The evolution and change of the global financial system

Background Introduction

The Age of Exploration: The Foundations of Modern Finance (15th - 17th Century)

The Age of Exploration established the building blocks of the modern financial system. The Dutch East India Company, in response to the substantial capital required for global maritime trade, pioneered the issuance of shares—introducing the pricing and partitioning of “trade revenue rights.” This allowed for assets to become tradable and enabled ordinary investors to participate in overseas trade and share in the profits. Around the same period, maritime insurance was born: by pooling premiums, shipowners could transfer shipping risks and create an early model of risk diversification and risk-based pricing. In cross-border commerce, gold and silver—valued for their scarcity and universal acceptance—became the primary instruments of settlement, solving the trust issue between disparate monetary systems. Thus, the earliest financial systems established three core pillars: asset returns (stock investment), risk hedging (maritime insurance), and value settlement (precious metals). These elements supported the expansion of global trade and formed the blueprint for today’s financial architecture.

The Silver Standard and Changing Hegemony (19th Century)

In the 19th century, China’s Qing Dynasty leveraged its competitive advantage in goods such as tea and silk to become a major force in global trade. This led to a significant influx of global silver into China, creating the “China Goods – Global Silver” cycle, where silver became the global settlement currency—its value fundamentally anchored by China’s trade strength. As global trade scaled up, stock trading spread from Europe worldwide, and insurance evolved from maritime to bulk commodity transport. Still, the core financial logic revolved around “asset pricing and risk support.” The Opium War upended this model; Britain’s wartime plunder of Chinese silver destabilized China’s monetary base. Leveraging its own gold reserves, the UK imposed the Gold Standard, redefining international settlement and illustrating how national power determines the status of settlement currencies.

The Bretton Woods Era and Dollar Dominance (20th Century)

In 1944, the Bretton Woods system established the dollar’s peg to gold and all other major currencies’ pegs to the dollar, shifting the global settlement anchor from precious metals to sovereign credit. The dollar emerged as the “central nervous system” of world finance. During this period, global stock market interconnection deepened, with exchanges in New York and London serving as key hubs. The insurance sector began using advanced actuarial models and derivatives for commodity price hedging, and financial markets innovated around “more precise asset pricing and more efficient risk management.” Here, the dollar led settlements, equities handled asset trading, and insurance and derivatives delivered risk hedging, forming a more integrated global financial system that powered post-war economic revival and growth.

When the Bretton Woods system collapsed, the US rapidly negotiated deals with Saudi Arabia and other oil giants to peg the dollar to oil, inaugurating the petrodollar era and extending the dollar’s dominance. By 2024, however, Saudi Arabia announced that oil sales would no longer be exclusively settled in dollars, signaling the end of the petrodollar epoch and the start of a new, evolving global currency order.

The Rise of Complexity and Return to Fundamentals in Modern Finance (21st Century)

In the 21st century, financial innovation reached new heights with the emergence of derivatives, commodity futures, and structured products. These innovations increased efficiency and addressed diverse market demands, but at their core, finance remained anchored in three pillars: return, risk, and settlement. Sophisticated financial instruments extend and adapt the functions of traditional finance—they are iterations of technique. Yet the purpose—return, risk, and settlement—remains constant, underscoring the financial industry’s essential mission: empowering the real economy and optimizing capital allocation.

