链上交易量正在流向哪里?(2024 年 1 月至 2025 年 3 月)

在过去的 15 个月里,DeFi 流动性的版图在各大区块链之间被重新绘制:从炒作驱动的热点中消失,悄然集中到基本面胜过噪音的地方。

关键洞察:

- DEX 交易量在 2025 年 1 月创下 3,800 亿美元的历史新高,但在两个月内下跌 35%,或预示着短期内已见顶。

- 前十名 DEX 占据了近 80% 的所有交易活动;其中 @Uniswap 与 @PancakeSwap 两者合计占比约 40%。

- @Solana 原生 DEX 占据排行榜,前十中有五个来自 Solana,份额因 meme 币交易热潮而持续增长。

- @HyperliquidX 改写了合约衍生品格局,从新秀跃升为市场主导者,在 2025 年 3 月的市场份额超过 60%。

所有洞察均基于公开数据,特别感谢 @DefiLlama 提供的一贯高质量统计数据。

一个由「暴涨与放缓」定义的周期

2024 年初,DEX 交易量在 3 月和 5 月表现活跃,但随后进入年中放缓阶段。

风向在第四季度急剧转变 —— 11 月和 12 月的交易量激增,并在 2025 年 1 月爆发至 3,800 亿美元的峰值。

但这波反弹并未持久。到 2 月,交易量已下跌至 2,450 亿美元,下降幅度达 35%,标志着这三个月垂直上涨走势的结束。这一退潮也为第二季度奠定了更为谨慎的基调。

DEX 主导权:集中度进一步提升

DEX 生态系统高度集中。前 10 个协议现在占据了 79.5% 的日交易量,而前 5 名则控制了 59.1%。

Uniswap 与 PancakeSwap 占据了全部 DEX 交易量的约 40%,也是唯二累计交易量突破 1 万亿美元的协议。它们的主导地位源自先发优势、多链布局与深度流动性。

Uniswap Labs 还推出了 @Unichain,这是一个基于 @Optimism Superchain 构建的专属以太坊 L2,旨在提供快速、低成本的交易体验,并原生支持多链互通。

Solana 的“低调接管”

最引人注目的是 Solana 不断增长的存在感。前十名 DEX 中有五个是原生于 Solana 的:

@orca_so、@MeteoraAG、@RaydiumProtocol、@Lifinity_IO 和 @pumpdotfun。

其中,Orca(8.02%)和 Meteora(6.70%)两者合计就贡献了约 15% 的全球 DEX 活跃量。

这股增长背后的动力源于:低费用、快速出块时间、以及 Solana 上粘性的 meme 币文化。Pump.fun 冲入前十的表现正是这种能量的体现。

新兴协议:Fluid 与 Aerodrome

@0x流体(7.09%)是前五中资本效率最高的 DEX。它主要部署于 Ethereum,每月成交额超过 100 亿美元。其在 @Arbitrum 上线后,成交量从 2 月的 4.26 亿美元跃升至 3 月的 16 亿美元,显示出快速的用户采纳率。

@AerodromeFi 原生于 @base,反映出 Base 二层链上流动性的持续增长。

尽管 @Hyperliquid 在现货市场上排名不高,但它在合约市场一骑绝尘 —— 占据了超过 60% 的市场份额。

按链划分的 DEX 市场份额:引爆容易,留存难

过去 15 个月揭示了一个事实:大多数公链都能吸引注意力,但能长期留住用户的却寥寥无几。 从 2024 年 1 月到 2025 年 3 月,不同链上的 DEX 市场份额变化迅速,只有少数维持了真实的增长动能。

Solana 是最大黑马:它在 2024 年稳步攀升,并在 2025 年 1 月达到 45.8% 的高峰,这主要受到了 $TRUMP 与 $MELANIA 等 meme 币热潮的驱动。但到了 3 月,其份额降至 21.5%,几乎腰斩。尽管如此,其 25.1% 的平均占比依旧是所有链中最高的。

以太坊走势相反:2024 年初占比约 32%,到 2025 年 1 月跌至 15.3%,但随后反弹至 3 月的 26.4%,证明了其即便失去势头仍具粘性与留存力。

Base 是最稳定的攀升者:2024 年 3 月占比仅 3%,12 月达 12.4%,2025 年 3 月回落至 7.4%,整体期间维持 6.6% 的平均值。没有炒作,只有持续增长。

BNB Chain 保持稳定:平均占比维持在 14.7%。没有爆发,也没有崩盘 —— 体现的是持续的零售资金流入。

Arbitrum 虽起步强劲(曾达 16%),但从未真正起飞,到 2025 年 1 月已跌至 4.8%,被 Base 与 Solana 反超。

Blast 是典型的“靠激励爆红再消失”的案例:2024 年 6 月曾一度冲上 42.3%,但下月即归零 —— 完全缺乏留存。

结论:链级的 DEX 主导权极具波动性。Solana 一度崛起,以太坊恢复动能,Base 稳步抢占份额,而炒作导向的链往往快速陨落。真正留下来的,不是最吵的,而是最常用的。

