Tokenisasi Saham AS: Narasi Baru On-Chain

Artikel ini menjelaskan konsep dan nilai inti dari tokenisasi saham AS dan membandingkannya dengan ekuitas AS tradisional. Ini memberikan gambaran umum tentang lanskap pasar saat ini, menganalisis platform dan pelopor terkemuka, mengeksplorasi risiko yang terkait, dan mendiskusikan potensi masa depan saham AS yang ter-tokenisasi.Ikhtisar

Dalam beberapa tahun terakhir, teknologi blockchain dan pasar cryptocurrency telah mendorong transformasi signifikan dalam keuangan tradisional. Salah satu tren paling menonjol adalah tokenisasi aset dunia nyata (RWA), yang mencakup aset seperti stablecoin (misalnya, USDT, USDC) dan obligasi pemerintah (misalnya, BUIDL).

Saat teknologi semakin matang dan kerangka regulasi terus berkembang, saham U.S. yang ditokenisasi bisa muncul sebagai kelas aset RWA ketiga yang muncul, mengikuti stablecoin dan obligasi pemerintah, menawarkan potensi pasar yang sangat besar dan dampak jangka panjang.

Nilai Inti

Pasar saham AS adalah yang terbesar di dunia, dengan total kapitalisasi pasar melebihi $50 triliun, menampilkan aset berkualitas tinggi di sektor teknologi, keuangan, dan konsumen. Namun, pasar ekuitas AS tradisional memiliki beberapa keterbatasan, seperti hambatan masuk yang tinggi, jam perdagangan yang terbatas, dan kompleksitas investasi lintas batas.

Tokenisasi mengubah aset saham menjadi token digital yang terikat pada blockchain, menawarkan manfaat-manfaat kunci berikut:

Aksesibilitas Global: Saham AS yang ditokenisasi dapat diperdagangkan 24/7, menghilangkan pembatasan geografis dan zona waktu serta memungkinkan partisipasi investor global kapan saja.

Kepemilikan Fraksional: Tokenisasi memungkinkan investor untuk membeli saham pecahan dari saham berharga tinggi (misalnya, Apple atau Tesla), secara signifikan menurunkan ambang batas investasi dan membuat saham lebih mudah diakses oleh investor ritel.

Penyelesaian Efisien: Blockchain memungkinkan penyelesaian T+0 atau bahkan penyelesaian secara real-time, secara drastis meningkatkan efisiensi transaksi.

Biaya Transaksi Lebih Rendah: Perdagangan ekuitas tradisional melibatkan banyak pihak perantara, seperti perusahaan pialang dan bursa, yang menyebabkan biaya yang lebih tinggi. Tokenisasi, dengan memanfaatkan sifat terdesentralisasi blockchain, mengurangi ketergantungan pada pihak perantara dan memotong biaya.

Likuiditas yang Ditingkatkan: Aset ter-tokenisasi dapat diintegrasikan ke dalam protokol keuangan terdesentralisasi (DeFi) sebagai jaminan atau pasangan perdagangan, yang secara signifikan meningkatkan likuiditasnya. Token saham U.S. juga dapat digunakan untuk membangun indeks dan produk dana dalam DeFi, memperluas kasus penggunaannya di seluruh ekosistem.

Keuntungan-keuntungan ini membuat saham U.S. yang telah ditokenisasi menarik bukan hanya bagi investor tradisional tetapi juga menyuntikkan energi baru ke pasar kripto.

Analisis Komparatif

Tabel berikut membandingkan saham U.S. yang ter-tokenisasi dengan pasar saham tradisional dalam berbagai dimensi, termasuk bentuk aset, platform perdagangan, likuiditas, dan kepatuhan. Perbandingan ini memberikan pemahaman yang lebih jelas tentang kelebihan dan tantangan saham U.S. yang ter-tokenisasi, menawarkan para investor pandangan komprehensif dari kedua pendekatan investasi.