The Emergence of Next-Gen Financial Models: DeFi and CeFi

DeFi: Blockchain-Powered Decentralized Finance

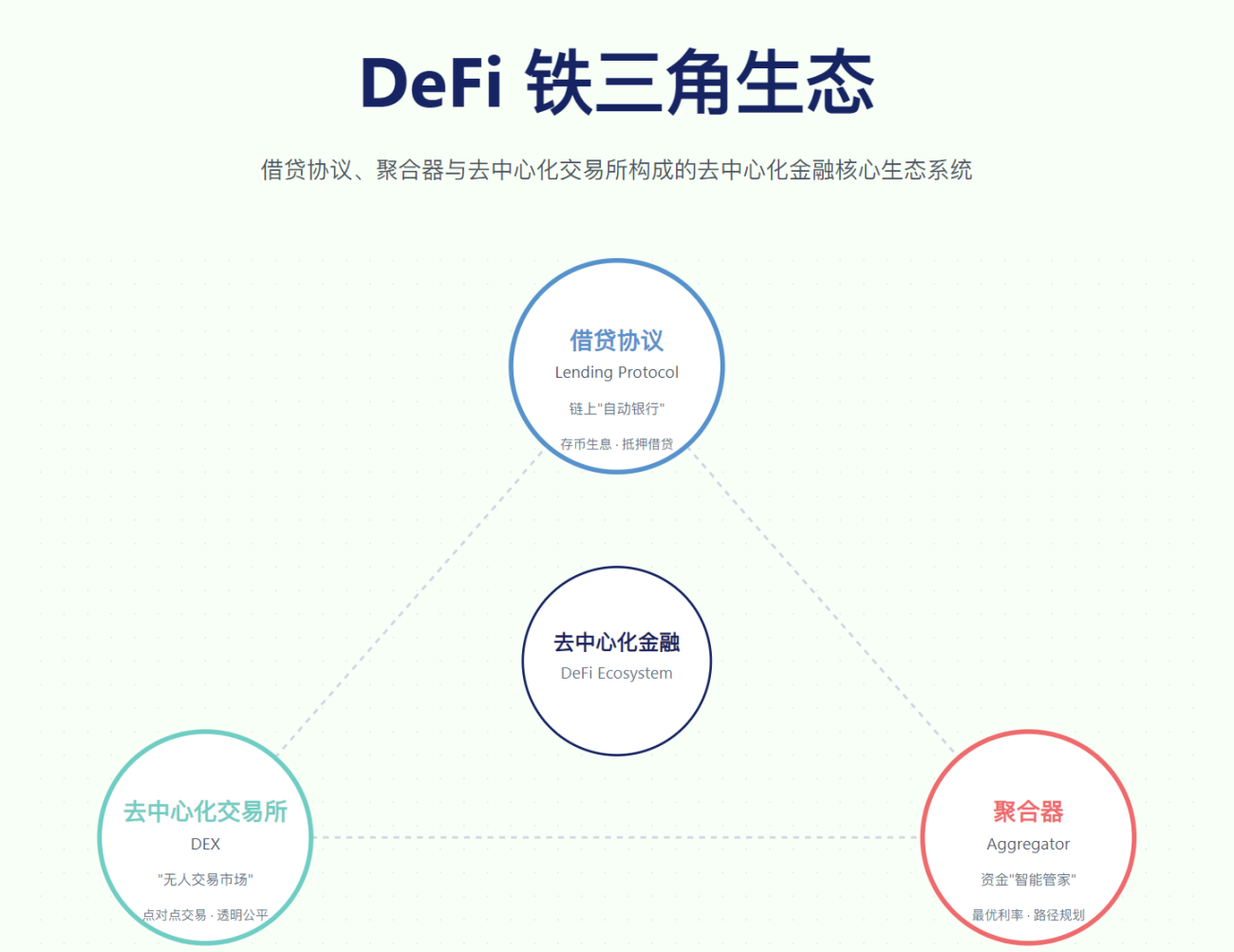

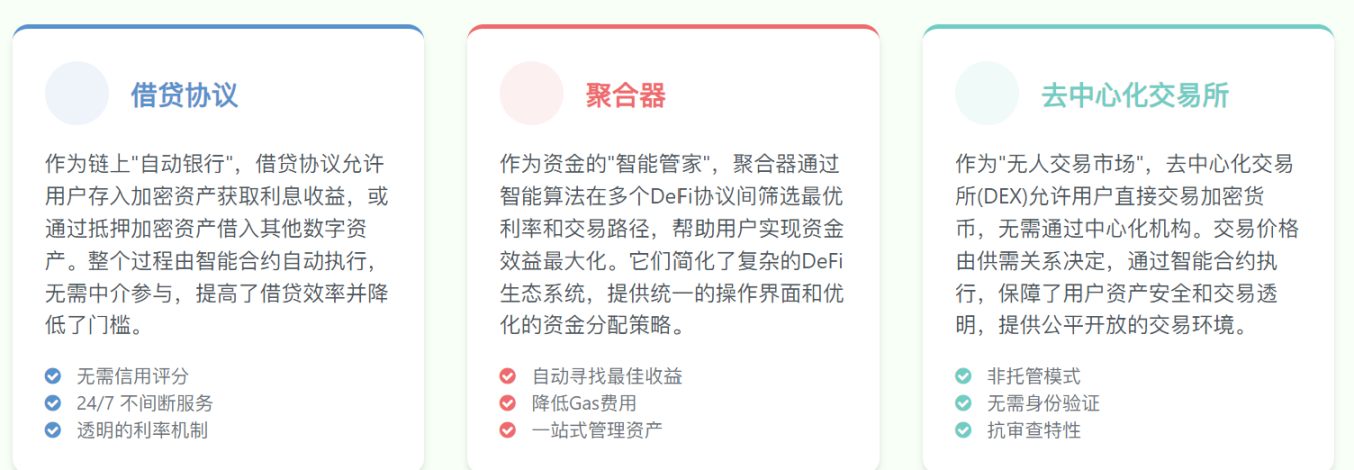

The advent of Ethereum smart contracts in 2015 set the technological foundation for DeFi. Smart contracts enabled financial logic to be coded and executed automatically—no intermediaries required—revolutionizing transaction execution. In the DeFi ecosystem, the “DeFi Triad” is pivotal. In essence, DeFi replicates the core functions of traditional finance, but uses blockchain to deliver full openness, true disintermediation, and automation—breathing new life into the financial system.

CeFi: The Centralized Bridge Linking Traditional and Decentralized Finance

While DeFi offers technical breakthroughs, it also faces challenges—high technical barriers and uncertain regulation. CeFi emerged to bridge this gap, serving as a “converter” between traditional finance and DeFi.

CeFi’s value proposition is clear: it enables seamless exchange between fiat (e.g., CNY, USD) and cryptocurrencies (e.g., BTC, ETH), making transfers between TradFi and DeFi more fluid. CeFi simplifies user experience with intuitive, accessible interfaces, lowering barriers for everyday users and managing asset custody for greater security. Additionally, CeFi provides compliance pathways for banks, brokers, and other traditional institutions exploring blockchain applications, fostering the integration of TradFi and DeFi.

