How will USD stablecoins disrupt the current fiat currency system and reshape the structure of nation-states?

Repost of Original Title: “‘GENIUS Act’ and the New East India Company: How Dollar Stablecoins Will Challenge the Existing Fiat Currency System and the Modern Nation-State”

I. Ghosts of History: The Digital Return of the East India Company

History never repeats itself in the same way, but it certainly rhymes. When Trump joyfully signed the GENIUS Act into law, what flashed through my mind was not just legislation—it was the echo of history itself: the rise of the Dutch and British East India Companies in the 17th and 18th centuries, giant commercial entities endowed with sovereign powers by the state.

At face value, the Act seems a technical adjustment in financial regulation. Underneath, though, it serves as a charter for the “New East India Company” of the 21st century—heralding a profound transformation that may rewire global power dynamics.

1a. Chartering a New Order of Power

Four hundred years ago, the Dutch East India Company (VOC) and the British East India Company (EIC) were never mere traders. With state-granted authority, they fused the identities of merchant, soldier, diplomat, and colonizer. The VOC could raise its own armies, issue currency, sign international treaties, and even wage war. Likewise, Queen Elizabeth I’s charter gave the EIC monopoly trading rights in India and the power to establish military and administrative operations. These companies were the world’s first true multinationals, not just shipping goods but shaping the very veins of early globalization—maritime trade routes.

In today’s world, the GENIUS Act legislates similar chartered legitimacy for a new class of power brokers: stablecoin issuers. Ostensibly, the Act aims to reduce risk and enforce standards by requiring reserves and asset attestations. In practice, it selects and certifies a small group of “officially recognized” stablecoin issuers—Circle (USDC), potentially Tether (if it chooses compliance), and Big Tech giants like Apple, Google, Meta, and X, all with billions of users. These entities won't be the wild, rogue revolutionaries of crypto—they’ll be licensed pillars of U.S. financial strategy, commanding the digital trade routes of our era: borderless, 24/7 financial rails.

1b. From Trade Routes to Financial Rails

The East India Companies built their power on monopolizing physical trade. Armed fleets and forts secured exclusive profits from the spice, tea, and opium trades. Today’s digital East India Companies will wield power by controlling the rails of global value movement. When US-regulated dollar stablecoins become the default for cross-border payments, DeFi lending, and real-world asset trading, their issuers dictate the rules of the new financial system. They decide who can connect, can freeze or restrict any address, and set compliance standards. This is power far deeper and more subtle than any physical monopoly.

1c. Blurred Symbiosis and Conflict with the State

The story of the East India Company is a saga of shifting relationships with the state. Early on, these companies were agents for the state’s mercantilist ambitions and geopolitical rivalries. But their drive for profit fueled their rise as independent centers of power. The EIC started wars (like Plassey), trafficked opium, and repeatedly forced the British government into diplomatic and military quagmires. Eventually, after fiscal collapse from mismanagement and overreach, the British government had to intervene—tightening controls through the Tea Act and Pitt’s India Act—until, after the 1858 Indian Uprising, the EIC lost all administrative control to the Crown.

This history previews where stablecoin issuers and the US government could head. Today, these firms are seen as assets for maintaining dollar supremacy and countering China’s digital yuan. But should they become “too big to fail” and too critical to global finance, their commercial interests and those of their shareholders may one day diverge from U.S. foreign policy.

As the private sector’s role in the dollar system grows, some clash with state sovereignty is inevitable. Regulatory escalation and “stablecoin acts 2.0” are likely as interests realign.

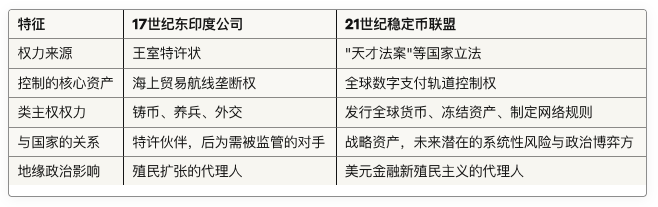

The table below highlights the striking similarities between these historical and present-day power structures:

The ghosts of history are back. Through the GENIUS Act, the United States is setting loose a new East India Company—in the guise of tech innovation, wielding the scepter of blockchain, yet at its core, repeating the old imperial formula: private, globally chartered corporations eventually locked in a contest for power with the state itself.