Riwayat Pengembangan

Sejarah perkembangan saham AS yang di-tokenisasi menunjukkan peralihan dari konsep eksperimental menjadi aplikasi utama, didorong oleh kemajuan teknologi, dukungan regulasi, dan penerimaan pasar yang semakin meningkat. Dibandingkan dengan stablecoin dan tokenisasi obligasi pemerintah, saham AS yang di-tokenisasi dimulai lebih lambat tetapi memiliki potensi besar karena ukuran (lebih dari $50 triliun) dan keragaman pasar saham AS.

Sumber:https://backed.fi/news-updates/backed-issued-tokenized-coinbase-stock-bcoin-on-base

Gambaran Umum Situasi Saat Ini

Per 14 April 2025, total aset on-chain untuk Aset Dunia Nyata (RWA) secara global sekitar $20.88 miliar, dengan aset terkait saham sebesar sekitar $414 juta, hanya menyumbang sekitar 2% dari total aset RWA on-chain.

Dalam aset terkait saham, EXOD mendominasi pasar dengan pangsa 95,57%, menyoroti kepemimpinan pasarannya. Sebaliknya, TSLA dan NVDA hanya menyumbang 0,09% dan 0,02%, masing-masing, meskipun dua saham ini memiliki kapitalisasi pasar besar dan sangat diikuti di pasar saham tradisional.

Saat ini, pasar tokenisasi RWA masih berada dalam tahap awal, dengan EXOD berpotensi menjadi pelopor. Namun, melakukan tokenisasi saham dari perusahaan besar lainnya menghadapi berbagai tantangan, termasuk hambatan teknologi dan regulasi.

