Руководство по психологическому развитию для опытных трейдеров

Введение

Торговля криптовалютой — это не только соревнование технологий и стратегий, но и психологическая битва. Для опытных трейдеров крайняя волатильность рынка выходит за рамки простых ценовых колебаний — это постоянное испытание самодисциплины. Устойчивая торговая установка определяет долгосрочную прибыльность и является важной для сопротивления эмоциональным импульсам и поддержания рационального принятия решений.

Эта статья исследует построение крепкой психологической основы с четырех ключевых точек зрения: управление эмоциями, когнитивные предвзятости, долгосрочное мышление и саморефлексия. Овладев этими аспектами, трейдеры могут оставаться спокойными в условиях рыночных флуктуаций и достигать стабильной отдачи.

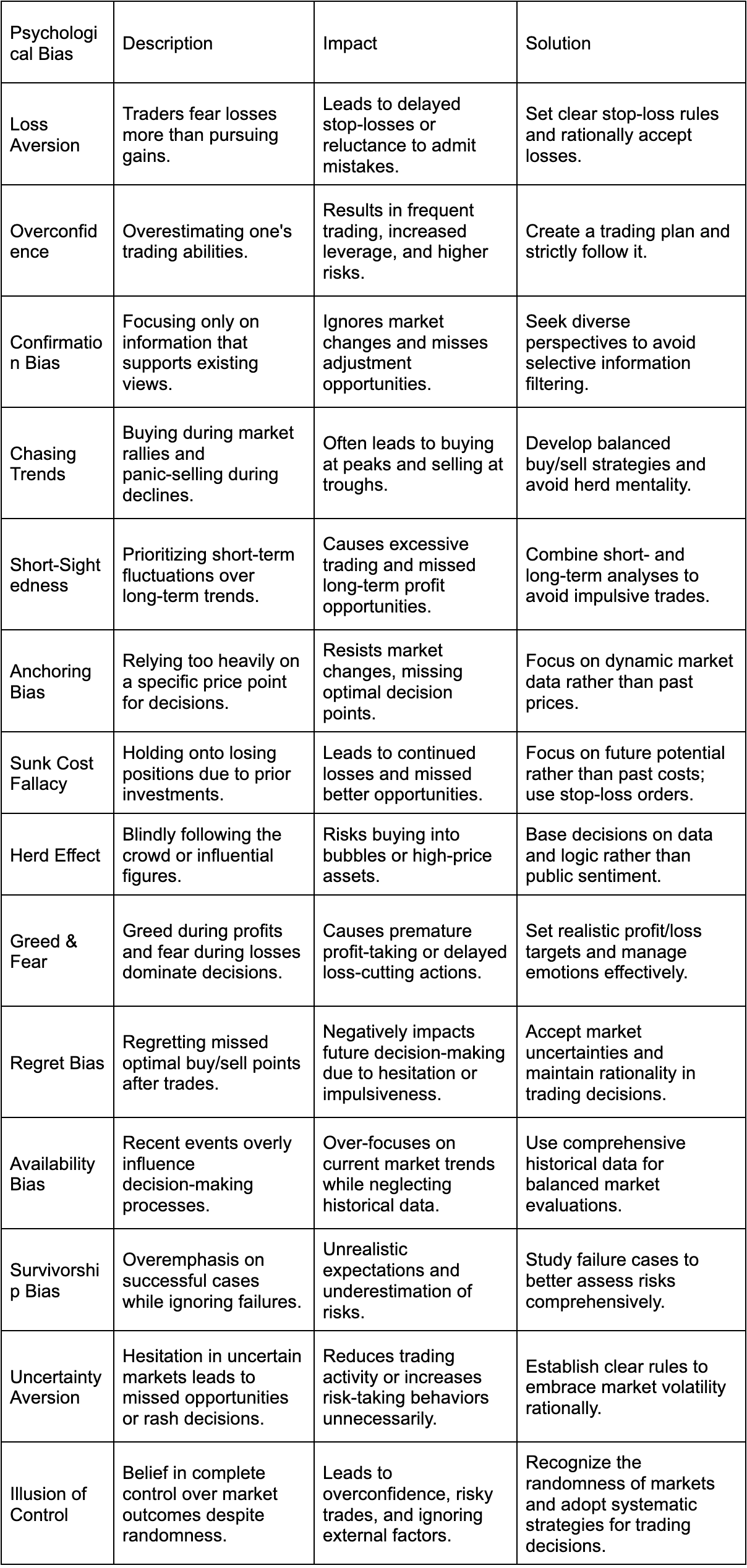

Общие психологические ловушки и риски

Из-за высокой волатильности, круглосуточной работы и информационной асимметрии торговля криптовалютой предъявляет огромные психологические требования к трейдерам. Эти психологические риски могут привести к неправильному принятию решений, финансовым потерям и даже долгосрочным эмоциональным напряжениям без должного осознания.

Ниже перечислены ключевые психологические риски, на которые должны обращать внимание трейдеры криптовалют, а также рекомендации по их выявлению и управлению ими.

1. FOMO (Страх пропустить)

Описание: Когда рынок быстро растет или токен сильно раздувается, трейдеры опасаются упустить момент и импульсивно покупают по высоким ценам.

Манифестация: Размещение заказов без анализа после просмотра взлетающих цен или шума в социальных медиа; частая смена торговых целей.

Последствия: часто приводят к покупке на пике, за которой следует падение цен и убытки.

Противодействия:

Используйте индекс быка-медведя LunarCrush или Augmento, чтобы оценить, перегрет ли рыночный настрой. Если индекс близок к 1, оставайтесь осторожными.

Установите четкий торговый план и вступайте в сделки только тогда, когда они соответствуют вашей стратегии.

