Aplikasi DeFi - Asuransi dan Derivatif

Nexus Mutual adalah protokol asuransi terdesentralisasi yang memungkinkan individu untuk membeli pertanggungan terhadap kegagalan dan peretasan smart contract. Platform beroperasi pada blockchain Ethereum dan menggunakan kontrak pintar untuk mengumpulkan dana dan membayar klaim. Nexus Mutual menawarkan token asli yang disebut NXM, yang dapat dipertaruhkan untuk mendapatkan hadiah dan berpartisipasi dalam keputusan tata kelola. Synthetix adalah platform terdesentralisasi untuk memperdagangkan aset sintetis yang melacak harga berbagai mata uang kripto, komoditas, dan mata uang fiat. Synthetix menggunakan model token unik, di mana pemegang SNX dapat mempertaruhkan token mereka sebagai jaminan untuk mencetak aset sintetis dan mendapatkan hadiah dalam bentuk biaya perdagangan. Protokol menggunakan sistem oracle terdesentralisasi untuk memastikan keakuratan harga aset dan meminimalkan risiko manipulasi.

Asuransi dan turunannya adalah dua aplikasi penting DeFi yang telah mendapatkan daya tarik yang signifikan dalam beberapa tahun terakhir. Mereka memberi pengguna lapisan perlindungan tambahan dan masing-masing memungkinkan strategi perdagangan yang lebih maju.

Protokol asuransi DeFi memungkinkan pengguna untuk melindungi aset mereka dari risiko dan peretasan smart contract. Protokol ini biasanya menggunakan model risiko gabungan, di mana pengguna berkontribusi pada kumpulan dana bersama yang dapat digunakan untuk membayar klaim. Salah satu protokol asuransi DeFi yang populer adalah Nexus Mutual, yang menggunakan model peer-to-peer untuk menjamin perlindungan. Premi asuransi pada protokol DeFi dapat bervariasi tergantung pada risiko yang dirasakan dari aset dasar. Protokol asuransi DeFi masih dalam tahap awal dan belum diadopsi secara luas, tetapi mereka menjanjikan untuk memberikan keamanan yang lebih besar kepada pengguna DeFi.

Derivatif DeFi memungkinkan pengguna untuk mengambil posisi pada nilai masa depan dari aset dasar. Posisi ini bisa panjang atau pendek, dan bisa digunakan untuk melakukan lindung nilai terhadap volatilitas pasar atau untuk berspekulasi tentang pergerakan harga di masa depan.

Derivatif DeFi dapat diperdagangkan di bursa terdesentralisasi atau melalui perjanjian peer-to-peer. Salah satu platform turunan DeFi yang populer adalah Synthetix, yang memungkinkan pengguna membuat aset sintetis yang melacak harga berbagai aset. Aset-aset ini menghadapi kritik karena kerumitan dan potensi manipulasinya, tetapi para pendukung berpendapat bahwa aset tersebut memungkinkan penemuan harga dan manajemen risiko yang lebih efisien.

Asuransi dan turunannya adalah dua aplikasi DeFi penting yang menunjukkan keserbagunaan dan potensi keuangan terdesentralisasi. Meskipun mungkin tidak digunakan secara luas seperti protokol DeFi lainnya, mereka menawarkan manfaat berharga bagi pengguna yang ingin melindungi aset mereka atau terlibat dalam strategi perdagangan yang lebih canggih.

Reksa Nexus

Sumber: Reksa Nexus

Nexus Mutual adalah platform asuransi mutual terdesentralisasi yang dibangun di blockchain Ethereum. Ini bertujuan untuk memberi pengguna perlindungan terhadap risiko kegagalan kontrak pintar dan risiko serupa lainnya yang mungkin terjadi dalam ruang DeFi. Tidak seperti perusahaan asuransi tradisional, Nexus Mutual sepenuhnya terdesentralisasi, artinya tidak diatur oleh otoritas atau organisasi terpusat.

Nexus Mutual memungkinkan pengguna mengambil polis asuransi tanpa harus melalui proses tradisional berurusan dengan perusahaan asuransi. Sebagai gantinya, pengguna dapat membeli cakupan melalui token asli platform, NXM, yang digunakan untuk membeli cakupan dan mempertaruhkan untuk menjadi anggota mutual. Sebagai imbalannya, anggota dapat memperoleh hadiah dalam bentuk dividen dan diskon pertanggungan.

Platform ini menggunakan sistem kontrak pintar yang unik untuk mengelola seluruh proses asuransi, mulai dari pembuatan polis hingga pembayaran. Saat pengguna membeli pertanggungan, dana disimpan dalam kontrak pintar, dan jika ketentuan polis terpenuhi, kontrak akan secara otomatis memicu pembayaran kepada pengguna. Proses ini benar-benar transparan, dan semua kebijakan serta pembayaran dapat dilihat di blockchain untuk dilihat siapa saja.