The Fusion of Tradition and Innovation

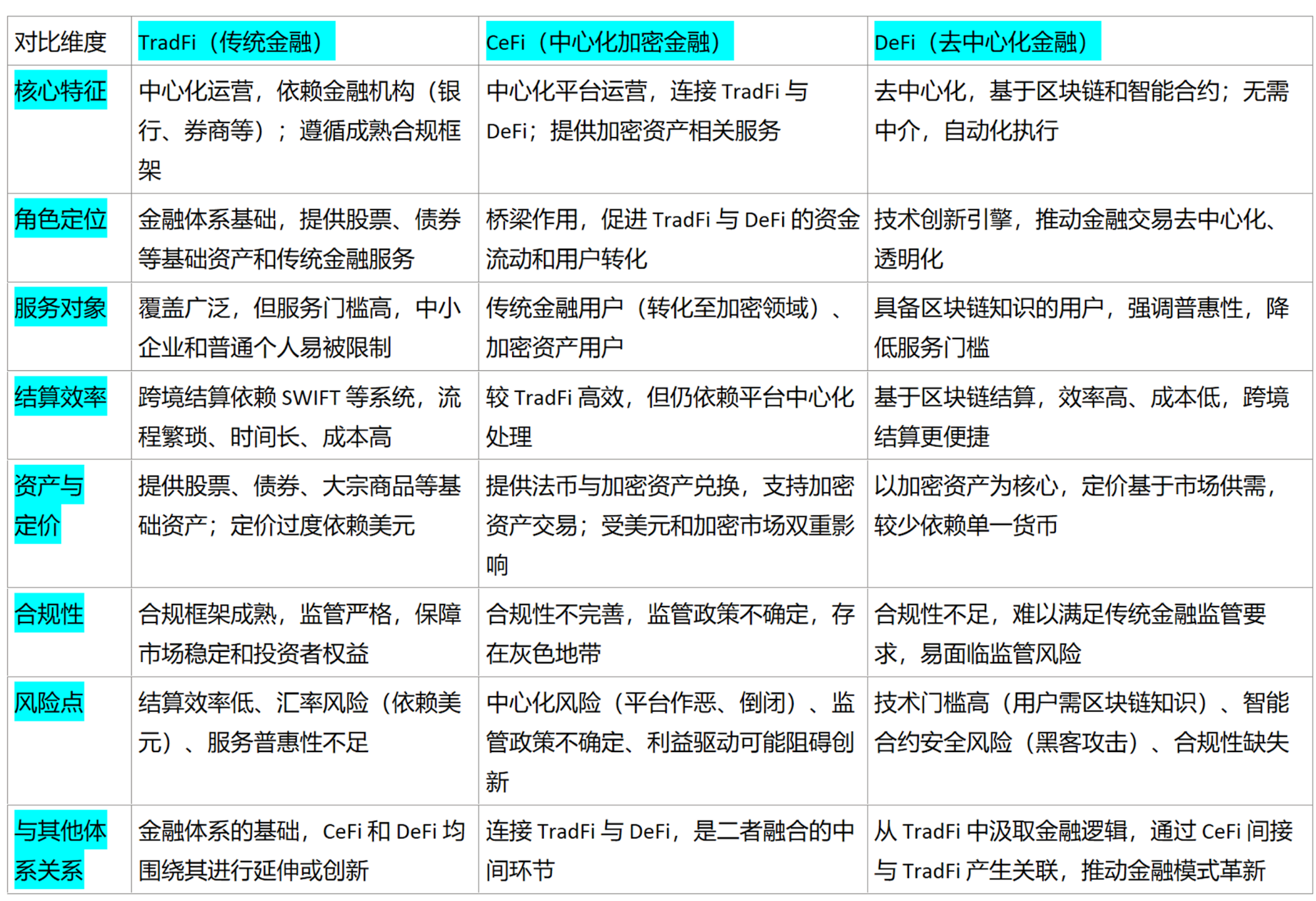

Positioning and Challenges of the Three Financial Systems

TradFi

TradFi comprises the standard financial services familiar to most people: banking (deposits, transfers), stock/fund investments via brokerages, or investments in gold and bonds.

Example: If you want to transfer $10,000 internationally but can’t do it directly, you need to use a bank with cross-border services. The bank converts currency, charges exchange and processing fees, and processes the transaction through SWIFT after significant paperwork and multiple approval steps—often taking days, with fees potentially running into hundreds of dollars. The bank is responsible for the entire transaction flow and for resolving any problems.

This is the TradFi model: for cross-border transfers, investing, or loans, you must go through banks and brokers—no way around them. They set the rules, collect the fees, and bear (and centralize) the risk and responsibility. This leads to low cross-border efficiency, higher costs, and due to the global reliance on US dollar settlements, dollar volatility can expose users to additional risks.

CeFi

CeFi includes centralized crypto platforms, functioning as a “bridge” between TradFi and decentralized crypto. It enables fiat-to-crypto conversion, simplifies crypto operations for non-engineers, and helps banks and brokerages operate crypto businesses compliantly, promoting domain integration. But CeFi also has downsides: regulation isn’t always robust, control is centralized, and some platforms have been caught misappropriating customer assets for their own benefit.

Example: Want to convert your paycheck to ETH for crypto investing but the process is too complicated? A major crypto exchange’s CeFi platform lets you deposit CNY via bank transfer, convert to ETH in a single click, and stake it for yield—no technical research needed—though you’re trusting the platform not to misuse your funds.

DeFi

DeFi leverages blockchain for “decentralized finance”—no banks, no brokers, just transparent, code-based transactions. Transfers and loans are faster, cheaper, and borderless for anyone with blockchain know-how. But DeFi’s hurdles are technical: wallets, private keys, and protocol risks. Security is user-managed; vulnerabilities can mean real losses.