Практика осознанности: глубоко вдохните и спросите себя: "Это возможность или импульс?"

2. Страх и паника

Описание: Когда рынок снижается, трейдеры паникуют и даже закрывают все позиции из-за страха дальнейших потерь.

Проявление: Липкие ладони и быстрое сердцебиение при наблюдении за падающими свечными графиками; реагирование немедленно на негативные новости.

Последствия: Приводит к продаже по низким ценам и упущенным возможностям для восстановления.

Контрмеры:

Проверьте индекс страха и жадности; показатель ниже 20 может указывать на перепроданное состояние, напоминая вам спокойно наблюдать.

Изучите онлайн-данные CryptoQuant, чтобы увидеть, продают ли крупные держатели, подстегивая панику.

Практика осознанности: примите страх и скажите себе: "Волатильность - это нормально, я буду придерживаться своего плана".

Источник: https://cryptoquant.com/

3. Жадность

Описание: После получения прибыли трейдеры остаются недовольными своими доходами и стремятся к еще более высоким доходам, что приводит к переизбытку или преследованию увеличения цен.

Проявление: Отказ от фиксации прибыли, воображение, что цены не имеют потолка; частое увеличение позиций или использование более высокого плеча.

Последствия: когда рынок разворачивается, прибыль аннулируется, что потенциально может превратиться в убытки.

Противодействие:

Используйте TradingView для установки уровней тейк-профита и строго следуйте плану выхода.

Обратитесь к отчетам о настроениях The TIE - если рынок перегрет (чувство жадности высоко), напомните себе закрепить прибыль.

Практика внимательности: Оцените удовлетворение от полученной прибыли и избегайте быть мотивированным жадностью.

Источник: https://www.tradingview.com/

4. Чрезмерная уверенность

Описание: После последовательных побед трейдеры считают, что они овладели рынком и недооценивают риски.

Манифестация: увеличение размера позиции или кредитного плеча, игнорирование технического анализа и управления рисками; отвержение советов других.