Sumber:https://app.rwa.xyz/stocks

Sumber: https://app.rwa.xyz/

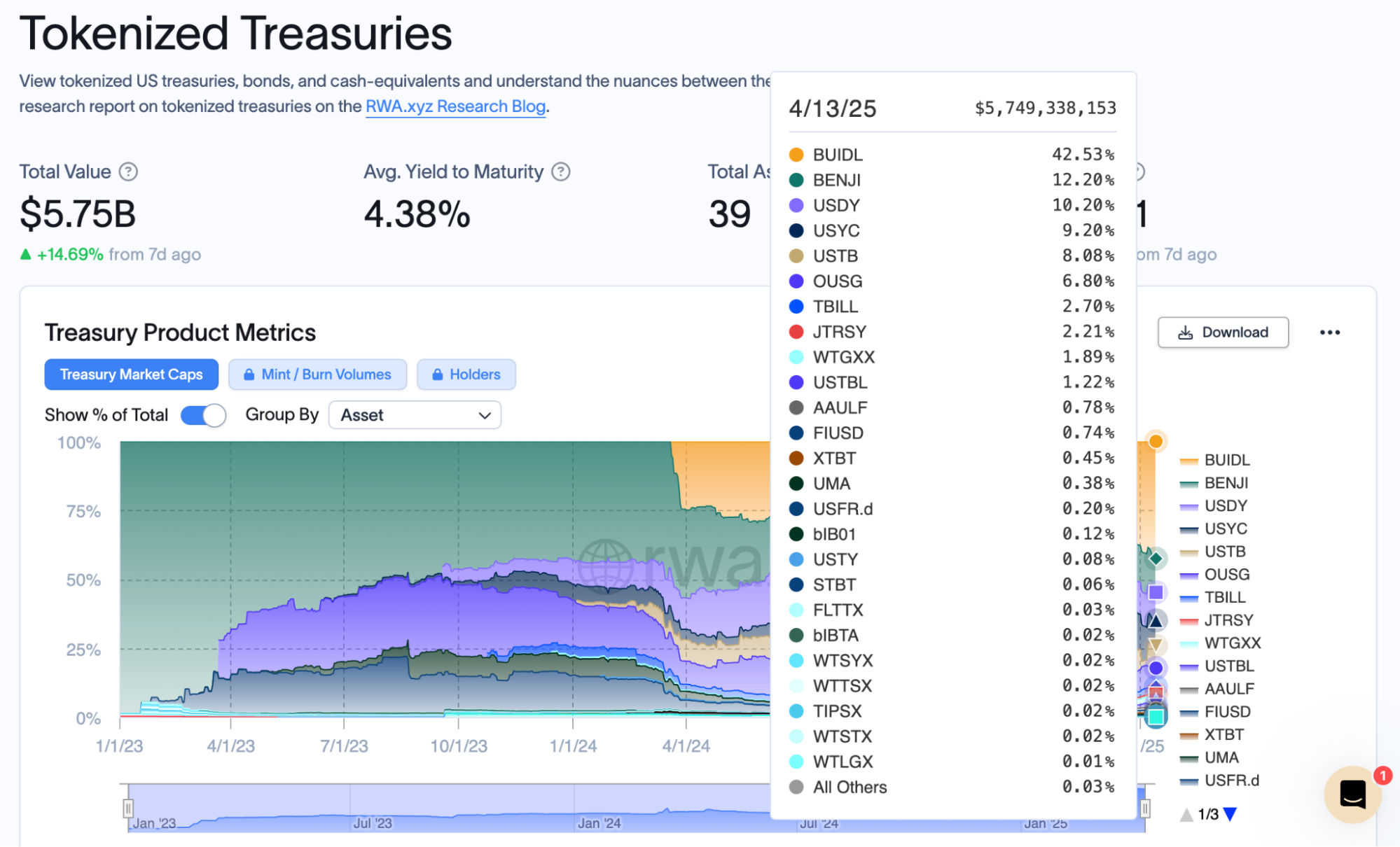

Dibandingkan dengan stablecoin dan tokenisasi obligasi pemerintah, tokenisasi saham AS lebih kompleks, tetapi ukuran pasar dan daya tariknya tidak diragukan lagi lebih besar. Pada 14 April 2025, total kapitalisasi pasar stablecoin sekitar $233.65 miliar, dan tokenisasi obligasi pemerintah (seperti Buidl) telah mencapai $5.75 miliar dengan cepat. Jika tokenisasi saham AS dapat mengatasi hambatan regulasi dan teknologi, diperkirakan skala nya akan melampaui angka-angka tersebut dengan cepat.

Sumber: https://defillama.com/stablecoins

Sumber: https://app.rwa.xyz/treasuries

Pioneer: Gerakan Exodus Inc. (EXOD)

Exodus Movement Inc. (EXOD) adalah perusahaan fintech yang berbasis di Omaha, Nebraska, AS, berfokus pada blockchain dan aset digital. Produk intinya adalah dompet kripto penjagaan diri (Exodus Wallet). Tokenisasi saham EXOD adalah kasus penting dalam bidang tokenisasi saham di AS.

Format Tokenisasi:

Nama Token: EXIT (sekarang diperdagangkan sebagai EXOD)

Blockchain: Diterbitkan di blockchain Algorand, dengan setiap token EXIT mewakili satu saham saham kelas A Exodus, dipatok 1:1.

Metode Penerbitan: Diterbitkan pada Juni 2021 melalui platform Securitize di bawah Reg A+ (pengecualian hukum Sekuritas AS), berhasil mengumpulkan $75 juta, dengan total saham yang diterbitkan sebanyak 2,73 juta.

Platform Perdagangan: Awalnya diperdagangkan di Pasar Securitize dan pasar over-the-counter (OTC) dengan kode saham EXOD. Pada 18 Desember 2024, EXOD mulai diperdagangkan di NYSE American dengan simbol ticker EXOD.

Fungsi dan Fitur:

Kepatuhan: Disetujui oleh SEC AS, mengharuskan kepatuhan dengan standar KYC/AML. Investasi tersedia untuk pengguna yang memenuhi syarat di AS dan lebih dari 40 negara lainnya.

Aksesibilitas: Mendukung investor ritel, dengan token disimpan di dompet Exodus, memungkinkan pengelolaan yang terpadu dengan aset digital lainnya.

Efisiensi: Teknologi blockchain memungkinkan penyelesaian cepat (misalnya, distribusi dividen) dan catatan transparan, mengurangi biaya perantara.

Token saham tokenized EXOD menggabungkan inovasi dan potensi pertumbuhan, berfungsi sebagai patokan untuk tokenisasi saham AS. Namun, volatilitas tinggi memerlukan kehati-hatian. Cocok untuk investor yang optimis tentang RWA, namun keputusan harus didasarkan pada dinamika pasar.

