Token dan koin yang bergerak paling banyak dalam 24 jam terakhir:

⚡ 14:00 – Gerakan Tengah Hari: Tenang Setelah Badai? –Penggerak Utama Hari Ini

Koin biasa dan DigiByte: Koin-koin ini telah tumbuh dengan luar biasa dalam 24 jam terakhir.

Big Time telah meningkat sebesar 2,49% sejak pembaruan pagi.

Ikhtisar: Dalam 24 jam terakhir, pasar kripto menunjukkan tanda-tanda awal stabilisasi, setelah penjualan brutal yang terjadi semalaman. Indeks sektor berbalik menjadi positif, dengan koin berkapitalisasi kecil memimpin. Namun, aset signifikan seperti Bitcoin dan Ether tetap tertekan, menekan indeks yang lebih luas. 🔍 Wawasan Pasar: Gerakan hari ini terutama mencerminkan pemulihan setelah penurunan tajam semalaman. Segmen dengan kapitalisasi pasar yang lebih kecil menunjukkan keuntungan intraday yang sedikit lebih substansial, tetapi ini kemungkinan merupakan hasil dari volatilitas yang lebih tinggi setelah penurunan tajam, bukan tanda kekuatan atau daya tarik yang diperbarui.

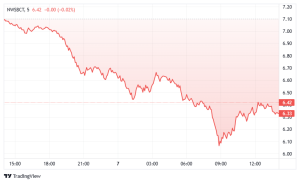

Indeks untuk Blue Chips: Indeks ini berfokus pada cryptocurrency, yang lebih mapan, ** bahasa sehari-hari dikenal sebagai "Blue Chips." Indeks telah mencerminkan tren keseluruhan. Grafik di sebelah kiri mengungkapkan indeks NWSBCT rebound sedikit dari level terendah pagi yang dalam di dekat 6,09, naik menuju 6,42 sebelum berkonsolidasi. Ini mencerminkan upaya pemulihan tentatif, meskipun pasar tetap lemah secara struktural. 🔄 Upaya pembalikan intraday. 🧭 Masih beroperasi jauh di bawah level support sebelumnya Indeks 2100NEWS, yang melacak kinerja berbagai kelompok token dan koin, telah melaporkan kerugian dari -3,34% (NWSET100) hingga -6,67% (NWSCo100) sejak tengah malam. 2100NEWS Total Index (NWST1100): Mewakili spektrum luas pasar crypto, mencakup 1100 cryptocurrency signifikan berdasarkan kapitalisasi pasar mereka. Ini telah jatuh 9,88% selama 24 jam terakhir. Bitcoin dan Ether: Selama 24 jam sebelumnya, Bitcoin telah menurun sebesar 7,44%, sementara Ether, dengan penurunan 17,19%, telah secara signifikan berkinerja buruk Bitcoin.

Pembaruan intraday ini mencakup aktivitas pasar antara pukul 9:00 pagi dan 2:00 siang CET. Penggerak Teratas termasuk kinerja 24 jam, tetapi fokus utama adalah pada aset dengan perubahan paling signifikan sejak laporan pukul 9:00 pagi. Indeks 2100NEWS menunjukkan perubahan dari 00:00 hingga 14:00 CET. Indeks Total 2100NEWS (NWST1100) dan bagian Bitcoin & Ether selalu mencerminkan perubahan 24 jam secara lengkap, terlepas dari waktu laporan. Harap dicatat bahwa kondisi mungkin telah berubah sejak waktu publikasi. Catatan tambahan menjelaskan kriteria untuk menyoroti cryptocurrency dan indeks tertentu ini

UXLINK (UXLINK)

| |

| --- |

| Peringkat 2100NEWS: 283, Token Non-Ethereum berbasis Mid-cap, Anggota indeks: NWST1100, NWSM200 |

| 2100NEWS DA Penilaian Kualitas Orderbook: Buruk, Skor: 8.7 (Rata-rata untuk Mid-caps: 13.2) |

