Unichain TVL 飆升背後:一場精心策劃的流動性盛宴,還是 DeFi 新格局的序幕?

自2025年2月正式上線以來,Layer2網絡Unichain似乎並未在第一時間激起市場的巨大水花,恰逢加密市場整體步入調整期,其聲量一度被淹沒。

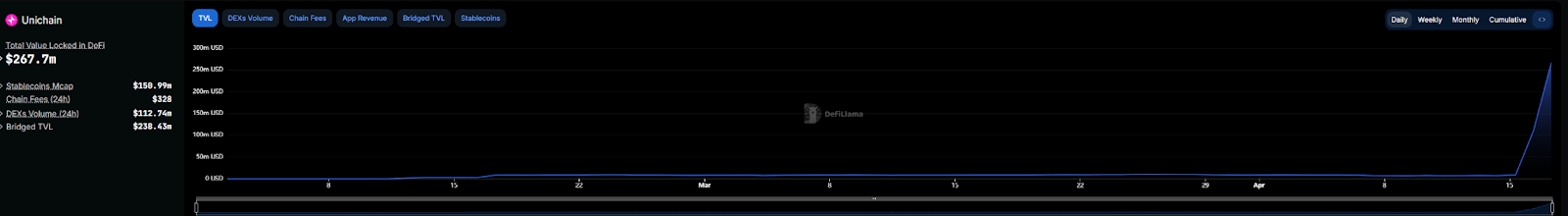

然而,沉寂並未持續太久。4月15日,在Unichain與Gauntlet聯合推出價值500萬美元的流動性激勵活動後,Unichain的跨鏈活動顯著升溫。僅在24小時內,就有11個地址累計向Unichain注入了價值約2223萬美元的代幣。這場突如其來的“撒錢”活動效果立竿見影。根據DefiLlama數據,Unichain的TVL在4月15日之後出現了驚人的躍升,2天的時間從約900萬美元飆升至2.67億美元。這一數字使其在衆多Layer2中迅速攀升至第4位。Unichain這次由激勵驅動的TVL爆發,僅僅是一場短暫的“擼毛”狂歡,還是Uniswap這位DeFi巨頭從協議層向底層公鏈華麗轉身的有效驗證?Unichain能否借此契機,真正成爲DeFi的新家園?

爲DeFi而生的L2

要理解Unichain近期的爆發之前,我們再來回顧一下其基本面。Unichain是UniswapLabs多年深耕DeFi領域後的產物。它被定位爲一個專爲DeFi和跨鏈流動性設計的高速、去中心化Layer2解決方案。

從性能方面來看,Unichain的表現與其他L2類似,據官方顯示,主網上線後即實現了1秒的出塊時間,並計劃在未來通過與Flashbots合作開發的TEE(可信執行環境)技術,實現低於200毫秒的“亞秒級”有效區塊時間,使交易近乎瞬時完成。在成本方面,Unichain的交易費用相比以太坊主網大幅降低了約95%。

截至2025年4月16日,Unichain官網數據顯示,已處理超2000萬筆交易,擁有超過37.1萬個錢包地址。另外,在測試網階段處理了9500萬筆交易和部署了1470萬個智能合約也在一定程度上體現出品牌效應之下的優勢。

而在生態合作方面,Unichain在發布之初就獲得了不少行業巨頭的支持,有近100個加密項目和基礎設施提供商宣布支持或在Unichain上構建,包括Circle、Coinbase、Lido、Morpho等重量級玩家。

綜合來看,Unichain似乎已經集齊了打造DeFi L2的基礎條件:高性能、低成本以及來自行業領導者的早期支持。

500萬美元UNI如何撬動2.7億TVL

Unichain的基礎雖好,但TVL的爆炸式增長無疑是由Gauntlet推出的流動性激勵活動直接點燃的。這場活動計劃在最初兩周內,向Unichain上的12個特定流動性池分發總計500萬美元的UNI代幣作爲獎勵。這12個池子主要集中在主流資產對,如USDC/ETH、ETH/WBTC、USDC/WBTC,以及UNI/ETH和多種LST/LRT與ETH的配對。

關於這場活動能如此有效地吸引流動性的內在原因,可能存在兩方面的背景。

一方面是“擼毛效應”,500萬美元的UNI代幣獎勵,集中在12個池子並在短時間內(初步爲兩周)分發,對於流動性提供者來說可能帶來潛在的高收益。

我們可以參考Gauntlet在其他鏈上運行類似激勵計劃的歷史數據來估算其吸引力。一份Gauntlet的分析提到,基於歷史數據,保守估計1美元激勵能帶來35-50美元的TVL。以此計算,這次活動可能最終爲Unichain帶來約1.75億美元到2.5億美元左右的TVL增長。就目前的數據來看,Unichain的表現已經超出了常規預期。

具體這個活動能帶來多少的收益率?就以2.67億美元的TVL增長計算,用戶每投入1萬美元約能獲得181美元的收益,收益率約爲1.81%。當然,這是以TVL目前的水準計算得出的結果,最終TVL可能會更高,對用戶來說實際的收益會相對更少一些。