II. The Global Currency Tsunami: Dollarization, Hyper-Deflation, and the Endgame for Non-Dollar Central Banks

The GENIUS Act is ushering in more than a new order of corporate power—it’s also triggering a worldwide monetary tsunami. The spark goes back to the collapse of Bretton Woods in 1971—the moment the shackles came off, paving the way for today’s global takeover by dollar stablecoins. For countries with weak sovereign credit, the question will no longer be whether the state picks its own currency or the traditional dollar. Instead, individuals will choose in real time between a collapsing national currency and a frictionless digital dollar. The result: a wave of hyper-dollarization, eroding monetary sovereignty and inflicting crushing deflation on vulnerable economies.

2a. The Lingering Ghost of Bretton Woods

To appreciate the might of stablecoins, look back to the unraveling of Bretton Woods. That system pegged the dollar to gold, and every other major currency to the dollar—a stable but ultimately self-defeating structure. “Triffin’s dilemma” doomed it: as the reserve currency, the dollar had to flow out in trade deficits to fuel global commerce, but endless deficits destroyed trust in its redeemability. Nixon closed the “gold window” in 1971, ending the system.

The dollar’s “death” was really a rebirth. Under the “Jamaica system,” it became pure fiat—free from gold, and thus, with the Fed able to supply liquidity to meet both American fiscal needs (Vietnam, for example) and global demand. For half a century, this has underpinned dollar hegemony: a power built on network effect, not metal. Stablecoins, especially those sanctioned by U.S. law, are the post-Bretton Woods system’s ultimate technical form. They turbocharge the dollar’s global reach, bypassing government and banks to penetrate every economic capillary—straight to every phone in the world.

2b. Hyper-Dollarization Arrives

In countries like Argentina and Turkey, wracked by inflation and instability, citizens already dollarize to protect their savings. But conventional dollarization meant bank accounts, capital controls, and physical cash risks. Stablecoins erase all that. Anyone with a smartphone can now swap devaluing currency for dollar-pegged tokens in a matter of seconds at minimal cost.

In Vietnam, the Middle East, Hong Kong, Japan, and South Korea, “USDT shops” are replacing currency exchanges; you can buy Dubai real estate with Bitcoin; small shops in Yiwu accept stablecoins for cigarettes.

As dollar stablecoin payments penetrate everywhere, dollarization may become a sudden tsunami. When inflation expectations tick up, capital doesn’t just “flow out”—it “evaporates,” leaving the local system and entering the global crypto network. This is the ultimate form of “sovereign currency substitution.”

For governments already on the brink, this is lethal. The local currency’s standing crumbles—because people and businesses now have a more perfect, efficient alternative.

2c. Hyper-Deflation and the Disappearance of State Power

When hyper-dollarization hits, sovereign governments lose two core powers: the ability to print money (seigniorage) and the independence to set monetary policy.

The consequences are catastrophic.

First, as the home currency is dumped, its value spirals downward in hyperinflation. Yet, at the same time, economic activity priced in dollars will see wages, assets, and goods values crash—deflation in dollar terms.

Second, the government’s tax receipts vanish. Revenues in a collapsing currency become worthless, and the state’s fiscal base implodes. This “death spiral” breaks the state’s ability to govern.

The timeline starts with Trump signing the GENIUS Act and accelerates as RWA tokenization picks up speed.

2d. White House vs. Federal Reserve: America’s Internal Power Struggle

This revolution isn’t limited to adversarial regimes—it could spark crises inside the US, too.

Today, the independent Federal Reserve controls monetary policy. But a parallel digital dollar system, issued by private firms but regulated by the Treasury or a new executive agency, would create a competing monetary rail. By shaping regulations over stablecoin issuers, the executive branch could indirectly or directly steer money supply and flows—sidestepping the Fed. This could become a powerful tool for achieving political or strategic goals (like election-year stimulus or surgical sanctions), potentially causing a major crisis in confidence in US monetary independence.

III. The 21st Century Financial Battlefield: America’s “Free Financial System” vs. China

If regulatory reform is about reordering domestic power, externally the stablecoin act is a critical move in America’s strategic chess match with China: through legislation, promoting a private, public-blockchain, dollar-centered “free financial system.”