Последствия: Одна ошибка может привести к значительным потерям, имея еще большее психологическое воздействие.

Контрмеры:

Используйте Glassnode или Dune Analytics, чтобы проверить, соответствует ли ваше мнение трендам on-chain.

Регулярно пересматривайте прошлые сделки, документируя реальные причины как успехов, так и неудач.

Практика внимательности: оставайтесь скромными и напоминайте себе: «Рынок всегда непредсказуем».

Источник: https://studio.glassnode.com/charts/addresses.ActiveCount?a=BTC

5. Усталость от принятия решений и умственное переутомление

Описание: Из-за круглосуточного характера рынка и информационного перенасыщения трейдеры остаются под постоянным давлением, что приводит к умственному истощению.

Проявление: снижение концентрации и ухудшение качества принятия решений; потеря интереса к торговле или чувство усталости.

Последствия: Медленные реакции, упущенные возможности или частые ошибки.

Противодействие:

Используйте Coinigy для интеграции данных и сокращения времени ручного мониторинга.

Установите ежедневный торговый график (например, 4 часа), чтобы избежать излишнего времени перед экраном.

Практика осознанности: Планируйте ежедневные перерывы, включая 10 минут медитации или активности на свежем воздухе, чтобы восстановить энергию.

Источник: https://www.coinigy.com/ru/

6. Торговля местью

Описание: После убытка трейдеры импульсивно пытаются восстановить убытки, увеличивая размеры позиций или торгуя чрезмерно.

Манифестация: Добавление позиций сразу после потери без следования стратегии; развитие "месть" менталитета против рынка.

Последствия: дополнительно усиливают убытки, приводя к зловещему циклу.

Противодействие:

Используйте сигналы искусственного интеллекта Token Metrics для объективной оценки того, стоит ли продолжать сделку.

Установите ежедневный максимальный предел убытков и приостановите торговлю, как только он будет достигнут.

Практика внимательности: После потери остановитесь и наблюдайте чувства разочарования. Напомните себе: «Одно поражение не определяет всё».

7. Самосомнение

Описание: После последовательных потерь или упущенных возможностей трейдеры начинают сомневаться в своих способностях и теряют уверенность.

Проявление: колебание и упущение точек входа; постоянное изменение стратегий или полное полагание на советы других.

Последствия: паралич принятия решений, неспособность придерживаться долгосрочного плана.

Контрмеры:

Проанализируйте данные из Dune Analytics или TradingView, чтобы определить, были ли убытки вызваны ошибками стратегии, а не личными недостатками.

Проверьте новые стратегии с маленькими сделками, чтобы постепенно восстановить уверенность.

Практика осознанности: Примите, что неудача является частью процесса обучения. Повторяйте себе: «Я улучшаюсь».

Источник:https://dune.com/home#query-engine

8. Внешнее давление

Описание: Мнения из социальных сетей, от друзей или семьи (например, «Почему ты не купил монету XX?») мешают принятию торговых решений.

Проявление: Чувство беспокойства из-за историй о прибыли других; частая корректировка планов, чтобы соответствовать внешним ожиданиям.

Последствия: потеря независимого суждения, что приводит к нестабильным торговым результатам.

Противодействие:

Используйте The TIE или LunarCrush, чтобы проверить реальное влияние внешней информации и избежать обмана хайпом.

Старайтесь держаться на расстоянии от внешних влияний и сосредоточьтесь на своем собственном торговом плане.

Практика осознанности: блокируйте шум и спрашивайте себя: "Это соответствует моим целям?"

Источник: https://www.thetie.io/

Как определить психологические риски

Ниже мы рассмотрим три ключевых аспекта: физические сигналы, поведенческие шаблоны и эмоциональные колебания, чтобы помочь вам лучше распознавать и управлять психологическими рисками в торговле.