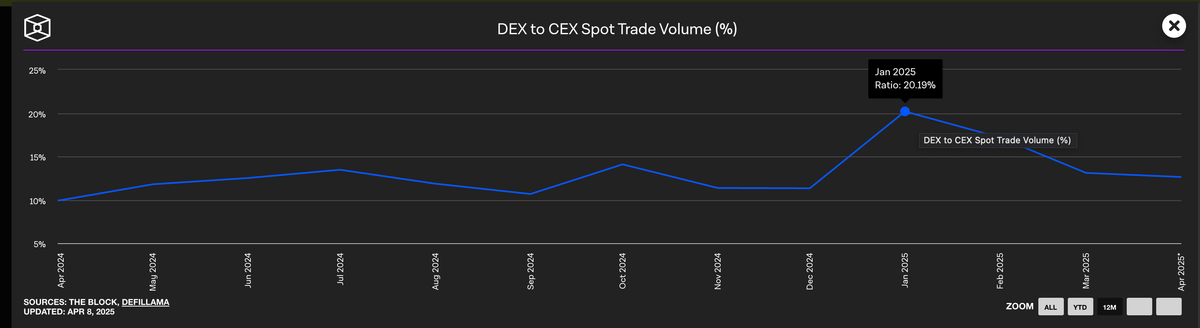

中心化交易所(CEX)仍主导现货交易

尽管 DEX 在 2025 年初迎来爆发,中心化交易所仍然主导着现货市场。

即便在 DEX 高峰的 1 月,CEX 仍保留了近 80% 的总交易量。

CEX 的市场份额虽从 2024 年初的 90% 降至最低点的 79%,但整体趋势仍清晰:

DEX 正在成长,但 CEX 仍是大多数交易者的默认选择。

合约协议的市场份额

链上合约市场在 2024 年发生了巨大变化。

在 dYdX 霸榜超过两年之后,@Hyperliquid 崛起并重塑了“主导地位”的定义。

它在 2 月首次登顶,虽然在年中短暂被 @SynFuturesDefi 超越,但 8 月再次夺回第一后便再未让出。 截至 2025 年 3 月,Hyperliquid 占据了近 59% 的总合约成交量,牢牢确立了其“专业交易者首选平台”的地位。

这次崛起赢得了用户的关注,因为它的产品体验比以往任何去中心化交易所都更接近中心化交易所(CEX)。相比之下,dYdX 的下滑则非常迅速:其在 2024 年初的市场份额为 13.2%,到了 2025 年 3 月却只剩下 2.7%,用户纷纷转向更快、更简洁、更现代化的替代方案。

@JupiterExchange 的合约交易走出了一条不同的道路,凭借 Solana 原生流动性和现货交易入口,迅速攀升至第二位,市场份额达 8.8%。虽然扩张迅速,但仍被 Hyperliquid 牢牢压制。其他项目如 SynFutures、 @Vertex_Protocol 和 @ParadexApp 虽然曾短暂获得关注,但未能持续发力。

合约链:执行层在一个周期内被彻底改写

过去一年中,衍生品基础设施的最大变化并不在于用户偏好哪一个协议,而是他们信任哪一条链来承载交易执行。

2024 年 1 月时,以太坊和 Arbitrum 仍控制着超过 65% 的合约交易量。但到了 2025 年 3 月,这一比例暴跌至仅 11.8%。更快、更高效的执行层开始全面接管。

最引人注目的变化来自 Hyperliquid 的自定义链,其市场份额从 13.6% 飙升至 58.9%。不到一年时间,它就成为默认的合约执行环境,取代了曾主导该领域的 L1 和 L2 链。不仅速度更快,它还提供了专业交易者所需的可靠性和低延迟。

Solana 在 2024 年末也有强劲表现,在 Jupiter 和 Phoenix 的推动下,份额一度接近 16%。但随后逐渐趋于稳定,维持在 10%-11% 左右,未能延续爆发趋势。Base 和 ZKsync 虽曾达到 6%-7% 的峰值,但尚未真正进入顶级梯队。

与此同时,Blast 则成为一个警示案例:它在 2024 年 6 月达到 18.8% 的峰值,却在短短一个月后迅速消失。在这个以产品质量和用户留存为主导的赛道中,光靠炒作无法长久。新的执行标准已经确立——以性能为核心的链重设了行业标准,传统基础设施已不再是默认选项。

DeFi 的未来不会属于链数量最多的那一方,而是属于那些能将叙事转化为用户习惯的链。

声明:

本文转载自 [X]。所有版权归原作者 [@stacy_muur] 所有。若对本次转载有异议,请联系 Gate Learn 团队,他们将及时处理。

免责声明:本文所表达的观点和意见仅代表作者个人观点,不构成任何投资建议。

本文的其他语言翻译由 Gate Learn 团队完成。除非另有说明,否则禁止复制、分发或抄袭翻译文章。