$450M Funded and the Sui Treasury Launches — Who’s Behind This Company?

On July 28, Mill City Ventures III, Ltd. (NASDAQ: MCVT) announced a $450 million private placement to launch a SUI treasury strategy. The hedge fund Karatage led the round, with the Sui Foundation providing a matching investment. Other prominent firms, including Galaxy Digital, Pantera Capital, and Electric Capital, also supported the initiative. Galaxy Asset Management will take responsibility for overseeing Mill City’s financial operations, further strengthening market confidence.

Following this announcement, MCVT’s stock price soared from $2 to a peak of $8 over three days—a cumulative gain of up to 400%—before closing at $6.65 yesterday. This move not only signifies a traditional publicly listed financial company’s entry into a new era of crypto infrastructure, but also marks the launch of another “altcoin microstrategy.” After ETH, SOL, and BNB, SUI is now capturing institutional attention and consensus.

Karatage and the Sui Foundation: Two Institutions Propel SUI Microstrategy

Mill City Ventures III, Ltd., a non-bank lender and financial services company, recently announced it had entered into a securities purchase agreement for a private investment in public equity. The company will buy and sell 83,025,830 shares of common stock at $5.42 per share, raising an anticipated $450 million in gross proceeds. The offering is expected to close around July 31, 2025. Mill City intends to use roughly 98% of the private placement’s net proceeds to acquire SUI, the native token of the Sui blockchain, while the remaining 2% will support its short-term lending business. SUI will become the company’s primary reserve asset. This strategic pivot marks Mill City’s transformation from conventional short-term lending and specialty finance to a financial structure anchored in crypto-native assets.

This successful transition is largely attributable to the deep involvement and strong support of both Karatage and the Sui Foundation.

The round was led by Karatage, a London-based hedge fund specializing in digital assets and advanced technologies, co-founded by Marius Barnett and Stephen Mackintosh. Beyond contributing capital, Karatage is directly shaping Mill City’s strategic direction and governance reforms—Barnett will become chairman of the board, and Mackintosh will serve as chief investment officer, leading the execution of the SUI investment and managing related assets.

Karatage’s participation is part of a deliberate, long-term strategy. The fund was involved in building key Sui ecosystem protocols—such as Walrus and Suilend—early on, and it has maintained a longstanding partnership with Sui’s core contributor, Mysten Labs, amassing extensive operational expertise. Mysten Labs, the technical engine behind the Sui Network, was founded in 2021 by former Meta-Novi head of engineering Evan Cheng and lead engineer Sam Blackshear, spearheading the development of foundational tools like Sui Wallet and Sui Explorer.

Stephen Mackintosh, co-founder of Karatage, commented, “We’re at a pivotal moment as institutional crypto and artificial intelligence reach critical scale, creating major opportunities for blockchain infrastructure. Sui offers the speed and efficiency institutions demand from large-scale crypto, with a technical architecture that supports AI workloads while remaining secure and decentralized—positioning it for widespread adoption.”

With this early, hands-on involvement and technical collaboration, Karatage has developed deep insight into Sui’s architecture and roadmap—adding credibility and executional support to Mill City’s strategic transformation.

The Sui Foundation is also playing a critical role in this strategic shift—not only participating in the financing round, but continuously supporting the Sui ecosystem’s development in multiple ways.

As an independent organization dedicated to Sui Network’s growth and adoption, the Sui Foundation is both a foundational investor and a primary driver of the ecosystem’s vitality. The Foundation consistently backs Sui’s expansion—granting funds to developers, supporting the creation of next-generation decentralized applications (dApps), and strengthening essential infrastructure like the DeepBook central limit order book (CLOB), automated market maker (AMM) systems, liquid staking protocols, and lending platforms.

The Foundation’s buyback and redistribution policy strategically allocates resources to projects with the greatest potential to drive network growth. It also regularly incentivizes top DeFi protocols with SUI token rewards. Nearly every leading project within the ecosystem has received official support, significantly boosting Sui’s TVL and user activity, and driving SUI’s price to hold strong through market cycles.

Christian Thompson, Managing Director of the Sui Foundation, explained: “Sui was built to deliver the scalability, speed, and security needed for the next wave of decentralized applications and real-world crypto use cases, serving both individuals and institutions—from stablecoins and AI to gaming and the broader financial landscape.”

As a “best-in-class Layer 1 blockchain network,” Sui is drawing increasing attention and trust from developers and institutions alike, thanks to its industry-leading throughput and parallel execution architecture. It is fast becoming a focal point for altcoin microstrategy innovation.

Summary

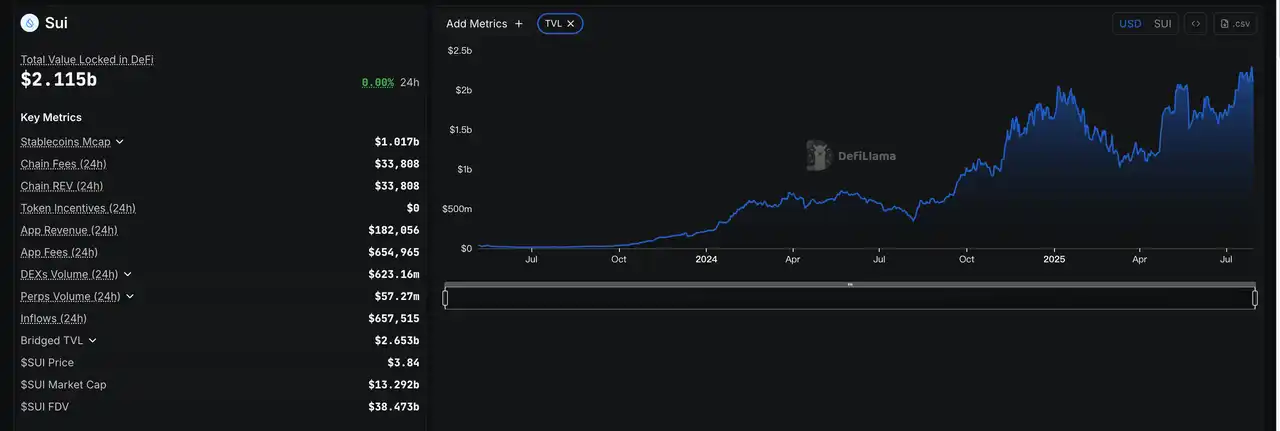

Sui’s ecosystem is surging in popularity, fueled by the rise of artificial intelligence and decentralized finance. Sui’s total value locked (TVL) recently exceeded $2 billion—an all-time high—with daily transaction volumes climbing and ecosystem activity on the rise. On July 27, SUI’s price briefly hit $4.5, reaching its highest level in six months and standing out as one of the most impressive altcoin performers of late.

From Mill City’s treasury microstrategy to the combined backing of Karatage and the Foundation, Sui is proving its capital appeal and demonstrating that its technology and ecosystem are gaining mainstream recognition. An institution-led, ecosystem-driven microstrategy paradigm is now taking shape, making Sui’s future performance one to watch.

Disclaimer:

- This article is republished from BLOCKBEATS, with copyright belonging to the original author [kkk]. If you have concerns about this republication, please contact the Gate Learn Team, and the team will address it according to established procedures.

- Disclaimer: The opinions and views expressed in this article belong solely to the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn Team. Copying, distribution, or plagiarism is prohibited without proper attribution to Gate.