UXLINK adalah platform sosial Web3 berbasis pengguna yang dirancang untuk mempercepat adopsi massal dengan menggabungkan interaksi sosial dengan teknologi blockchain. UXLINK memupuk hubungan otentik, dua arah, tipe teman dan interaksi real-time melalui alat inovatif seperti UXGroup, tidak seperti sistem tradisional satu arah, berbasis pengikut. Misi inti platform berfokus pada tiga elemen utama: menjadi infrastruktur sosial paling signifikan untuk koneksi dua arah (Social Central), menjembatani Web2 dan Web3 untuk memfasilitasi penemuan dan perdagangan aset kripto (Gateway All), dan membina (Community Prosperity) komunitas yang inklusif, dapat dipercaya, dan bermanfaat. Inovasi utama termasuk aplikasi terdesentralisasi yang mudah digunakan (DApps) terintegrasi dengan platform seperti Telegram, enkripsi grup dunia nyata ke dalam unit operasional Web3, dan model ekonomi token ganda yang terdiri dari poin on-chain dan token tata kelola. Model ini memastikan kesederhanaan, keadilan, dan keterlibatan pengguna. Dengan menciptakan transisi yang mulus antara Web2 dan Web3, UXLINK memberdayakan pengguna dan pengembang untuk mengeksplorasi dan memperdagangkan aset kripto dalam konteks yang diperkaya secara sosial. Pendekatan UXLINK merevolusi interaksi sosial dan memposisikan platform di garis depan adopsi Web3, membentuk kembali masa depan media sosial dan komunitas online.

☀️ 9:00 – Pulse Pagi: Pasar Turun Tajam Saat Ether Memimpin Penurunan –Penggerak Utama Hari Ini

Saros dan Fasttoken**:** Koin-koin ini telah menjadi yang terbaik dalam 24 jam terakhir.

GMX telah naik 8,09% sejak tengah malam, menjadikannya sebagai kinerja intraday terkuat.

Ikhtisar: Selama 24 jam terakhir, pasar crypto mengalami penurunan yang tajam dan meluas. Hampir semua indeks sektor berada dalam keadaan merah, dengan Ether menjadi yang terdepan dalam penurunan di antara yang utama. Pada jam perdagangan Asia, gelombang kedua reaksi pasar modal terhadap perang tarif yang sedang berlangsung terpicu, memicu lingkungan yang menghindari risiko. 🔍 Wawasan Pasar: Penurunan tajam semalam menunjukkan suasana yang menghindari risiko di seluruh pasar crypto. Penurunan besar Ether mungkin menarik sentimen dan likuiditas yang lebih luas.

Indeks NWSBCT untuk Koin Blue Chips: Indeks ini fokus pada koin kripto yang lebih mapan, yang secara akrab dikenal sebagai "Blue Chips". Grafiknya di sebelah kiri menunjukkan penurunan sepanjang malam dan pagi hari, turun dari di atas 7.00 menjadi mendekati 6.09 pada pukul 09:00 CET. Tekanan turun yang terus-menerus menyoroti hilangnya struktur bullish yang jelas.

Indeks 2100NEWS, yang melacak kinerja berbagai kelompok token dan koin, telah mencerminkan tekanan di seluruh pasar, terjun dari -5,77% (NWSBE) menjadi -10,48% (NWSC100) sejak tengah malam.

2100NEWS Total Index (NWST1100): Indeks ini mewakili spektrum luas dari pasar koin dan melacak 1100 koin kripto signifikan berdasarkan kapitalisasi pasar mereka. Ini telah terjun 12,88% dalam 24 jam sebelumnya.

Bitcoin dan Ether: Selama 24 jam terakhir, Bitcoin telah terjun 9,96%, sementara Ether telah turun 20,00%, secara signifikan berkinerja lebih buruk dibandingkan Bitcoin.

