LINK Token Price Analysis: Latest Market Momentum & the JPMorgan Effect

LINK Token Overview

Chainlink is a decentralized oracle network built on Ethereum, designed to deliver highly reliable and secure off-chain data to smart contracts. Its native token, LINK, plays multiple roles within the ecosystem—as a payment method, an incentive mechanism, and staking collateral. Chainlink, launched in 2017, is recognized as a pioneer and leader in the oracle sector.

Today, Chainlink’s data feeds have been integrated by leading DeFi protocols such as Aave, Synthetix, and Compound, firmly establishing it as a core component of DeFi data infrastructure.

Current Price and Market Performance

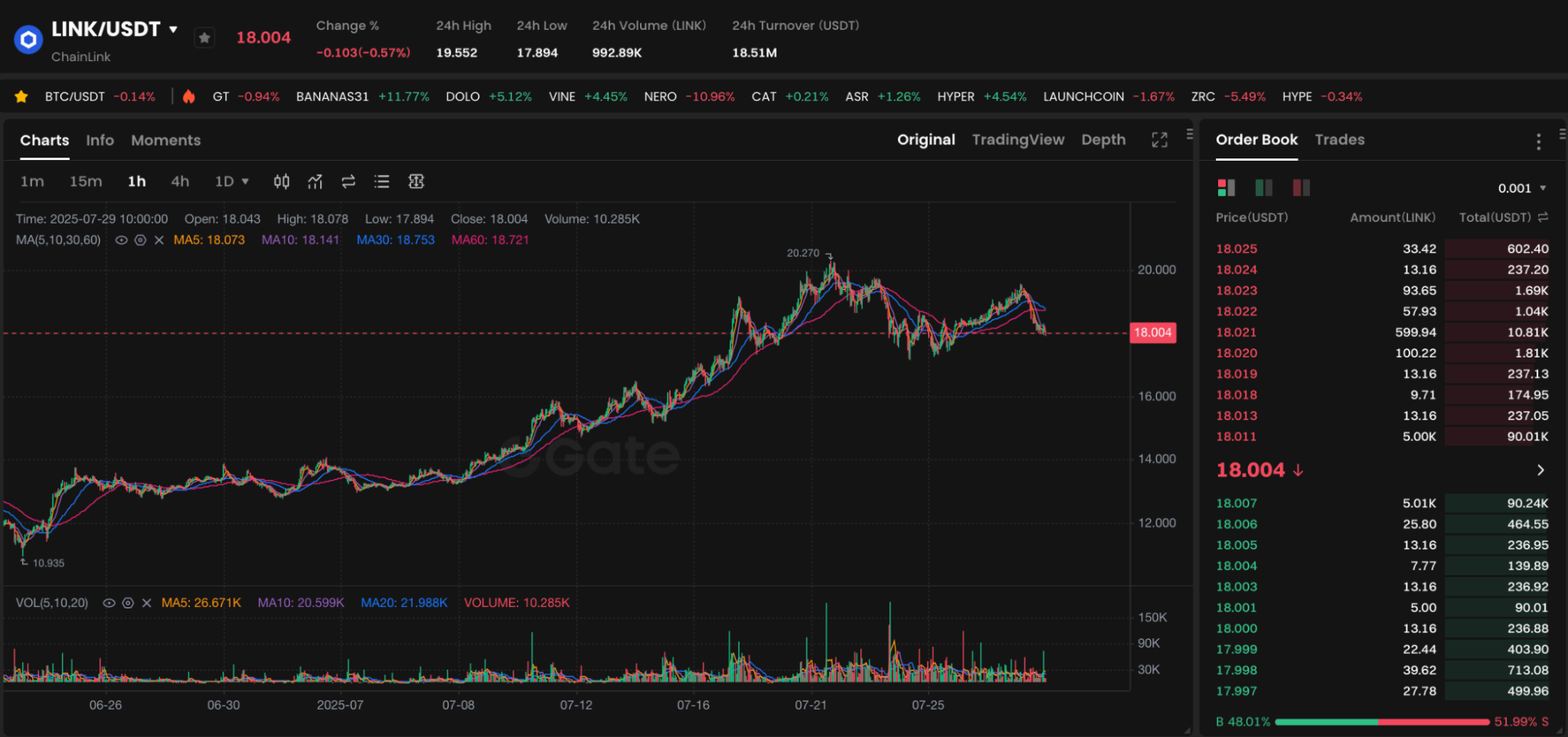

Chart source: https://www.gate.com/trade/LINK_USDT

According to Gate trading data, as of July 29, 2025, LINK/USDT is trading at 18.11 USDT, with a 24-hour gain of approximately +0.33% and a trading volume of $18,302,010. The market maintains a relatively stable outlook on LINK, as indicated by this price performance.

From the start of the year to now, LINK has achieved a gain of more than 40%. This was largely driven by rising demand for oracle solutions and a broader market rebound.

Latest News Briefs

- JPMorgan Connects to Chainlink Network

Fintech outlet Coindesk reports that JPMorgan is piloting Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to enable interoperability between on-chain assets and traditional financial infrastructure. This marks the first formal adoption of Chainlink technology by a major bank and further validates Chainlink’s technical leadership. - Transparent LINK Circulation Management

At the end of July, Chainlink announced it would automatically monitor LINK token circulation and launch a transparency dashboard, aiming to counter market fears and misunderstandings. Chainlink aims to boost investor confidence and help stabilize the price with this move. - Expanded Integration with Solana and Polygon

Chainlink recently announced the deployment of its price oracle on Solana mainnet and a long-term partnership with Polygon to support DePIN and RWA applications.

Price Analysis and Short-Term Forecast

Technically, LINK has shown steady price action recently. Its candlestick chart is forming a textbook “ascending triangle” pattern—a sign the market is building momentum. Key short-term support is at 17.20 USDT with strong resistance at 20.00 USDT.

If trading volume exceeds the average in the near term, LINK could test the psychological $20 barrier. Continued strength from Bitcoin could also spur LINK to rally alongside other major cryptocurrencies.

Risk Disclosure and Trading Strategies

Main risk factors include:

- Macroeconomic headwinds, such as interest rate hikes or geopolitical tensions

- Intensifying competition from projects like API3 and Band Protocol

- Rising pressure for technical pullbacks

Recommended trading strategies:

- Consider accumulating positions in batches within the 17.50–18.00 USDT range

- Set stop-loss orders just below 16.80 USDT

- Set target prices between 19.80–20.50 USDT and plan to take profits incrementally

Conclusion and Outlook

LINK’s value lies not only in its price performance but also in its ecosystem impact and continuous technical innovation. As institutional adoption grows and the cross-chain ecosystem deepens, LINK is positioned to become a leading standard for data in on-chain infrastructure. The $18 price level may offer a solid mid-term entry point for investors seeking exposure to this sector.