Sumber: https://app.rwa.xyz/assets/EXOD

Ikhtisar Platform

Tokenisasi saham di Amerika Serikat, sebagai cabang utama dari tokenisasi Aset Dunia Nyata (RWA), telah melihat munculnya beberapa proyek perwakilan dalam beberapa tahun terakhir. Proyek-proyek ini menggunakan teknologi blockchain untuk mendigitalkan saham, bertujuan untuk meningkatkan efisiensi perdagangan, menurunkan hambatan masuk, dan meningkatkan likuiditas. Berikut adalah beberapa proyek perwakilan utama, mencakup berbagai jenis teknologi dan jalur kepatuhan:

Securitize

Ikhtisar: Securitize adalah platform yang berfokus pada tokenisasi kepatuhan aset, bermitra dengan perusahaan pialang tradisional untuk menerbitkan sekuritas digital yang terikat pada saham-saham AS.

Fitur:

- Menyediakan kerangka STO (Security Token Offering) yang mematuhi SEC untuk memastikan kepatuhan KYC/AML.

- Mendukung kepemilikan pecahan, memungkinkan investor untuk membeli pecahan ter-tokenisasi dari saham seperti Amazon, Tesla, dll.

- Memanfaatkan kontrak pintar untuk penyelesaian real-time dan distribusi dividen otomatis.

Kemajuan: Pada tanggal 14 April 2025, $2 miliar aset telah berhasil ditokenisasi on-chain. Securitize telah menstabilkan beberapa aset saham U.S., dengan proyek-proyek terkemuka termasuk Exodus Movement Inc. (EXOD), BlackRock’s U.S. Dollar Institutional Digital Liquidity Fund (BUIDL), dan Arca U.S. Treasury Fund.

Signifikansi: Securitize mewakili jalur yang patuh untuk menggabungkan keuangan tradisional dengan teknologi blockchain, menarik investor institusional.

Sumber: https://securitize.io/invest

Protokol Cermin (Eksplorasi Awal)

Ikhtisar: Protokol Mirror adalah platform terdesentralisasi berbasis blockchain Terra (sekarang dihentikan), yang menggunakan aset sintetis untuk mensimulasikan harga saham AS.

Fitur:

- Pengguna dapat melakukan perdagangan saham U.S. yang ditokenisasi (misalnya, Apple, Google) sebagai mAssets tanpa benar-benar memiliki saham tersebut.

- Data harga saham real-time diperoleh melalui orakel seperti Chainlink.

- Dukungan perdagangan 24/7, ditujukan untuk pengguna kripto global.

Kemajuan: Protokol Mirror mencapai puncaknya antara 2020-2021 namun menurun karena runtuhnya ekosistem Terra.

Signifikansi: Meskipun tidak aktif, Protokol Cermin menunjukkan potensi untuk tokenisasi terdesentralisasi dan menginspirasi proyek-proyek berikutnya.

Sumber: https://x.com/mirror_protocol

Dinar

Ikhtisar: Dinari adalah startup yang berbasis di California yang didedikasikan untuk tokenisasi sah saham AS, dengan investasi dari raksasa keuangan tradisional seperti Susquehanna.

Fitur:

- Berpokus pada mengubah saham-saham AS menjadi token keamanan berbasis blockchain, dengan menekankan kepatuhan terhadap hukum sekuritas AS.

- Menggunakan penjaga teratur untuk menyimpan aset yang mendasari, memastikan kecocokan 1:1.

- Menyediakan antarmuka perdagangan yang ramah pengguna yang ditujukan untuk investor kripto dan tradisional.

Kemajuan: Meluncurkan uji coba pada tahun 2023, dengan perluasan penawaran saham U.S. tambahan dimulai pada tahun 2024.

Signifikansi: Dinari mewakili tren proyek-proyek yang muncul bekerjasama dengan Wall Street, dengan fokus pada kesesuaian regulasi.

Sumber: https://sbt.dinari.com/tokens?orderType=0

Synthetix (Platform Aset Sintetis)

Ikhtisar: Synthetix adalah protokol berbasis Ethereum yang memungkinkan penerbitan token sintetis, yang dikenal sebagai Synths, yang melacak harga saham AS.