Example: If you own BTC but want ETH, you can connect your wallet on a DeFi platform, select swap terms, and a smart contract will execute the trade with funds sent directly to your wallet—no middlemen, lower fees, and rapid settlement. But lose your private key, and your funds are gone for good.

“Trifi” Ecosystem: The Foundation for Integration

We propose a new concept: “Trifi”—the convergence of TradFi, CeFi, and DeFi. The on-chain migration of traditional finance essentially reflects their gradual fusion, culminating in the birth of Trifi. This evolution—from fragmentation to interconnectivity, and from competition to symbiosis—captures the long-term transformation of finance. Trifi is both the end state and the signature outcome of this integration.

The Logic of Complementary Value: Trifi Ecosystem Synergy

Trifi combines the core strengths of TradFi, CeFi, and DeFi to resolve the pain points of traditional and single-chain finance, creating a more robust and resilient system.

Example: A traditional real estate company (TradFi) owns $10 million in commercial property. To increase liquidity, it legally fractionalizes and tokenizes the property into “A Tokens” (each token representing a share), undergoing regulatory filings. The company, as asset provider, converts real property into digital, on-chain assets. Next, the company chooses a CeFi crypto exchange as intermediary: users transfer USD from bank accounts to convert to stablecoins, and the real estate firm deposits A Tokens into the platform’s custody. After review, a trading pair launches, where users can buy A Tokens with stablecoins, hold them on the platform, or withdraw to personal wallets. The platform thus connects fiat rails and provides a compliant trading scene for A Tokens—bridging users to DeFi. Holders can transfer A Tokens to a DeFi lending protocol, which assesses value via smart contract and enables borrowing against A Token collateral instantly, with no manual approval—everything is code-based. DeFi brings new decentralized tools, letting traditional real estate assets serve as on-chain collateral for lending, greatly improving capital efficiency. This full-cycle migration, from off-chain to on-chain, is powered by all three systems working in concert.

In summary: TradFi supplies assets and capital; CeFi provides the access channel; DeFi offers technical infrastructure. Their integration lets Trifi bridge deep institutional capital with the frontier of on-chain finance.

The Construction and Future Outlook of the Financial System

The Circulatory Core: Payment and Settlement Evolution

Cross-Border Trade Revolution

Blockchain technology is radically reshaping how cross-border settlements are handled in global trade.

Take the Lightning Network, for example. It acts as a “fast lane” on the Bitcoin network: once, small-value international payments were slow and expensive, but now, transfers clear in seconds and fees are a fraction of traditional methods. This empowers small businesses and individuals to operate globally with faster turnarounds and lower costs—making global micro-commerce far more attractive.

As for bulk commodity trades like oil, new Layer2 technology smooths transactions and cuts costs further. Commodities can be “tokenized”—oil, for example, becomes a digital code string. No more opening letters of credit or shuffling shipping paperwork: buyers and sellers transact digital tokens through smart contracts, with instant settlement and dramatic efficiency gains.

Social and Inclusive Finance Innovation

Embedding payment functions into decentralized social platforms is a powerful trend.

Innovations are bringing finance right into our daily lives, with features like “on-chain red packets” and P2P micro-payments. Traditional small-value transfers were costly and clunky, often locked to a handful of payment platforms. Now, decentralized social networks enable easy, low-fee crypto transfers, bypassing the old processes. This especially benefits people in remote areas and the unbanked, broadening access and lowering the cost barrier to financial services.

The Shifting Role of Governments in Settlement

For large, complex, and high-risk cross-border settlements, sovereign governments will long remain in control—shaping policy, regulating institutions, and ensuring stability through international cooperation. When it comes to strategic commodities like oil and minerals, states maintain tight control over settlement currencies and processes to safeguard national economic security and interests.

As blockchain matures, however, smaller-scale cross-border payments will increasingly move on-chain. Governments will need to enact policy frameworks to support, supervise, and guide blockchain’s compliant use in these contexts—balancing innovation with regulation to enhance global financial competitiveness.

