Artigos

TudoAltcoinsBitcoinBlockchainDeFiEthereumMetaversoNFTNegociaçãoTutorialPerpétuosBots de NegociaçãoBRC-20GameFiDAOMacrotendênciasCarteirasInscriptionTecnologiaMemeIASocialFiDePinStablecoinLiquid StakingFinançasRWABlockchains modularesProva de Conhecimento ZeroRestakingFerramentas CriptográficasAirdropProdutos GateSegurançaAnálise de projectosCryptoPulseInvestigaçãoEcossistema TONLayer 2SolanaPagamentosMineraçãoTemas da atualidadeP2PEcossistema SuiAbstração de cadeiaOpçãoLeituras rápidasVídeoRelatório diárioPrevisão do mercadoBots de negociaçãoRelatório da indústria VIP

Mais

Investigação Gate: A Nova Ordem Cripto Sob uma Tempestade Tarifária — Mudanças Estruturais e Oportunidades em Stablecoins, RWA e DeFi

Descarregue o relatório completo (PDF)

Este artigo explora como as políticas tarifárias recíprocas afetam os mercados financeiros globais através de mecanismos de transmissão macroeconómica. Analisa ainda o seu impacto nos ecossistemas de stablecoins, ativos do mundo real (RWAs) e finanças descentralizadas (DeFi), examinando tanto os mecanismos subjacentes como os potenciais riscos e oportunidades envolvidos.Resumo

- Turbulência no Mercado Global e Amplia Queda das Criptomoedas: Após a divulgação da política de "Tarifa Recíproca" em abril de 2025, os mercados financeiros globais experimentaram uma intensa volatilidade. Em 7 de abril, o mercado de criptomoedas sofreu uma significativa queda, com o Bitcoin brevemente caindo para cerca de $74.600, e a capitalização total do mercado de criptomoedas diminuindo 7% em um único dia.

- Reação forte dos mercados tradicionais: Após a implementação da política tarifária, os mercados de ações dos EUA perderam $5.9 trilhões em capitalização de mercado ao longo de dois dias de negociação. O Índice de Volatilidade (VIX) disparou 50.9% em um único dia, e os preços do ouro atingiram um máximo histórico de $3,167.70 por onça.

- A atividade da stablecoin On-Chain dispara: Entre 20 de janeiro e 9 de abril de 2025, a capitalização de mercado total das stablecoins cresceu 11,13%, atingindo $233.5 biliões. Em 7 de abril, o volume de transações de stablecoins On-Chain atingiu um máximo de dois meses de $72 biliões, e os endereços ativos diários excederam 300.000—refletindo uma forte procura.