Nexus memiliki fitur inovatif seperti "proses penilaian klaim". Dalam industri asuransi tradisional, klaim seringkali tunduk pada proses penyelidikan yang panjang dan rumit, yang dapat memakan waktu dan mahal. Sebaliknya, Nexus Mutual memiliki proses klaim yang lebih ramping dan otomatis yang diatur oleh kontrak pintar. Klaim dinilai oleh sekelompok anggota yang memegang token NXM, dan proses penilaian dirancang agar lebih efisien dan hemat biaya daripada metode tradisional.

Nexus Mutual juga mengizinkan polis asuransi "parametrik". Ini berarti bahwa kebijakan dipicu berdasarkan peristiwa tertentu, seperti kegagalan kontrak pintar di seluruh sistem, bukan pada klaim individu. Hal ini dapat membantu mengurangi risiko penipuan dan membuat proses klaim menjadi lebih efisien.

Meskipun Nexus Mutual masih merupakan platform yang relatif baru, Nexus Mutual telah mendapatkan banyak pengikut di ruang DeFi. Platform ini telah menarik semakin banyak pengguna dan telah menerima ulasan positif untuk antarmuka yang ramah pengguna dan pendekatan inovatif untuk asuransi terdesentralisasi. Karena ruang DeFi terus berkembang, kemungkinan Nexus Mutual akan terus memainkan peran penting dalam memberikan perlindungan yang dibutuhkan pengguna untuk berpartisipasi dengan aman dan percaya diri di ruang tersebut.