The Battle for Pricing Power and Stablecoin Anchors

Dollar Hegemony Under Siege

The US dollar’s global dominance is under pressure as digital currency advances. The US seeks to maintain pricing power with new stablecoin regulations—such as the GENIUS Act—aimed at ensuring most stablecoins (e.g., USDT, USDC) are tightly pegged to the dollar, monitoring reserves and issuers’ operations, and preserving the dollar’s core role. But as global finance grows increasingly multipolar, other countries are developing alternative settlement systems to reduce their reliance on the dollar.

Toward a Multipolar Stablecoin Era

China is aggressively piloting the digital RMB, offering features like controlled anonymity and offline payments, and expanding to retail, transport, and government services. These projects are poised to reshape cross-border settlements along Belt and Road markets and drive RMB internationalization. Similarly, the EU seeks digital currency solutions to boost its standing in global finance and buffer against dollar volatility. Such regional settlement mechanisms challenge the US dollar’s dominance over stablecoins and push global finance toward a “USD-led, multi-currency” stablecoin landscape—fueling diversity and resilience in the system.

New Opportunities: On-Chain Migration of TradFi & DeFi 2.0

The Rise of RWA Tokenization

Tokenization of real-world assets (RWA) represents a major future financial trend. Traditional assets—US stocks, private equity, real estate—are issued as on-chain tokens, becoming new collateral and tradeable targets within DeFi. For example, tokenized US equities allow investors to trade and lend stock tokens on DeFi platforms, offering new capital-raising paths for public companies. Tokenized private equity increases liquidity, while real estate tokenization lowers minimum investment sizes, letting more people invest and benefit—integrating TradFi with DeFi and revitalizing markets.

The Mission and Trajectory of DeFi 2.0

DeFi 2.0 sets out to model the complexity of TradFi in a blockchain-native way—essentially, building an “on-chain Wall Street.” Using assets like tokenized US stocks, DeFi 2.0 supports sophisticated operations such as lending and derivatives. Smart contracts bring traditional product logic and trading strategies on-chain, letting users collateralize stock tokens for capital or trade stock-token-based futures and options—expanding DeFi’s offerings and driving efficiency and transparency.

The Catalytic Role of Traditional Finance

With regulation advancing and mainstream acceptance of crypto assets growing, banks and asset managers are entering the sector—investing in DeFi, collaborating on new applications, and bringing in capital, expertise, and robust risk management to help crypto assets go mainstream. Leveraging trust and client networks, they increase market depth and liquidity, and their compliance practices foster a healthier environment for deeper integration between traditional and new finance.

Summary

In the next wave of on-chain migration for traditional finance, RWA (real-world asset) tokenization will become the mainstream model. From real estate and US equities to private equity, substantial physical assets will be fractionalized as tokens—turning them into “real-asset-backed altcoins” and spurring an “Altcoin Season.” The Ethereum ecosystem, leveraging mature DeFi infrastructure and regulatory compliance, will be the backbone for RWA tokenization, supporting cross-chain asset flows, lending, and more via smart contracts—with growth surging as RWA and DeFi deeply converge.

Key growth areas include RWA tokenization, DeFi innovation within Ethereum, and compliant on-chain exchanges (such as a “Nasdaq on-chain”). Private companies can tokenize equity via compliant methods and raise capital without a traditional IPO, significantly lowering funding barriers. TradFi supplies assets and compliance frameworks; DeFi delivers chain-native financial tools for “recursive strategies” (such as using RWA to mint stablecoins, then investing in other tokenized assets). Together, they are guiding the market from speculative bubbles to the financialization of real-world assets on-chain.

Disclaimer:

- This article is republished from [ForesightNews], with all copyrights retained by the original author [Andy, epochChain]. For concerns about republication, please contact the Gate Learn Team, who will handle any issues promptly and according to procedure.

- Disclaimer: The opinions and views expressed are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless otherwise noted as authorized by Gate, translated articles may not be copied, redistributed, or plagiarized.

Share

Content