Статьи

ВсеАльткоиныБиткоинБлокчейнDeFiEthereumМетавселеннаяNFTТрейдингУчебное пособиеФьючерсыТорговые БотыBRC-20GameFiDAOМакротенденцииКошелькиInscriptionТехнологияМемИИSocialFiDePinСтейблкоинЛиквидный стейкингФинансыRWAМодульные блокчейныДоказательство с нулевым разглашениемРестейкингКриптоинструментыАирдропПродукты GateБезопасностьАнализ проектовCryptoPulseResearchЭкосистема TONУровень 2SolanaПлатежиМайнингАктуальные темыP2PЭкосистема SuiАбстракция блокчейнаОпционБыстрое чтениеВидеоЕжедневный отчетПрогноз РынкаТорговые ботыОтчет отрасли для VIP

Еще

Исследование Gate: Новый криптовалютный порядок в условиях тарифной бури — структурные сдвиги и возможности в стейблкоинах, RWA и DeFi

Скачать полный отчет (PDF)

Эта статья исследует, как взаимные тарифные политики влияют на мировые финансовые рынки через макроэкономические передаточные механизмы. Далее анализируется их влияние на экосистемы стейблкоинов, активов реального мира (RWAs) и децентрализованной финансовой (DeFi), рассматривая как основные механизмы, так и потенциальные риски и возможности, связанные с этим.Абстрактный