GMX (GMX)

| |

| --- |

| Peringkat 2100NEWS: 221, Token Non-Ethereum berbasis Mid-cap, Anggota Indeks: NWST1100, NWSM200 |

| 2100NEWS DA Penilaian Kualitas Orderbook: Biasa, Skor: 14.4, (Rata-rata untuk Mid-caps: 13.2) |

GMX adalah (DEX) pertukaran terdesentralisasi terkemuka untuk perdagangan berjangka abadi dengan leverage hingga 50x pada aset seperti BTC dan ETH. Diluncurkan pada tahun 2021 di Arbitrum dan Avalanche, GMX telah melampaui $140 miliar dalam volume perdagangan dengan lebih dari 360 ribu pengguna. Ini menggantikan buku pesanan tradisional dengan model AMM inovatif yang didukung oleh kumpulan likuiditas multi-aset (GLP), memungkinkan perdagangan selip rendah dan penyedia likuiditas yang menguntungkan. Ekosistem ini ditambatkan oleh dua token, GLP (liquidity index) dan GMX (governance dan pembagian biaya). Harga bersumber dari oracle Chainlink, memastikan keandalan dan transparansi.

Halaman ini mungkin berisi konten pihak ketiga, yang disediakan untuk tujuan informasi saja (bukan pernyataan/jaminan) dan tidak boleh dianggap sebagai dukungan terhadap pandangannya oleh Gate, atau sebagai nasihat keuangan atau profesional. Lihat Penafian untuk detailnya.

Penggerak Hari 7-Apr-2025

Token dan koin yang bergerak paling banyak dalam 24 jam terakhir:

⚡ 14:00 – Gerakan Tengah Hari: Tenang Setelah Badai? – Penggerak Utama Hari Ini

Ikhtisar: Dalam 24 jam terakhir, pasar kripto menunjukkan tanda-tanda awal stabilisasi, setelah penjualan brutal yang terjadi semalaman. Indeks sektor berbalik menjadi positif, dengan koin berkapitalisasi kecil memimpin. Namun, aset signifikan seperti Bitcoin dan Ether tetap tertekan, menekan indeks yang lebih luas. 🔍 Wawasan Pasar: Gerakan hari ini terutama mencerminkan pemulihan setelah penurunan tajam semalaman. Segmen dengan kapitalisasi pasar yang lebih kecil menunjukkan keuntungan intraday yang sedikit lebih substansial, tetapi ini kemungkinan merupakan hasil dari volatilitas yang lebih tinggi setelah penurunan tajam, bukan tanda kekuatan atau daya tarik yang diperbarui.

Indeks untuk Blue Chips: Indeks ini berfokus pada cryptocurrency, yang lebih mapan, ** bahasa sehari-hari dikenal sebagai "Blue Chips." Indeks telah mencerminkan tren keseluruhan. Grafik di sebelah kiri mengungkapkan indeks NWSBCT rebound sedikit dari level terendah pagi yang dalam di dekat 6,09, naik menuju 6,42 sebelum berkonsolidasi. Ini mencerminkan upaya pemulihan tentatif, meskipun pasar tetap lemah secara struktural. 🔄 Upaya pembalikan intraday. 🧭 Masih beroperasi jauh di bawah level support sebelumnya Indeks 2100NEWS, yang melacak kinerja berbagai kelompok token dan koin, telah melaporkan kerugian dari -3,34% (NWSET100) hingga -6,67% (NWSCo100) sejak tengah malam. 2100NEWS Total Index (NWST1100): Mewakili spektrum luas pasar crypto, mencakup 1100 cryptocurrency signifikan berdasarkan kapitalisasi pasar mereka. Ini telah jatuh 9,88% selama 24 jam terakhir. Bitcoin dan Ether: Selama 24 jam sebelumnya, Bitcoin telah menurun sebesar 7,44%, sementara Ether, dengan penurunan 17,19%, telah secara signifikan berkinerja buruk Bitcoin.

