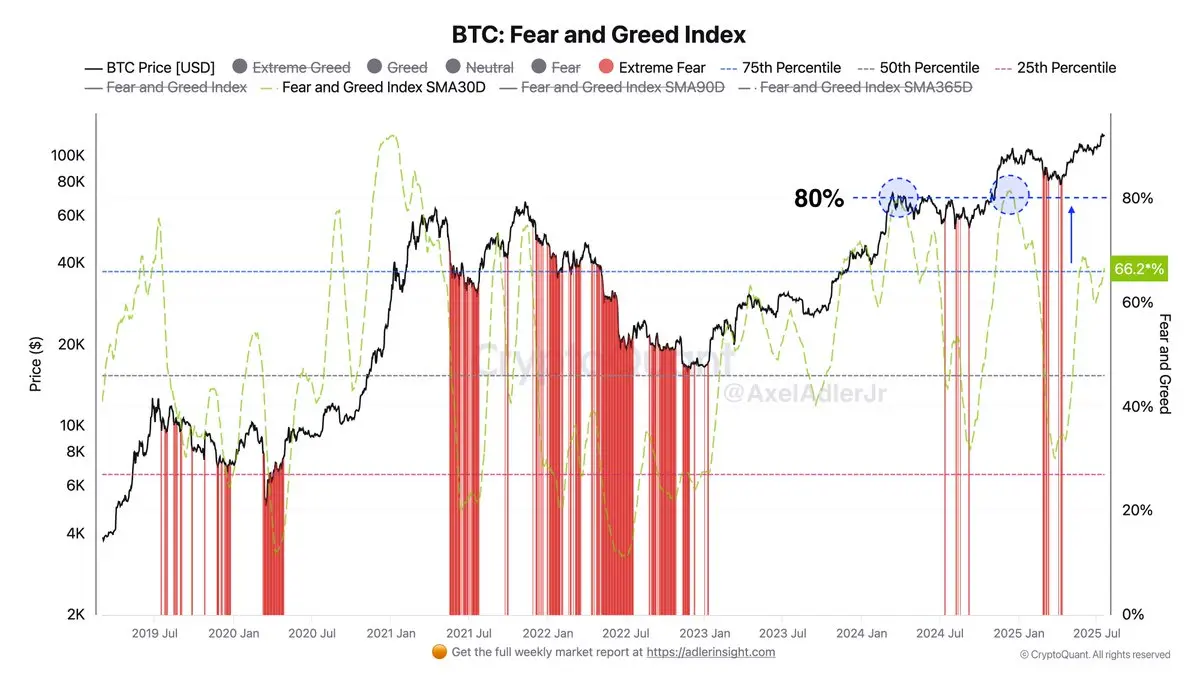

The 30‑day moving average of the Fear and Greed Index has climbed back into the optimism zone, currently sitting at 66%. Market sentiment remains broadly greedy, but we have yet to hit the extreme 75–80% threshold that coincided with local highs in March and December 2024. Bulls still have room to push prices higher.