另一方面,在大資金追逐這種擼毛效應的背後,更深層次的原因是市場下行期的“穩定收益”需求,2025年第一季度,加密市場整體經歷了回調,比特幣和以太坊等主流資產價格下跌,市場波動性加劇。在這種環境下,大量資金,尤其是大額資金,傾向於尋找風險相對較低且收益穩定的避風港。

隨着湧入的資金越來越多,狼多肉少的情況加劇了內卷。博主@0x_Todd就吐槽,這種機制迫使LPs將流動性集中在極窄的價格區間。比如USDC/USDT維持在0.9998-1.0000之間,這導致在這個狹窄區間內有幾千萬美元的超高流動性深度,但由於費率僅 0.01%,每天的交易費收入僅 1K-2K 美元,這種內卷也造成了資金的極大浪費。

總體來說,UnichainTVL的飆升是高額短期激勵、市場避險情緒下的穩定收益需求共同作用的結果,但這種短期飆升,是否具有實際意義仍有待觀察。

Uniswap的“陽謀”,靠Unichain與V4重回DeFi龍頭?

隨着Unichain的主網上線和激勵活動開始激活市場,Uniswap Labs的全盤布局在近期也開始同步落地。從Uniswap V4上線部署到監管風波平息,再到社區治理推進費用開關提案。Uniswap似乎正努力重回DeFi龍頭。

今年1月,Uniswap V4在以太坊、Polygon、Arbitrum等10多個主流網絡部署。V4引入了“Hooks”機制,允許開發者在流動性池生命周期的關鍵節點插入自定義代碼,極大地增強了協議的可定制性,將其從一個DEX轉變爲一個DeFi開發者平台。截至4月17日,Uniswap V4的TVL已經達到了3.69億美元,超過了V2版本。

此外,曠日持久的SEC調查於2025年2月宣告結束,且未對UniswapLabs採取執法行動,此外,與CFTC就特定槓杆代幣交易達成17.5萬美元的和解。總體來看,Uniswap核心業務面臨的系統性監管風險已大大降低。

對於Unichain和V4的推動,離不開資金的支持。今年3月,“Uniswap Unleashed”提案獲得通過,批準了總計約1.655億美元的資金用於支持Unichain和V4的增長,包括9540萬美元的贈款、2510萬美元的運營費用和4500萬美元的流動性激勵。這筆資金直接來源於UniswapDAO金庫。

協議費用開關,這無疑是UNI持有者最關心的核心問題之一。盡管相關提案已高票通過初步投票和最終的“UniswapUnleashed”資金投票,但其實施仍需等待Uniswap基金會解決相關的法律實體問題。一旦成功激活,將直接爲質押和參與治理的UNI持有者帶來協議收入,成爲UNI代幣價值捕獲的關鍵一步。

總的來看,Unichain更像是Uniswap打造的一個核心、高度優化的“主場”,V4則是這個戰場上所展示出的最強武器。最終,將大部分TVL遷移到Unichain是一個可能的長期目標,但短期內似乎仍有難度。目前Unichain TVL(約1.78億美元)相較於以太坊主網(約25億美元)和Base(約6億美元)仍有較大差距。

不過,接下來Uniswap大概率還會通過持續的社區激勵來刺激這一最終目標的達成。目前,Uniswap DAO已批準爲Unichain提供2100萬美元的初始流動性激勵(爲期3個月),並預計在第一年總共需要約6000萬美元的激勵資金。此外,還有9540萬美元的贈款預算,部分將用於Unichain生態。

Unichain近期由流動性激勵計劃引爆的TVL飆升,不僅僅是一場資金追逐短期高收益的狂歡,更像是Uniswap精心布局下的一次“火力偵察”。它成功地將市場的目光重新聚焦到這個爲DeFi量身打造的L2網絡上,並初步驗證了通過雄厚財力撬動生態冷啓動的可行性。

這次事件背後,是UniswapLabs更深遠的戰略圖謀:通過推出Unichain和V4協議,實現從應用到基礎設施的垂直整合,打造一個性能優越、成本低廉、高度可定制的DeFi專屬鏈,以鞏固其在激烈競爭中的領先地位。然而,Unichain能否真正從“協議的應用鏈”蛻變爲“DeFi的新家園”,仍面臨諸多考驗。短期的激勵能否轉化爲長期的用戶粘性和真實的生態繁榮?V4Hooks的創新潛力能否被充分激發?備受期待的協議費用開關何時能最終落地,真正賦能UNI代幣。

對於Uniswap和UNI持有者而言,未來充滿了機遇與挑戰。Unichain的成功與否,將深刻影響Uniswap在下一代DeFi格局中的地位。這場從應用到鏈的華麗轉身能否成功,市場正拭目以待。

聲明:

- 本文轉載自 [PANews],著作權歸屬原作者 [Frank],如對轉載有異議,請聯系 Gate Learn 團隊,團隊會根據相關流程盡速處理。

- 免責聲明:本文所表達的觀點和意見僅代表作者個人觀點,不構成任何投資建議。

- 文章其他語言版本由 Gate Learn 團隊翻譯, 在未提及 Gate.io 的情況下不得復制、傳播或抄襲經翻譯文章。