Pembaruan intraday ini mencakup aktivitas pasar antara pukul 9:00 pagi dan 2:00 siang CET. Penggerak Teratas termasuk kinerja 24 jam, tetapi fokus utama adalah pada aset dengan perubahan paling signifikan sejak laporan pukul 9:00 pagi. Indeks 2100NEWS menunjukkan perubahan dari 00:00 hingga 14:00 CET. Indeks Total 2100NEWS (NWST1100) dan bagian Bitcoin & Ether selalu mencerminkan perubahan 24 jam secara lengkap, terlepas dari waktu laporan. Harap dicatat bahwa kondisi mungkin telah berubah sejak waktu publikasi. Catatan tambahan menjelaskan kriteria untuk menyoroti cryptocurrency dan indeks tertentu ini

| | | --- | | Peringkat 2100NEWS: 283, Token Non-Ethereum berbasis Mid-cap, Anggota indeks: NWST1100, NWSM200 | | 2100NEWS DA Penilaian Kualitas Orderbook: Buruk, Skor: 8.7 (Rata-rata untuk Mid-caps: 13.2) |

UXLINK adalah platform sosial Web3 berbasis pengguna yang dirancang untuk mempercepat adopsi massal dengan menggabungkan interaksi sosial dengan teknologi blockchain. UXLINK memupuk hubungan otentik, dua arah, tipe teman dan interaksi real-time melalui alat inovatif seperti UXGroup, tidak seperti sistem tradisional satu arah, berbasis pengikut. Misi inti platform berfokus pada tiga elemen utama: menjadi infrastruktur sosial paling signifikan untuk koneksi dua arah (Social Central), menjembatani Web2 dan Web3 untuk memfasilitasi penemuan dan perdagangan aset kripto (Gateway All), dan membina (Community Prosperity) komunitas yang inklusif, dapat dipercaya, dan bermanfaat. Inovasi utama termasuk aplikasi terdesentralisasi yang mudah digunakan (DApps) terintegrasi dengan platform seperti Telegram, enkripsi grup dunia nyata ke dalam unit operasional Web3, dan model ekonomi token ganda yang terdiri dari poin on-chain dan token tata kelola. Model ini memastikan kesederhanaan, keadilan, dan keterlibatan pengguna. Dengan menciptakan transisi yang mulus antara Web2 dan Web3, UXLINK memberdayakan pengguna dan pengembang untuk mengeksplorasi dan memperdagangkan aset kripto dalam konteks yang diperkaya secara sosial. Pendekatan UXLINK merevolusi interaksi sosial dan memposisikan platform di garis depan adopsi Web3, membentuk kembali masa depan media sosial dan komunitas online.

☀️ 9:00 – Pulse Pagi: Pasar Turun Tajam Saat Ether Memimpin Penurunan – Penggerak Utama Hari Ini

Ikhtisar: Selama 24 jam terakhir, pasar crypto mengalami penurunan yang tajam dan meluas. Hampir semua indeks sektor berada dalam keadaan merah, dengan Ether menjadi yang terdepan dalam penurunan di antara yang utama. Pada jam perdagangan Asia, gelombang kedua reaksi pasar modal terhadap perang tarif yang sedang berlangsung terpicu, memicu lingkungan yang menghindari risiko. 🔍 Wawasan Pasar: Penurunan tajam semalam menunjukkan suasana yang menghindari risiko di seluruh pasar crypto. Penurunan besar Ether mungkin menarik sentimen dan likuiditas yang lebih luas.

GMX (GMX)

| | | --- | | Peringkat 2100NEWS: 221, Token Non-Ethereum berbasis Mid-cap, Anggota Indeks: NWST1100, NWSM200 | | 2100NEWS DA Penilaian Kualitas Orderbook: Biasa, Skor: 14.4, (Rata-rata untuk Mid-caps: 13.2) |

GMX adalah (DEX) pertukaran terdesentralisasi terkemuka untuk perdagangan berjangka abadi dengan leverage hingga 50x pada aset seperti BTC dan ETH. Diluncurkan pada tahun 2021 di Arbitrum dan Avalanche, GMX telah melampaui $140 miliar dalam volume perdagangan dengan lebih dari 360 ribu pengguna. Ini menggantikan buku pesanan tradisional dengan model AMM inovatif yang didukung oleh kumpulan likuiditas multi-aset (GLP), memungkinkan perdagangan selip rendah dan penyedia likuiditas yang menguntungkan. Ekosistem ini ditambatkan oleh dua token, GLP (liquidity index) dan GMX (governance dan pembagian biaya). Harga bersumber dari oracle Chainlink, memastikan keandalan dan transparansi.