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

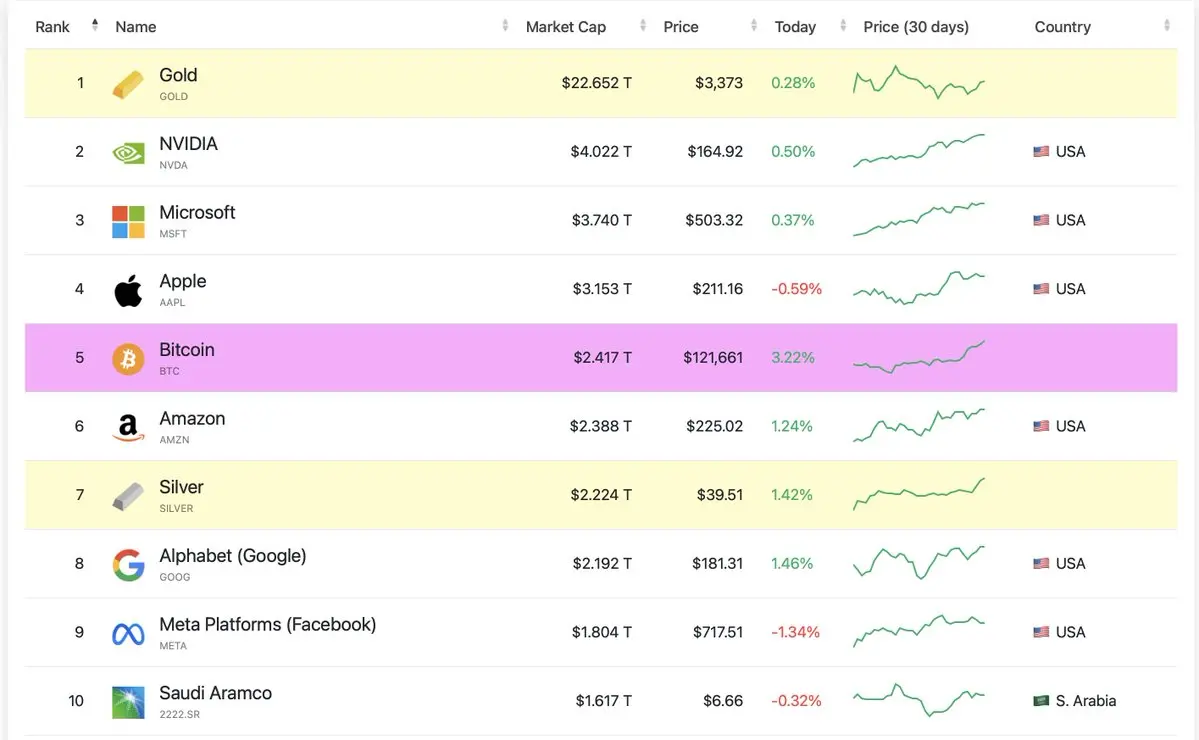

🎉Big milestone for Bitcoin.

The network’s Realised Cap has surpassed $1 trillion for the first time a new all‑time high.

Unlike simple market capitalization Realised Cap sums the value of each coin at the time of its last transaction, providing a more realistic picture of the capital locked in the network.

For comparison: if a company earned $1 every second, it would take 31 710 years to accumulate one trillion dollars.

What do you think this means for Bitcoin’s next growth cycle?

The network’s Realised Cap has surpassed $1 trillion for the first time a new all‑time high.

Unlike simple market capitalization Realised Cap sums the value of each coin at the time of its last transaction, providing a more realistic picture of the capital locked in the network.

For comparison: if a company earned $1 every second, it would take 31 710 years to accumulate one trillion dollars.

What do you think this means for Bitcoin’s next growth cycle?

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

European markets are set to open higher: Euro Stoxx 50 and Stoxx 600 futures are up 0.8% in premarket trading as concerns over the Fed chair’s stance ease and China confirms efforts to normalize ties with the EU ahead of the summit.

Investors continue to monitor trade risks the US will impose a 30% tariff on EU imports from August 1 and await earnings from ABB, Novartis, Investor AB, Volvo, Assa Abloy, SSE, Swedbank, TSMC, Publicis and EasyJet as well as UK employment data.

Investors continue to monitor trade risks the US will impose a 30% tariff on EU imports from August 1 and await earnings from ABB, Novartis, Investor AB, Volvo, Assa Abloy, SSE, Swedbank, TSMC, Publicis and EasyJet as well as UK employment data.