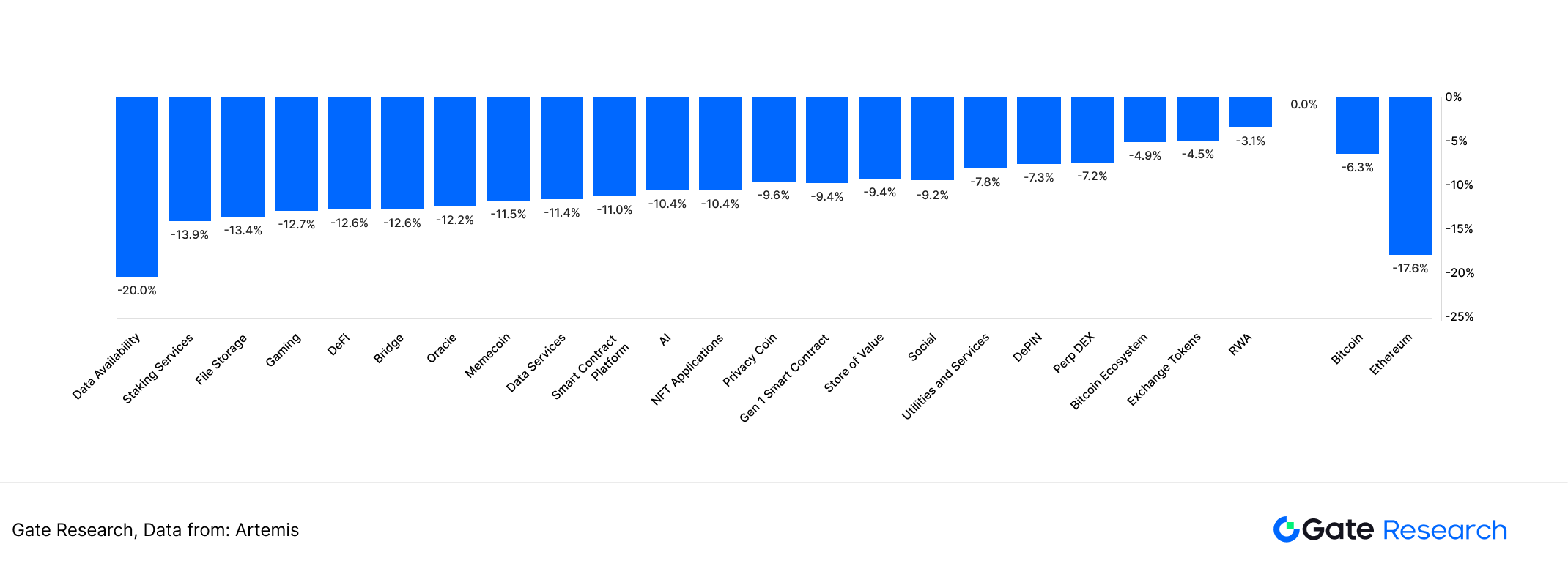

- RWA Mostra Resiliência e Crescimento Rápido: Dentro de uma semana do lançamento da tarifa, o setor RWA caiu apenas 3.1%, muito abaixo de outros setores de criptomoedas (que viram quedas superiores a 10%), indicando a sua robustez. A capitalização total de mercado de RWA ultrapassou os $32 mil milhões, e o volume de negociação disparou 99% dentro de cinco dias da implementação da tarifa.

- O volume de negociação de ouro tokenizado dispara: Nos sete dias que antecederam 11 de abril, o volume de negociação semanal de ouro tokenizado excedeu $1 bilhão—o mais alto desde março de 2023. Desde o anúncio da tarifa, o volume de negociação do PAXG disparou mais de 900%, o XAUT subiu mais de 300%, e o KAU disparou 83.000%

- O TVL do DeFi diminui e o risco de liquidação intensifica: Impactado pela queda do mercado em geral, o valor total bloqueado (TVL) do setor DeFi caiu 35,34% de 20 de janeiro a 9 de abril de 2025, caindo para $135,2 bilhões. Na semana seguinte à implementação da tarifa, o TVL caiu 13,88%. Os riscos de liquidação on-chain aumentaram significativamente, com o AAVE V3 registrando $94,39 milhões em liquidações de tokens de garantia em 6 e 7 de abril.

- Oportunidades de mercado de criptomoedas em meio à tempestade tarifária: Stablecoins e RWA mostram forte potencial para cobertura e liquidação transfronteiriça. DeFi está explorando modelos de arbitragem tarifária impulsionados por algoritmos usando taxas de colateralização dinâmica, arbitragem geográfica e cobertura regulatória para navegar em novas estratégias financeiras sob barreiras comerciais.

(Clique abaixo para aceder ao relatório completo)

Investigação Gate

Gate Research é uma plataforma abrangente de pesquisa em blockchain e criptografia que fornece aos leitores conteúdo aprofundado, incluindo análise técnica, insights quentes, revisões de mercado, pesquisa setorial, previsões de tendências e análise de políticas macroeconômicas.

Clique no Linkpara aprender mais

Autor: Ember、Addie

Tradutor(a): Piper

Revisor(es): Edward、Wayne、Evelyn

Revisor(es) de tradução: Ashley、Joyce

* As informações não se destinam a ser e não constituem aconselhamento financeiro ou qualquer outra recomendação de qualquer tipo oferecido ou endossado pela Gate.

* Este artigo não pode ser reproduzido, transmitido ou copiado sem fazer referência à Gate. A violação é uma violação da Lei de Direitos de Autor e pode estar sujeita a ações legais.

Partilhar

Conteúdos

Comece agora

Registe-se e ganhe um cupão de

100 USD

!