3a. The New Financial Iron Curtain

After WWII, America established the Bretton Woods system to rebuild economies and, in the Cold War, to build a Western economic bloc excluding the USSR. The IMF and World Bank became tools to project Western values and cement alliances. Today, the GENIUS Act is aimed at constructing a new digital-age Bretton Woods: a global network built on dollar stablecoins—open, efficient, and ideologically opposed to China’s state-first model. America’s play is bolder and more disruptive than its Cold War free trade system ever was.

3b. Open vs. Closed: Permissioned vs. Permissionless

The US and China follow fundamentally different digital currency philosophies: “open” vs. “closed.”

China’s digital yuan (e-CNY) is a “permissioned” system, running on a central bank-controlled private ledger. Every account and transaction is state-monitored—a digital walled garden. While highly manageable and effective for governance, its closed nature breeds distrust among global users, especially those wary of surveillance.

The US, by contrast, backs stablecoins built on permissionless blockchains like Ethereum or Solana. Anyone on earth can innovate, deploy DeFi apps, create new markets, or transact—without asking a central authority’s permission. The US acts not as network operator, but as the credit backer of the dollar, the network’s core asset.

This is a masterstroke of asymmetric strategy. The US exploits its rival’s greatest weakness—fear of losing control—to build its moat, attracting global innovators, developers, and everyday users to a dollar-based open ecosystem. China can only play on its own closed terms, unable to compete with the network effects of an open financial internet.

3c. Bypassing SWIFT: A Dimensional Power Play

China, Russia, and other challengers have tried to counter dollar dominance by building alternatives to SWIFT. But stablecoins make these efforts look outdated. Public blockchain-based stablecoin transfers don’t need SWIFT or any incumbent bank rails. Value moves cryptographically, peer to peer, on a distributed global network—a new infrastructure running alongside legacy systems.

America no longer needs to defend the old castle (SWIFT)—it’s built a new battlefield. Here, protocol and code—not treaties—set the rules. As most digital value moves onto these rails, the push to build a “better SWIFT” will be as futile as building luxury carriage roads in the freeway age.

3d. The Battle for Network Effect

In the digital era, network effects are destiny. Once a platform achieves critical mass, its pull becomes overwhelming. Through the GENIUS Act, the US is fusing the world’s strongest monetary network (the dollar) with the most innovative technology network (crypto). The synergies will be exponential.

Developers worldwide will prefer to build for the biggest liquidity pool and user base. Users will converge where asset options and use cases are richest. Meanwhile, the e-CNY may gain ground on the Belt and Road, but its closed, yuan-centric architecture makes global adoption difficult.

In short, the GENIUS Act is no “normal” domestic law—it’s a cornerstone of America’s 21st-century geopolitical strategy. By leveraging decentralization and openness, it shores up dollar hegemony with finesse. This is not an arms race; it’s a remapping of the financial battlefield, playing on terrain where the US has absolute advantage and can undercut rivals’ financial architectures at the protocol level.