AB2.05%

- Reward

- like

- Comment

- Share

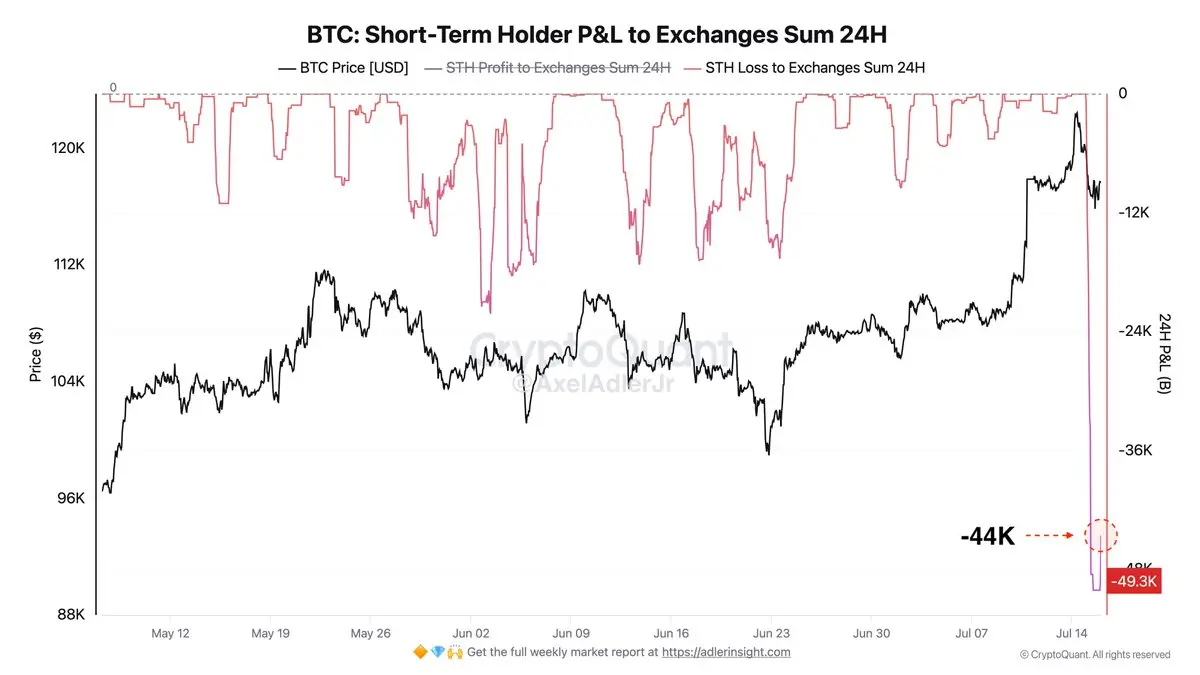

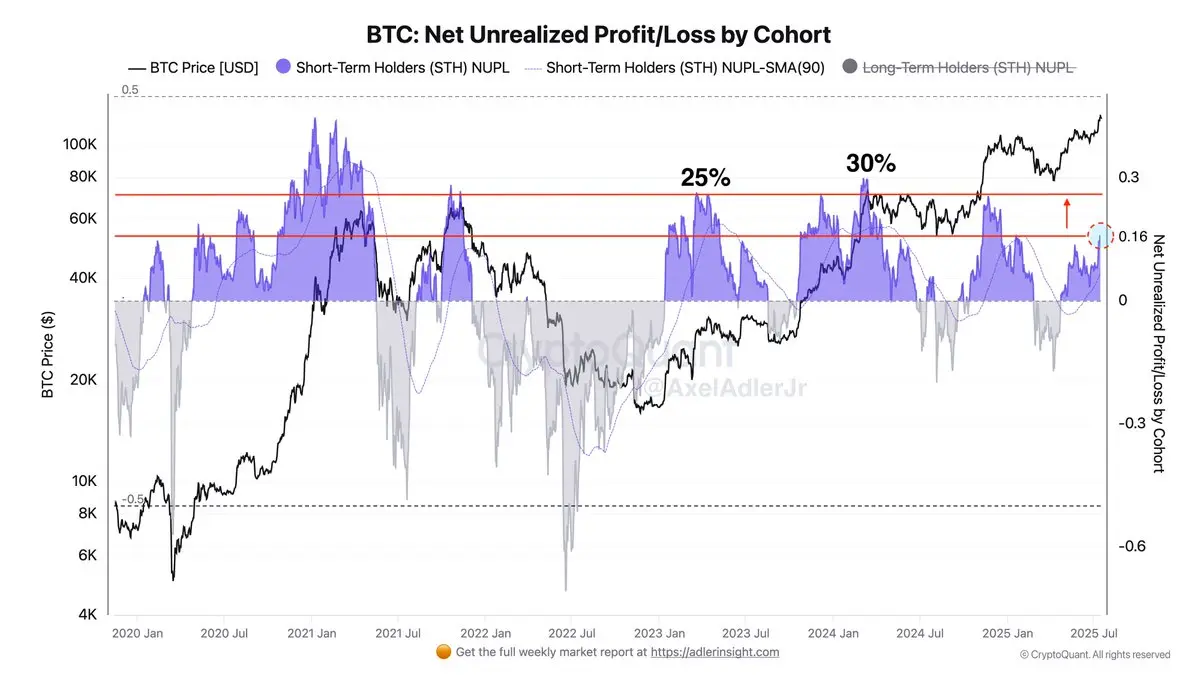

In previous macro cycles, the STH NUPL metric at the 25% level coincided with the peak of speculative euphoria among short-term holders: they began massively taking profits, which restrained or reversed the bullish momentum.