1. Физические сигналы

Криптовалютный рынок крайне волатилен, с ценами, взлетающими или падающими в течение коротких периодов. Эта неопределенность может вызвать стрессовые реакции в организме. Вот некоторые распространенные физические сигналы, указывающие на потенциальные психологические риски:

Учащенное сердцебиение: Если вы замечаете, что ваше сердцебиение ускоряется, глядя на графики свечей, это может быть вызвано страхом (беспокойство о потерях) или жадностью (ожидание взрывного роста).

Липкие ладони: Потоотделение перед размещением заказа или во время экстремальных колебаний рынка может указывать на тревогу или нервозность, что говорит о недостатке контроля над результатом торговли.

Напряженные плечи: Сидя жестко перед экраном долгие часы с напряженными плечами или шеей, может быть признаком накопленного стресса, сигнализирующим о необходимости сделать паузу и сбросить напряжение.

Как управлять: Как только вы узнаете эти сигналы, попробуйте выполнить глубокие дыхательные упражнения или отойдите от экрана на несколько минут. Предварительное остывание перед принятием решений может помочь предотвратить импульсивную торговлю в стрессовых ситуациях.

Источник:https://www.michiganmedicine.org/health-lab/your-racing-heart-sign-supraventricular-tachycardia

2. Поведенческие шаблоны

Круглосуточный характер торговли криптовалютой делает легким попадание в иррациональные психологические петли. Следующие образцы могут указывать на скрытые психологические проблемы:

Постоянная проверка цен: обновление вашего торгового приложения или веб-сайта каждые несколько минут может быть вызвано отсутствием четкого торгового плана или глубоко укоренившимся чувством неуверенности. Этот привычка усиливает беспокойство и может привести к чрезмерной торговле.

Импульсивная торговля: размещение ордеров непосредственно после внезапных ценовых движений (погоня за нарастанием или паническая продажа) часто является эмоциональной реакцией, а не стратегическим решением.

Повторное изменение заказов: Постоянное отмена или корректировка лимитных заказов может сигнализировать нерешительность или потерю уверенности в рыночном направлении, отражая психологическое замешательство.

Как управлять: установите четкий торговый план, включая точки входа, стоп-лосс и уровни тейк-профита, и придерживайтесь его. Сократите ненужное время на экране, чтобы избежать чрезмерного влияния краткосрочных рыночных флуктуаций.

3. Эмоциональные колебания

Высокий риск и потенциально высокая доходность криптовалютной торговли могут вызвать эмоциональные колебания, напоминающие аттракцион. Будьте внимательны к этим эмоциональным состояниям:

Чрезмерное волнение после победы: Чувство чрезмерной уверенности после прибыльной сделки, даже фантазирование о "финансовой свободе", может указывать на неукротимую жадность, которая может привести к опрометчивому перекредитованию.

Экстремальное разочарование после поражения: если вы считаете одно поражение полным провалом или упускаете из виду чрезмерное самообвинение, это может означать, что вы слишком тесно привязаны к своей самооценке к результатам торговли, что делает ваши эмоции слишком хрупкими.

Тревога & FOMO (страх пропустить): Чувство беспокойства, когда другие зарабатывают деньги или когда монета стремительно растет, что приводит к импульсивным решениям.

Как управлять: Ведите торговый журнал — не только для отслеживания прибылей и убытков, но и для записи вашего эмоционального состояния во время каждой сделки. Идентифицируйте шаблоны, которые вызывают эмоциональные колебания. Сохраняйте установку «инвестируйте только то, что вы можете позволить себе потерять», чтобы снизить психологическое давление.

Источник: https://www.wps.com/blog/how-to-make-crypto-spreadsheets-in-excel-the-ultimate-guide/

Инструменты поддержки

Инструменты анализа настроений криптовалютного рынка не только предоставляют поддержку данных, но также эффективно укрепляют психологическую устойчивость инвесторов. Путем снижения неопределенности, предоставления объективной перспективы и улучшения самоконтроля эти инструменты помогают инвесторам оставаться рациональными во время рыночных флуктуаций.