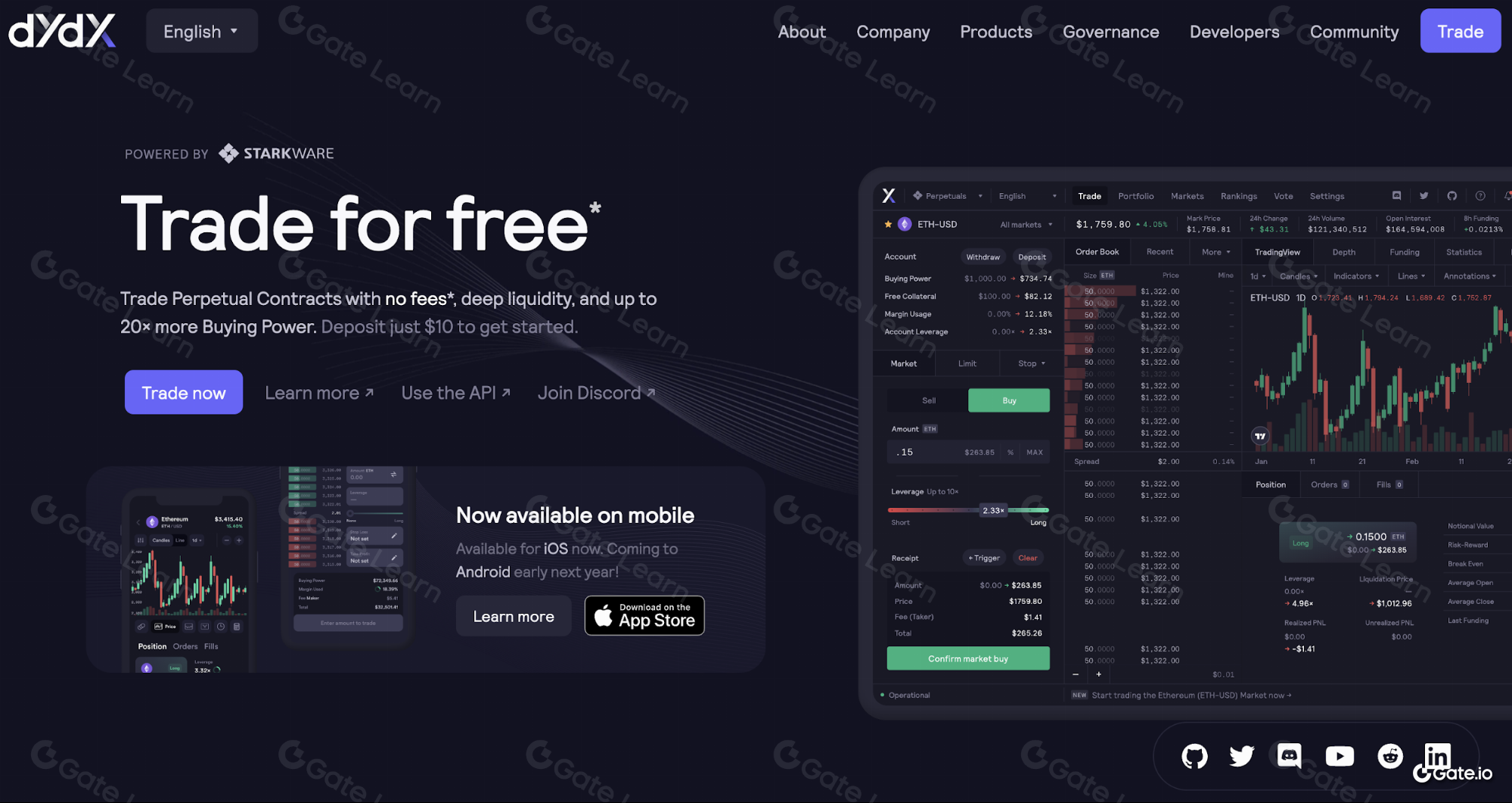

dYdX

Sumber: dYdX

dYdX adalah platform pertukaran dan perdagangan margin terdesentralisasi yang dibangun di atas Ethereum. Didirikan pada tahun 2017 oleh Antonio Juliano, dan misinya adalah menyediakan layanan keuangan terdesentralisasi yang lebih mudah diakses, transparan, dan aman. dYdX memungkinkan pengguna untuk memperdagangkan berbagai token ERC-20 dengan leverage hingga 10x, serta meminjamkan dan meminjam cryptocurrency dengan cara yang tidak dapat dipercaya dan terdesentralisasi.

Platform ini disorot oleh penerapan Kontrak Masa Depan Abadi. Perpetual adalah jenis kontrak derivatif yang memungkinkan pedagang untuk berspekulasi mengenai harga suatu aset tanpa benar-benar memilikinya. Kontrak Perpetual yang ditawarkan oleh dYdX dirancang untuk meniru harga aset dasar, dengan harga penyelesaian diperbarui setiap detik berdasarkan rata-rata dari beberapa feed harga. Hal ini memungkinkan trader untuk mengambil posisi long dan short pada berbagai aset dengan leverage, dan untuk trading tanpa mengkhawatirkan tanggal kedaluwarsa.

dYdX juga menawarkan perdagangan margin, yang memungkinkan pedagang meminjam dana dari kumpulan likuiditas untuk meningkatkan daya beli mereka. Hal ini memungkinkan pedagang untuk mengambil posisi yang lebih besar daripada yang bisa mereka lakukan dengan dana mereka sendiri, dan berpotensi memperoleh keuntungan lebih tinggi. Perdagangan margin juga berisiko, karena pedagang dapat dilikuidasi jika nilai posisinya turun di bawah ambang batas tertentu. dYdX telah menerapkan sistem manajemen risiko yang canggih untuk mencegah likuidasi berlebihan dan memastikan keamanan dana penggunanya.

Ini memiliki buku pesanan terdesentralisasi, yang memungkinkan pedagang mengirimkan pesanan langsung ke blockchain Ethereum. Ini berarti bahwa perdagangan diselesaikan secara on-chain, dan pengguna memiliki kendali penuh atas aset mereka setiap saat. dYdX juga menggunakan model non-penahanan, yang berarti bahwa pengguna mempertahankan kepemilikan dan kendali atas aset mereka selama proses perdagangan dan peminjaman.

Token asli platform disebut DYDX, dan digunakan untuk berpartisipasi dalam tata kelola protokol. Pemegang DYDX dapat memilih proposal untuk mengubah parameter protokol, seperti biaya perdagangan dan persyaratan agunan. Selain itu, sebagian dari biaya perdagangan di dYdX digunakan untuk membeli kembali dan membakar token DYDX, yang mengurangi pasokan keseluruhan dan berpotensi meningkatkan nilai setiap token.

Synthetix

Sumber: Sintetik

Synthetix adalah platform keuangan terdesentralisasi (DeFi) yang dibangun di atas blockchain Ethereum yang memungkinkan pembuatan dan perdagangan aset sintetis. Synthetix sebelumnya dikenal sebagai Havven hingga berganti nama pada tahun 2018. Platform ini memungkinkan pengguna membuat aset sintetis, juga dikenal sebagai Synths, yang melacak harga aset dunia nyata seperti mata uang, komoditas, dan saham. Synths ini adalah token ERC-20 di blockchain Ethereum yang dapat diperdagangkan di bursa Synthetix.

Platform Synthetix beroperasi melalui sistem posisi utang yang dijaminkan (CDP). Pengguna dapat mengunci token asli Synthetix, SNX, sebagai jaminan dan membuat Synths untuk melawannya. Semakin banyak SNX yang dikunci pengguna, semakin banyak Synth yang dapat mereka buat. Saat pengguna membuat Synths, mereka secara efektif meminjamnya dengan agunan SNX yang telah mereka kunci. Synth kemudian diperdagangkan di bursa Synthetix, dan pengguna dapat memperdagangkannya dengan Synth lain atau menebusnya dengan nilai dasarnya di SNX.