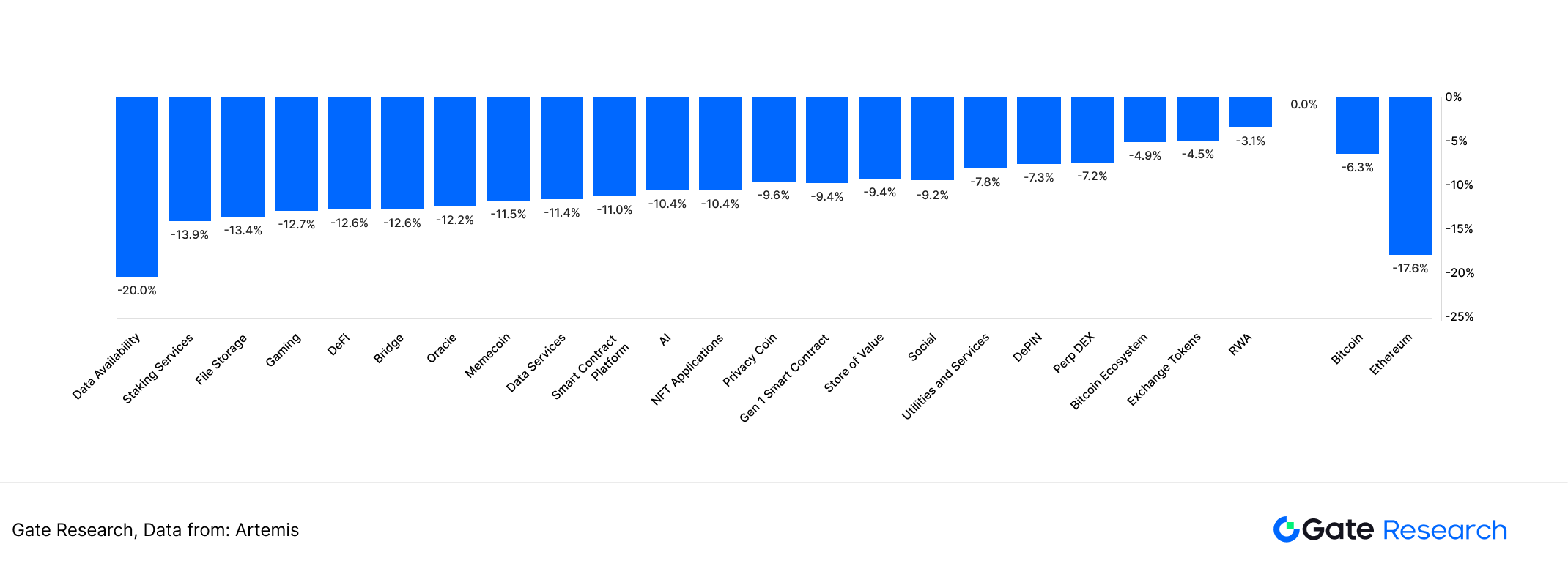

- Мировая Турбулентность На Рынке и Широкий Спад Криптовалют: После выпуска политики "Взаимной Тарифной" в апреле 2025 года, мировые финансовые рынки испытали интенсивную волатильность. 7 апреля криптовалютный рынок пережил значительное снижение, с биткоином, в общем, опускающимся до уровня около $74,600, и общая капитализация криптовалютного рынка сократилась на 7% за один день.

- Сильная реакция традиционных рынков: после введения тарифной политики американские фондовые рынки потеряли $5.9 триллиона капитализации за два торговых дня. Индекс волатильности (VIX) вырос на 50.9% за один день, а цены на золото достигли исторического максимума в $3,167.70 за унцию.

- Активность стабильных монет на цепи взлетает: с 20 января по 9 апреля 2025 года общая рыночная капитализация стабильных монет выросла на 11,13%, достигнув 233,5 миллиарда долларов. 7 апреля объем транзакций стабильных монет на цепи достиг двухмесячного максимума в 72 миллиарда долларов, а ежедневное количество активных адресов превысило 300 000, что свидетельствует о сильном спросе.

- RWA показывает стойкость и быстрый рост: всего за неделю после введения тарифа сектор RWA упал всего на 3,1%, что намного меньше, чем другие криптосекторы (где снижение превысило 10%), что свидетельствует о его надежности. Общая рыночная капитализация RWA превысила 32 миллиарда долларов, а объем торгов вырос на 99% всего за пять дней после введения тарифа.

- Торговый объем токенизированного золота стремительно растет: за семь дней, предшествующих 11 апреля, еженедельный торговый объем токенизированного золота превысил 1 миллиард долларов — самый высокий с марта 2023 года. С момента объявления тарифов торговый объем PAXG вырос более чем на 900%, XAUT возрос более чем на 300%, а KAU взлетел на 83 000

- Снижается общий объем заблокированных средств DeFi, и риск ликвидации усиливается: Под воздействием общего спада рынка общий объем заблокированных средств (TVL) в секторе DeFi снизился на 35,34% с 20 января по 9 апреля 2025 года, упав до $135,2 миллиарда. В неделю после внедрения тарифов TVL упал на 13,88%. Риски ликвидации на цепи значительно увеличились, с AAVE V3, где 6 и 7 апреля произошло ликвидирование заложенных токенов на сумму $94,39 миллиона.

- Возможности криптовалютного рынка в условиях тарифной бури: стейблкоины и RWA показывают сильный потенциал для хеджирования и трансграничного расчета. DeFi исследует модели арбитража тарифов, используя динамические коэффициенты обеспеченности, географический арбитраж и регулятивное хеджирование, чтобы разрабатывать новые финансовые стратегии при условии торговых барьеров.

(Нажмите ниже, чтобы получить полный отчет)

Исследование Gate

Исследовательский центр Gate - это комплексная платформа исследований блокчейна и криптовалют, предоставляющая читателям глубокий контент, включая технический анализ, актуальные идеи, обзоры рынка, отраслевые исследования, прогнозы трендов и анализ макроэкономической политики.

Нажмите Ссылкаузнать больше

Автор: Ember、Addie

Переводчик: Piper

Рецензент(ы): Edward、Wayne、Evelyn

Рецензенты перевода: Ashley、Joyce

* Информация не предназначена и не является финансовым советом или любой другой рекомендацией любого рода, предложенной или одобренной Gate.

* Эта статья не может быть опубликована, передана или скопирована без ссылки на Gate. Нарушение является нарушением Закона об авторском праве и может повлечь за собой судебное разбирательство.

Пригласить больше голосов

Содержание

Начните торговать сейчас

Зарегистрируйтесь сейчас и получите ваучер на

$100

!