Сценарий: 27 марта 2025 года Ethereum внезапно падает на 10%.

Без инструментов: паника распространяется, ведущая к интуитивному убеждению в том, что "бычий рынок может быть окончен", что приводит к спешному продаже.

С инструментами:

Индекс страха и жадности: показывает 40 (нейтрально с небольшим страхом), что указывает на то, что рынок еще не вошел в крайнюю панику.

Общественное мнение: настроение отрицательное, но может быть повлияно краткосрочными реакциями.

Данные On-Chain от Glassnode: нет аномальных крупных продаж, что указывает на то, что основные держатели не паникуют и не продают.

Применяя техники регулирования эмоций (такие как осознанность), инвесторы могут оценить ситуацию более спокойно, понять, что это может быть краткосрочная коррекция, и выбрать удержание вместо необоснованных потерь.

Ниже приведен анализ того, как именно эти инструменты помогают инвесторам развивать психологическую устойчивость:

1. Индекс страха и жадности

Психологические выгоды:

Снижение паники и жадности: четкий балл рыночного настроения (0-100) помогает инвесторам определить, насколько эмоции являются крайними, предотвращая их участие в коллективной панике (например, "рынок рушится") или жадности (например, "это точно взлетит").

Установка психологической опоры: видение «Крайнего страха» может побудить инвесторов мыслить вопреки толпе и продавать; «Крайняя жадность» служит напоминанием о рациональном извлечении прибыли.

Пример: Когда индекс падает до 10, вы можете почувствовать страх, но инструмент указывает на потенциальную покупочную возможность, помогая вам превратить негативные эмоции в положительные действия.

Источник: https://coinmarketcap.com/charts/fear-and-greed-index/

2. Инструменты анализа настроений в социальных сетях (LunarCrush, Santiment)

Психологические выгоды:

Борьба с FOMO (страх пропуска): Когда токен становится горячей темой в социальных сетях, инвесторы могут импульсивно следовать за трендом. Эти инструменты количественно оценивают настроения (например, 70% положительных), помогая вам оценить, является ли это просто шумом, а не реальным импульсом, обусловленным ценностью.

Развитие независимого мышления: данные раскрывают источник рыночного настроения (например, твит от ведущего мнения), делая вас более осведомленными об внешних влияниях и уменьшая психологическое давление следовать толпе вслепую.

Пример: Определенный альткоин внезапно становится трендом в Twitter, но LunarCrush показывает взрыв настроения, в то время как объем торгов остается низким. Это понимание может помочь вам оставаться спокойным и наблюдать, вместо того чтобы ловить азарт из-за FOMO.

Источник: https://lunarcrush.com/

3. Инструменты анализа данных On-Chain (Glassnode, Nansen)

Психологические выгоды:

Обеспечение чувства безопасности: Наблюдение за накоплением китов или действиями долгосрочных держателей могут снять страхи перед рыночным крахом и повысить уверенность. Напротив, обнаружение масштабных продаж может морально подготовить вас к потенциальным спадам.

Снижение неопределенности: Данные on-chain представляют собой объективные факты, а не спекуляции или слухи, помогая инвесторам избавиться от психологического бремени "рыночного манипулирования" или "теорий заговора."

Пример: Если поступления биткойнов на биржи увеличиваются, вам может быть страшно из-за падения цен. Однако наличие доступа к этим данным позволяет вам заранее корректировать свою позицию, что дает вам больший контроль.

4. Индекс настроений рынка и инструменты визуализации (TradingView, Bitcoin Rainbow Chart)

Психологические выгоды:

Визуальное спокойствие: Графики и цветовые индикаторы (такие как "зеленая зона покупки" Bitcoin Rainbow Chart) обеспечивают интуитивное руководство, помогая инвесторам ориентироваться на рынке Gate.io и избегать эмоциональной интерпретации колебаний цен.