Fitur:

- Token (mis., sAAPL, sTSLA) tidak memiliki saham aktual tetapi mensimulasikan harga saham menggunakan orakel.

- Mendukung integrasi dengan ekosistem DeFi, memungkinkan token digunakan sebagai jaminan, pinjaman, dll.

- Tidak diperlukan KYC, terbuka untuk pengguna global, meskipun dengan kepatuhan yang lebih rendah.

Kemajuan: Pada tahun 2023, Synthetix memperluas jangkauan Synths terkait saham AS, meskipun beberapa fitur dibatasi karena tekanan regulasi.

Signifikansi: Synthetix menunjukkan bagaimana keuangan terdesentralisasi dapat menawarkan solusi inovatif untuk melakukan tokenisasi saham-saham U.S., meskipun kepatuhan masih perlu ditingkatkan.

Sumber: https://x.com/ChainLinkGod/status/1385338143746924544

InvestaX

Ikhtisar: InvestaX adalah platform tokenisasi berbasis di Singapura, yang berfokus pada penerbitan dan perdagangan token keamanan, termasuk aset terkait saham AS.

Fitur:

- Menyediakan solusi dari awal hingga akhir dari penerbitan hingga perdagangan pasar sekunder.

- Mendukung struktur tokenisasi SPV (Special Purpose Vehicle) untuk saham-saham AS, sesuai dengan regulasi Singapura dan AS.

- Memungkinkan baik investor ritel maupun institusional untuk berpartisipasi, meningkatkan aksesibilitas pasar.

Kemajuan: Pada tahun 2024, InvestaX melakukan tokenisasi saham ekuitas di beberapa perusahaan yang terdaftar di NASDAQ, dengan pertumbuhan volume perdagangan yang stabil.

Signifikansi: InvestaX memperlihatkan potensi pasar Asia dalam tokenisasi saham AS, dengan menekankan kepatuhan regulasi lintas batas.

Sumber: https://www.investax.io/

Risiko

1. Risiko Teknis

Kerentanan Kontrak Pintar: Tokenisasi bergantung pada kontrak pintar di blockchain, dan jika ada kelemahan dalam kode, hal itu bisa menyebabkan pencurian aset atau kegagalan transaksi. Sebagai contoh, pada tahun 2023, Curve mengalami kerentanan yang mengakibatkan kerugian sebesar $70 juta.

Masalah Skalabilitas Blockchain: Blockchain publik utama seperti Ethereum mungkin menghadapi biaya gas tinggi atau keterlambatan transaksi saat waktu sibuk, membatasi skenario perdagangan saham frekuensi tinggi. Misalnya, meskipun Rantai Dasar memiliki biaya lebih rendah, stabilitasnya untuk transaksi skala besar masih belum terbukti.

Serangan Jaringan: Para peretas bisa menargetkan node blockchain, dompet, atau bursa dengan serangan seperti serangan 51% atau penipuan phishing, yang mengancam keamanan aset ter-tokenisasi.

Masalah Interoperabilitas: Aset yang diberi token harus dapat berinteraksi di berbagai rantai atau terintegrasi dengan lancar dengan sistem keuangan tradisional. Jika standar tidak disatukan, hal itu dapat menyebabkan silo data atau kegagalan transaksi.

Ketidakmatangan Teknologi Penitipan Aset: Aset ter-tokenisasi memerlukan teknologi penitipan untuk memastikan keberadaan dan kepatuhan aset riil. Meskipun teknologi penitipan multi-tanda tangan dan terdesentralisasi sedang berkembang, namun masih menghadapi keterbatasan teknis dan tidak dapat sepenuhnya menjamin keamanan aset.

Risiko Manajemen Dompet: Jika pengguna kehilangan kunci privat atau frasa mnemonik mereka, mereka bisa kehilangan aset saham tokenisasi mereka secara permanen, dan sifat tak terbalik dari blockchain membuat pemulihan hampir tidak mungkin.