Today, as of July 17, 2025, STH NUPL stands at 13% (compared to 16% at the level of the last ATH), indicating moderate unrealized profit among this cohort and the absence of signs of market overheating.

For the share of unrealized profit to grow to 25%, the current BTC price must break above the $137K mark. This level will be a trigger for mass selling and subsequent corre

Today, as of July 17, 2025, STH NUPL stands at 13% (compared to 16% at the level of the last ATH), indicating moderate unrealized profit among this cohort and the absence of signs of market overheating.

For the share of unrealized profit to grow to 25%, the current BTC price must break above the $137K mark. This level will be a trigger for mass selling and subsequent corre

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

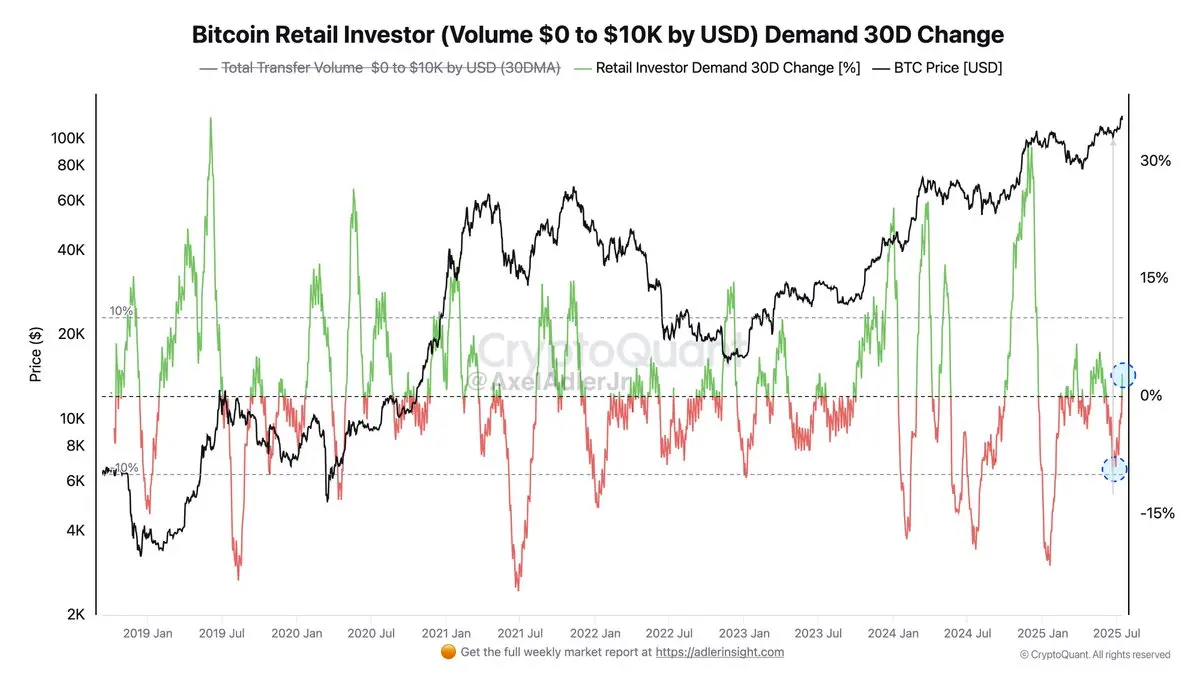

Retail investors are making a comeback.

The 30-day change in demand for small transfer volumes ($0–$10K) has moved out of negative territory over the past week.

The 30-day change in demand for small transfer volumes ($0–$10K) has moved out of negative territory over the past week.

OVER-9.72%

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

United States Inflation Rate YoY was reported at 2.7% in Jun from 2.4% in the previous period.

- Reward

- like

- Comment

- Share

Over the past year, the cumulative balance of large holders (wallets with 1K+ BTC) decreased by approximately 447K BTC, but these outflows were stretched across all 12 months. If they attempted to dump the entire yearly volume at once, the price would immediately collapse, so large players sell gradually: in short-term dynamics, maximum net sales didn't exceed 61K BTC over 30 days.

Nevertheless, the market can digest even 100K BTC if the sales are offset by bullish sentiment in futures and corporate purchases.

Nevertheless, the market can digest even 100K BTC if the sales are offset by bullish sentiment in futures and corporate purchases.