Долгосрочная перспектива: Эти инструменты подчеркивают циклические тенденции, поощряя инвесторов отказаться от краткосрочных эмоциональных реакций и развить терпение и дисциплину.

Пример: Во время резкого падения цен Радужная диаграмма все еще указывает на "зону удержания", что делает вас более склонным придерживаться своей стратегии, а не панически продавать.

Источник: https://www.blockchaincenter.net/ru/bitcoin-rainbow-chart/

5. Инструменты сигналов торговли, управляемые искусственным интеллектом (Token Metrics, SignalPlus)

Психологические выгоды:

Снижение стресса при принятии решений: искусственный интеллект предоставляет четкие рекомендации на покупку/продажу, минимизируя тревогу, вызванную колебаниями или излишним анализом.

Укрепление уверенности: знание того, что решения поддерживаются данными и алгоритмами, помогает снять самосомнение, предотвращая негативный эмоциональный спираль после потерь.

Пример: Во время волатильности рынка SignalPlus предлагает подождать на стороне, что поможет вам избежать импульсивных сделок и почувствовать себя более спокойно психологически.

Источник: https://www.signalplus.com/

Ссылка на рабочий процесс

Ниже приведен эталонный рабочий процесс для трейдеров криптовалют. Он интегрирует инструменты рыночного настроения (такие как CryptoQuant, LunarCrush, и т. д.) и психологические стратегии (такие как осознанность), чтобы помочь трейдерам сохранить рациональность, эффективность и психологическое равновесие в своей повседневной деятельности.

Этот рабочий процесс подходит для краткосрочных трейдеров, свинг-трейдеров или долгосрочных инвесторов и может быть адаптирован в соответствии с индивидуальными стилями торговли.

Источник: https://www.gate.io/

ПERSПЕКТИВА

По мере развития криптовалютного рынка устойчивость психологии трейдеров будет формироваться технологическими достижениями, изменениями на рынке и психологическими исследованиями. Нижеследующие идеи предлагают перспективный взгляд, чтобы помочь трейдерам оставаться стабильными и расти в постоянно меняющейся среде.

Будущие тенденции и психологическое воздействие

1. Зрелость рынка

Тенденция: Институциональное принятие, улучшение регулирования и модернизация инфраструктуры (например, больше криптовалютных ETF) снизят волатильность, переведя рынок из "Дикого Запада" в более стабильную экосистему.

Психологическое воздействие:

Положительное: Уменьшение крайних колебаний смягчит FOMO и панику, что облегчит трейдерам сохранять спокойствие.

Проблемы: Зрелый рынок может привести к большему использованию алгоритмической и высокочастотной торговли, увеличивая конкурентное давление и приводя к усталости от принятия решений или сомнениям в себе.

Перспективы будущего: Трейдеры должны перейти от краткосрочного спекулятивного мышления к долгосрочному стратегическому подходу, подчеркивая терпение и дисциплину.

2. Интеграция искусственного интеллекта и автоматизации

Тенденция: AI-приводный анализ настроений (например, улучшенные версии Token Metrics) и торговые боты станут более умными, предлагая сигналы в реальном времени, оценку рисков и эмоциональное руководство.

Психологическое воздействие:

Позитивно: автоматизация снижает стресс от постоянного мониторинга рынка, облегчая усталость от принятия решений и импульсивной торговли (например, месть торговле).

Проблемы: Чрезмерная зависимость от искусственного интеллекта может ослабить независимые навыки принятия решений, увеличивая риск психологического краха в случае сбоя технологии.

Будущий прогноз: Трейдеры должны научиться сотрудничать с искусственным интеллектом, сосредотачиваясь на балансировке зависимости от технологий со смыслом личного контроля.