IV. The De-Nationalization of Everything: How RWA and DeFi Dismantle State Control

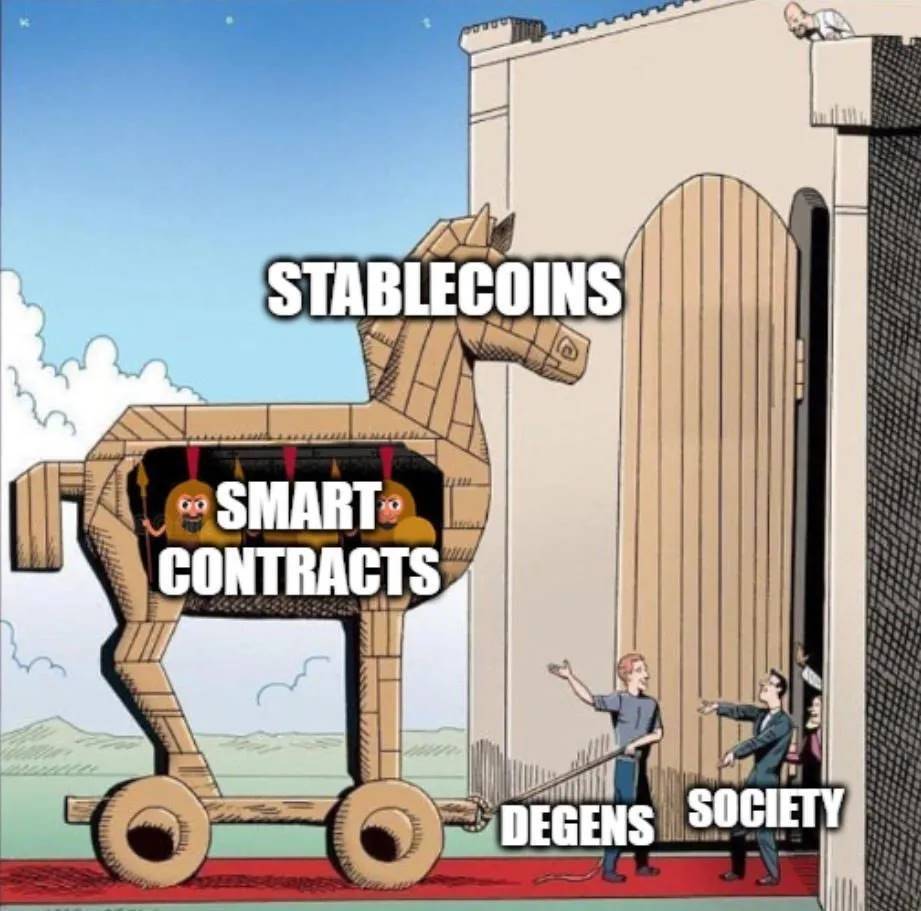

Stablecoins aren’t the end—they’re the Trojan horse. Once users are habituated to global value transfer via stablecoins, a deeper revolution follows: tokenizing everything of value—stocks, bonds, real estate, art—into free-floating digital tokens on public ledgers. This “real world asset on-chain” (RWA) process will sever assets from any single country’s jurisdiction, “de-nationalize” asset control, and ultimately disrupt the entire bank-centered financial system.

4a. Stablecoins: The Trojan Horse to a New World

Legend has it the Greeks took Troy with a giant wooden horse. Today, stablecoins play a similar role. To regulators, asset-backed, “safe” stablecoins look like tamed onramps to the crypto wildlands.

But the reality is paradoxical. In its push to fortify state power, the GENIUS Act inadvertently creates the world’s biggest acquisition channel for “dangerous,” fully decentralized, non-state digital money.

The true purpose of stablecoins is to bridge the fiat and crypto asset worlds. They serve as low-friction “on-ramps.” While most users join for cost-effective remittances or daily payments, once acclimated to digital wallets and on-chain transactions, they are just a click away from Bitcoin, Ethereum, and other censorship-resistant assets.

Platforms like Coinbase and Kraken are crypto marketplaces. Users come for stablecoins but are soon drawn by DeFi yields or Bitcoin’s store-of-value narrative. Going from USDC to ETH staking is a natural progression for anyone who’s crossed the digital threshold.

This creates a profound policy dilemma. The state’s goal—entrench dollar hegemony through stablecoins—means investing in wallet, exchange, and app infrastructure. The catch: these tools are technologically neutral. The same wallet can hold regulated USDC or anonymous Monero; the same exchange can list both.

As users’ sophistication grows, so does demand for higher yield, privacy, and true censorship-resistance. Eventually, they shift beyond simple stablecoins to assets that better meet those needs.

4b. The RWA Revolution: Assets Break National Chains

If DeFi is the revolution’s superstructure, RWA is its bedrock. The core of RWA is to harness legal and technical processes to tokenize real-world or traditional assets on blockchain.

Imagine: A Chinese development team launches an app with millions of global users; its ownership is tokenized and circulates freely on-chain. That token trades on a permissionless DeFi protocol. An Argentine user can buy it and receive it in moments—no banks in China, the US, or Argentina involved.

In this world, asset tokenization, collateralization, stablecoin minting, and transfer all happen on-chain, bypassing traditional banks and borders. It’s not just a better payment rail but a parallel financial universe, one that renders Westphalian borders almost irrelevant.

This is how de-nationalized money drives de-nationalized finance and, finally, de-nationalized capital. When capital escapes national chains, so does the capitalist.