Token asli platform, SNX, digunakan untuk mempertaruhkan dan mengatur. Pengguna dapat mempertaruhkan SNX mereka untuk mendapatkan hadiah dan berpartisipasi dalam keputusan tata kelola, seperti mengusulkan dan memberikan suara pada perubahan protokol. Semakin banyak SNX yang dipertaruhkan pengguna, semakin besar kekuatan voting mereka dalam proses tata kelola.

Platform Synthetix juga menggunakan sistem oracle unik yang memungkinkan pelacakan harga aset dunia nyata. Platform ini menggunakan jaringan feed harga, atau oracle yang terdesentralisasi, untuk menyediakan data harga yang andal dan akurat. Oracle ini disediakan oleh sekelompok peserta tepercaya, yang dikenal sebagai oracle harga Synthetix.

Synthetix memungkinkan pengguna untuk mendapatkan eksposur ke berbagai aset tanpa benar-benar memilikinya. Ini bisa sangat berguna bagi investor yang ingin mendiversifikasi portofolio mereka dan mendapatkan eksposur ke aset yang mungkin sulit diakses di pasar keuangan tradisional.

GMX

Sumber: GMX

GMX adalah proyek DeFi yang bertujuan untuk menciptakan ekosistem yang terdesentralisasi, transparan, dan adil untuk perdagangan dan investasi dalam instrumen keuangan tradisional seperti saham, komoditas, dan pasar valas. Proyek ini memanfaatkan teknologi blockchain dan kontrak pintar untuk membangun platform tanpa kepercayaan di mana pedagang dan investor dapat melakukan perdagangan dan mengakses instrumen keuangan dunia nyata.

Salah satu fitur utama GMX adalah kemampuan untuk menandai aset keuangan tradisional dan memperdagangkannya di bursa terdesentralisasi. Dengan tokenisasi aset, GMX memungkinkan pengguna untuk membagi kepemilikan dan memperdagangkannya secara transparan dan terdesentralisasi. Ini membuka akses ke aset yang lebih luas dan membuatnya tersedia untuk audiens global, tanpa memandang batas geografis.

GMX juga menawarkan perdagangan leverage, yang memungkinkan pengguna memperbesar keuntungan mereka melalui perdagangan margin. Perdagangan margin memungkinkan pedagang meminjam dana untuk meningkatkan posisi perdagangan mereka, sehingga meningkatkan potensi keuntungan atau kerugian mereka. Fitur perdagangan margin GMX didukung oleh protokol unik yang disebut Lendroid, yang memungkinkan pengguna untuk meminjamkan dan meminjam dana dengan cara yang terdesentralisasi.

Fitur kunci lain dari GMX adalah sistem tata kelolanya, yang dikelola oleh token asalnya, token GMX. Pemegang Token dapat mengusulkan dan memberikan suara pada perubahan peraturan dan regulasi platform, menjadikannya proyek berbasis komunitas. Ini juga memberi insentif kepada pengguna untuk memegang token GMX, karena mereka memiliki suara untuk mengarahkan proyek dan dapat memperoleh hadiah karena berpartisipasi dalam tata kelola.

Tim pengembangan GMX mencakup para profesional berpengalaman dari industri blockchain, keuangan, dan perdagangan, yang memastikan bahwa proyek ini dilengkapi dengan baik untuk memenuhi janjinya. Tim memiliki rekam jejak yang kuat dalam membangun proyek berbasis blockchain yang sukses, dan keahlian mereka dalam perdagangan dan keuangan memposisikan mereka dengan baik untuk mewujudkan visi ambisius GMX.

Highlight

Nexus Mutual adalah protokol asuransi terdesentralisasi yang memungkinkan individu untuk membeli pertanggungan terhadap kegagalan dan peretasan smart contract.

Platform beroperasi pada blockchain Ethereum dan menggunakan kontrak pintar untuk mengumpulkan dana dan membayar klaim.

Nexus Mutual menawarkan token asli yang disebut NXM, yang dapat dipertaruhkan untuk mendapatkan hadiah dan berpartisipasi dalam keputusan tata kelola.

Synthetix adalah platform terdesentralisasi untuk memperdagangkan aset sintetis yang melacak harga berbagai mata uang kripto, komoditas, dan mata uang fiat.

Synthetix menggunakan model token unik, di mana pemegang SNX dapat mempertaruhkan token mereka sebagai jaminan untuk mencetak aset sintetis dan mendapatkan hadiah dalam bentuk biaya perdagangan.

Protokol menggunakan sistem oracle terdesentralisasi untuk memastikan keakuratan harga aset dan meminimalkan risiko manipulasi.