Источник: https://www.tokenmetrics.com/pricing

Ключевые области психологического развития для будущего

1. Управление эмоциями на основе данных

Разработка: Будущие инструменты будут интегрировать данные с цепи (например, CryptoQuant), социальные настроения (например, The TIE) и физиологические сигналы для генерации персонализированных отчетов. Например: "Ваша тревога коррелирует с падением рынка, рекомендуемые упражнения по глубокому дыханию."

Психологическая польза: обеспечивает объективные инсайты, повышая уверенность трейдеров в эмоциональной регуляции и снижая чувство чрезмерной уверенности или паники.

Пример: AI alert: «Индекс страха 20 + пульс 90, оставайтесь спокойными и наблюдайте», помогая трейдерам покупать на низких уровнях вместо панической продажи.

2. Поддержка сообщества и совместная работа

Развитие: виртуальные реальности (VR) сообщества или децентрализованные платформы будут служить сетями психологической поддержки, где трейдеры смогут делиться стратегиями и эмоциональными переживаниями.

Психологическая польза: Одногруппническая поддержка снимает самосомнение, но требует осторожности против стадного менталитета и решений, основанных на FOMO.

Пример: В торговом зале виртуальной реальности опытные трейдеры делятся своими спокойными стратегиями принятия решений, помогая новичкам ориентироваться на рыночные спады на Gate.io.

Источник: https://hypebeast.com/2017/4/facebook-launches-social-vr-platform-spaces

3. Персонализированное психологическое обучение

Разработка: программы психологической направленности на основе искусственного интеллекта будут предоставлять индивидуальные стратегии, такие как рекомендация заниматься осознанным медитацией для трейдеров, склонных к жадности, или когнитивно-поведенческие упражнения для тех, кто подвержен панике.

Психологическая выгода: Адресует индивидуальные слабые стороны с точностью, ускоряя психологический рост и стойкость.

Пример: Система обнаруживает, что вы часто гонитесь за прибылью после получения прибыли, и рекомендует упражнение 'отсроченное удовлетворение', чтобы помочь вам освоить навык получения прибыли.

4. Долгосрочное мышление и ориентация на цель

Разработка: Инструменты, такие как Dune Analytics, будут подчеркивать анализ циклов, стимулируя трейдеров сосредотачиваться на трендах в течение 3-5 лет, а не на краткосрочных флуктуациях.

Психологическая выгода: изменение установки с «мгновенного удовлетворения» на «долгосрочные результаты», что снижает жадность и нетерпение.

Пример: Диаграмма Радуги Биткойна показывает, что текущая фаза - это "зона удержания", что укрепляет уверенность в том, чтобы придерживаться своей стратегии, а не заниматься излишней торговлей.

Сценарий будущего:

К 2030 году торговый опыт плавно интегрирует искусственный интеллект с личными данными о здоровье. Носить монитор сердечного ритма, инструмент искусственного интеллекта будет анализировать как данные цепочки, так и эмоциональные показатели, предоставляя оперативные торговые идеи, такие как «Рыночный страх + нормальный пульс = Возможность покупки».

Утром вы общаетесь с сообществом торговли виртуальной реальности, чтобы обсудить стратегии, затем после торговли входите в виртуальную медитационную капсулу, чтобы обдумать свои эмоции и результаты. Технологические достижения повышают вашу уверенность, снижают рыночную волатильность и делают вас более собранными. Практика осознанности помогает вам поддерживать независимое мышление и быть свободным от эмоциональных импульсов.

Заключение

Для опытных трейдеров психологическое развитие — это не достижение за одну ночь, а непрерывный процесс совершенствования. Управление эмоциями помогает им оставаться спокойными, преодоление когнитивных искажений приближает их к истине, долгосрочное мышление дарит им терпение, а саморефлексия служит основой для роста.

Рынок беспощаден, но для тех, кто может постоянно развиваться на психологическом уровне, он также является землей возможностей. В конечном итоге успех в торговле не заключается в покорении рынка, а в покорении самого себя.