4c. Traditional Finance’s Doomsday

This new ecosystem—powered by stablecoins and built on RWA—is an existential challenge to existing finance. Traditional intermediaries—banks, brokerages, payment processors—exist to broker trust and information, extracting heavy fees.

Blockchain upends this with “code as law,” where transparent, immutable ledgers and smart contracts automate trust. In this new model:

- Bank lending is replaced by decentralized protocols.

- Exchanges’ order books by automated market makers (AMM).

- Payment firms’ cross-border settlement by instant, global stablecoin transfers.

- Wall Street securitizations by transparent, efficient RWA tokenization.

V. The Rise of the Sovereign Individual—and the Dusk of the Nation-State

When capital can cross borders freely, assets escape state control, and power migrates from nations to private giants and communities, the endgame is clear: an era led by “sovereign individuals,” signaling the sunset of the Westphalian order. This revolution, driven by stablecoins and AI, will ultimately have more profound effects than the French Revolution—not just changing who holds power, but upending power’s very nature.

(“The Sovereign Individual” is indeed a prophecy of our times.)

5a. The Sovereign Individual’s Prophecy Realized

In 1997, James Dale Davidson and Lord William Rees-Mogg foresaw in “The Sovereign Individual” how the Information Age would transform the logic of power. The nation-state thrived in the industrial era by taxing and protecting static, tangible capital. But in the Information Age, the most valuable assets—knowledge, skills, money—are weightless, borderless. The state is like a rancher trying to fence “cows with wings”—taxing and controlling them becomes almost impossible.

Stablecoins, DeFi, RWA—these are the “cybermoney” and “cybereconomy” the book envisioned. Together, they build a global, low-friction network that gives capital wings. The global elite can allocate wealth anywhere via RWA tokens and shift funds instantly with stablecoins—out of any single state’s reach. The book’s vision—individuals escaping government oppression, and asset-holders evading monetary monopoly—is manifesting.

5b. The End of the Westphalian System

Since 1648’s Treaty of Westphalia, world politics has rested on sovereign states—each supreme within its borders, equal to all others, protected from outside interference. The nation-state’s bedrock is total control over its territory and people.

The rise of the sovereign individual is eroding this base. When the world’s most creative, productive individuals (and their wealth) exist in cyberspace, geographical borders lose meaning. States can no longer tax the truly mobile elite, and their fiscal base withers. Desperate governments may escalate with “hostage-style” taxes or attack autonomy-promoting technologies, as the book predicted, but this only accelerates the exodus, creating a vicious cycle. The eventual result: the nation-state becomes a hollowed shell—reduced to a “nanny state” for the immobile, its link to wealth creation severed.

5c. The Final Frontier: The Privacy and Taxation Endgame

The next battle in this revolution is privacy. Today’s public blockchains are pseudonymous but traceable. As privacy tech like zero-knowledge proofs (ZKP) matures—see Zcash, Monero—fully anonymous, untraceable transactions become possible.

When a stablecoin-based global system fuses with advanced privacy, tax authorities face the ultimate test: a black box where neither counterparties nor incomes can be discerned. This is the endgame of “de-regulation”: when the state can’t tax, it can’t regulate or provide public goods.

The French Revolution replaced monarchic sovereignty with national sovereignty—but the state’s territorial logic survived. The stablecoin revolution is dissolving that logic, replacing “national territorial sovereignty” with “network sovereignty” and “individual sovereignty.” This isn’t a mere transfer of power, but a full-scale decentralization and de-nationalization. The paradigm shift is as great as, or greater than, that of the French Revolution. We now stand at the dawn of a new order, one that will grant individuals unprecedented power and freedom—but also unleash chaos and challenges we can scarcely imagine.

Statement:

- This article is reprinted from TechFlow, original title: “‘GENIUS Act’ and the New East India Company: How Dollar Stablecoins Will Challenge the Existing Fiat Currency System and the Modern Nation-State.” Copyright remains with the original author [TechFlow]. For repost concerns, contact the Gate Learn team for prompt handling.

- Disclaimer: The views and opinions expressed in this article are those of the author alone and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless otherwise stated, no part of these translations may be copied, distributed, or plagiarized without referencing Gate.

Share

Content