- Reward

- like

- Comment

- Share

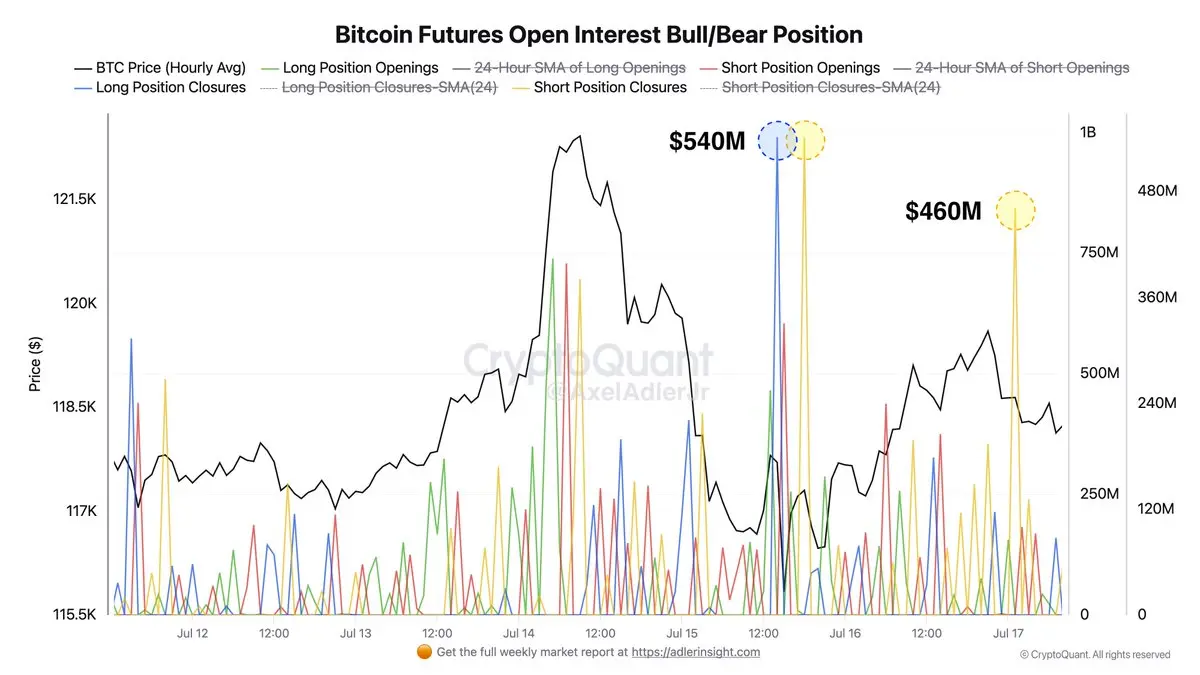

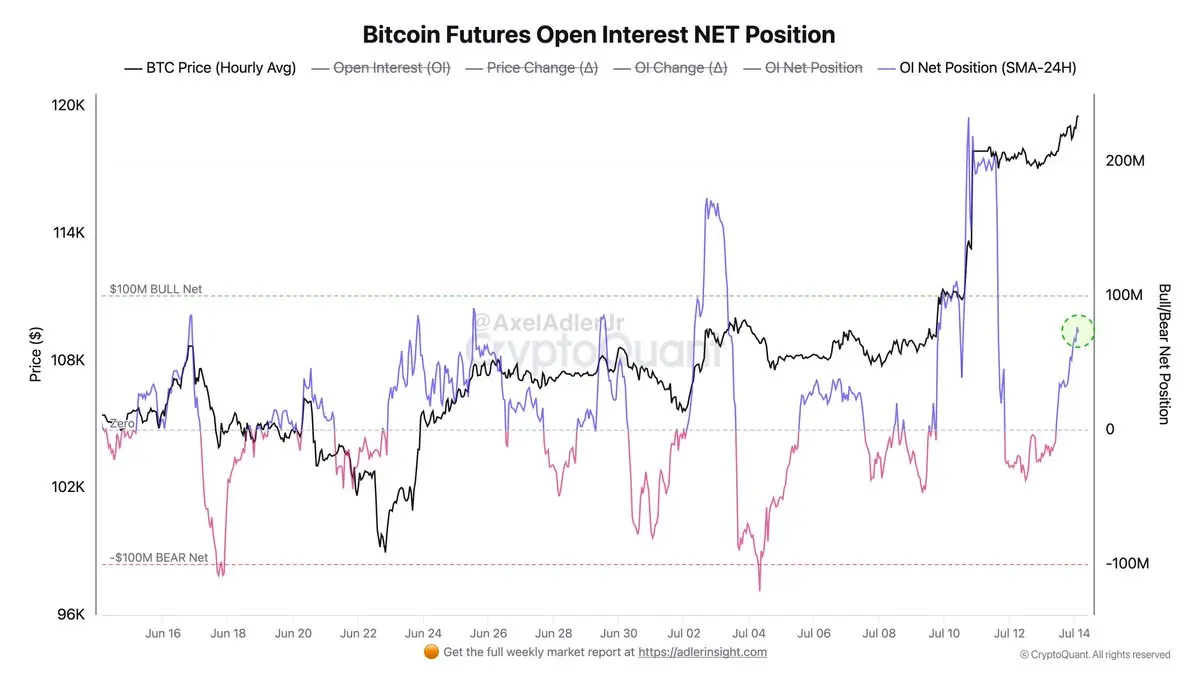

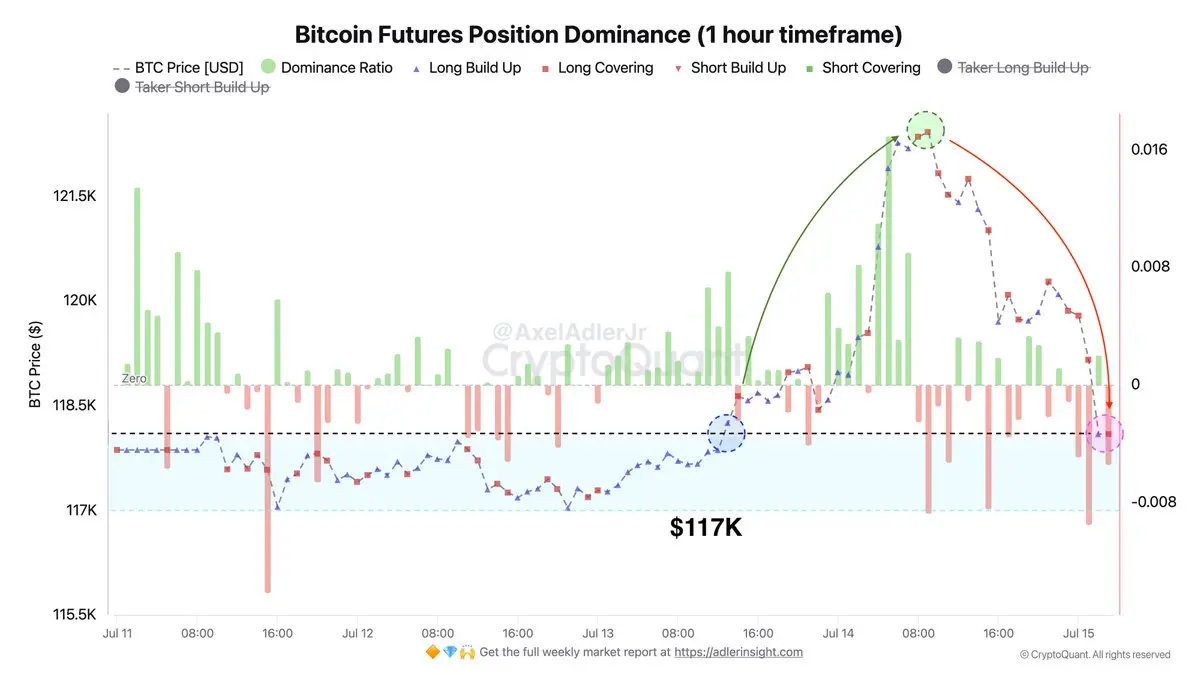

After the ATH, bears began aggressively shorting: bull dominance sharply declined, and the long‑to‑short ratio shifted into negative territory.

Bulls need to hold the $117K level.

Bulls need to hold the $117K level.

HOLD-6.48%

- Reward

- like

- Comment

- Share

- Reward

- like

- 1

- Share

GateUser-31658c4f :

:

What market capitalization can be discussed without liquidity?- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

According to history from 2012–2025, July is among the most reliable months for Bitcoin growth: in 10 out of 14 cases (71%) it showed positive returns.

However, October demonstrates the highest reliability where the percentage of "positive" months reaches 77%.

However, October demonstrates the highest reliability where the percentage of "positive" months reaches 77%.

BTC0.65%

- Reward

- like

- Comment

- Share