Sumber: https://www.chainalysis.com/blog/curve-finance-liquidity-pool-hack/

2. Risiko Pasar

Spekulasi dan Volatilitas: Saham yang di-tokenisasi mungkin menarik spekulan, terutama mereka yang menggunakan protokol DeFi untuk memperbesar leverage (misalnya, token leverage 50x), yang dapat meningkatkan volatilitas pasar. Sebagai contoh, pada 12 Maret 2025, bursa kontrak perpetual terdesentralisasi Hyperliquid mengalami likuidasi besar-besaran, dengan satu trader mengendalikan lebih dari $200 juta nilai ETH dengan leverage 50x.

Risiko Likuiditas: Kolam perdagangan saham ter-tokenisasi mungkin kurang dalam, menyebabkan slippage atau ketidakmampuan untuk mengeksekusi perdagangan, terutama selama panik pasar. Dibandingkan dengan triliunan dalam kolam likuiditas pasar tradisional, pasar DeFi biasanya hanya memiliki kolam senilai jutaan hingga ratusan juta, yang dapat menimbulkan kesulitan dalam mengeksekusi perdagangan selama fluktuasi pasar.

Manipulasi Pasar: Anonimitas blockchain bisa digunakan untuk manipulasi, seperti skema "pump and dump", yang memengaruhi keadilan harga saham yang di-tokenkan.

Kurangnya Pendidikan Investor: Investor ritel mungkin tidak sepenuhnya memahami mekanisme aset ter-tokenisasi (seperti aturan penyelesaian on-chain), yang mengakibatkan pengambilan keputusan yang buruk atau menjadi korban proyek-proyek penipuan.

Persaingan dari Pasar Tradisional: Jika saham yang ditokenisasi tidak menawarkan keuntungan signifikan (misalnya, biaya lebih rendah atau efisiensi yang lebih tinggi), mereka mungkin kesulitan menarik investor tradisional, membatasi ukuran pasar mereka.

3. Risiko Kepatuhan

Ketidakpastian Regulasi: Klasifikasi aset ter-tokenisasi yang samar oleh SEC di AS dapat menyebabkan aset tersebut dianggap sebagai sekuritas, memerlukan kepatuhan dengan Undang-Undang Sekuritas. Jika regulasi semakin ketat, platform-tokenisasi mungkin menghadapi denda atau bahkan penutupan. Sebagai contoh, pada tahun 2021, Binance menghapus daftar pasangan perdagangan saham ter-tokenisasi (seperti Tesla dan Google) karena tekanan regulasi.

Persyaratan Anti-Pencucian Uang (APU) dan Kenal Customer Anda (KYC): Anonimitas blockchain dapat menimbulkan kekhawatiran tentang pencucian uang atau pembiayaan ilegal. Regulator dapat memberlakukan proses KYC/APU yang ketat, meningkatkan biaya operasional dan melemahkan sifat terdesentralisasi dari platform-platform ini.

Konflik Kepatuhan lintas Batas: Saham AS yang Ditokenisasi mungkin menarik investor global, tetapi perbedaan dalam regulasi sekuritas di berbagai negara bisa menyebabkan tantangan kepatuhan. Misalnya, pembatasan China terhadap perdagangan cryptocurrency bisa menghambat partisipasi dari beberapa pasar.

Kompleksitas Pajak: Perdagangan aset ter-tokenisasi bisa memicu masalah pajak yang kompleks, seperti pajak capital gains atau kesulitan dalam melacak transaksi on-chain, meningkatkan beban kepatuhan bagi para investor.

Risiko Penegakan Hukum: Jika platform tokenisasi gagal untuk memenuhi persyaratan regulasi dengan baik, mereka mungkin menghadapi pembekuan aset atau tindakan hukum, yang dapat memengaruhi kepercayaan pengguna dan keamanan aset.

Sumber: https://www.cnbc.com/2021/07/16/crypto-exchange-binance-halts-stock-tokens-as-regulators-circle.html

Tinjauan Masa Depan

Stablecoin, karena stabilitas harganya dan fungsionalitas pembayarannya, menjadi pelopor untuk Aset Dunia Nyata (RWAs), banyak diterapkan dalam pembayaran lintas batas dan DeFi. Obligasi pemerintah yang ditokenisasi menarik investor institusi karena risiko rendah dan kredibilitas tinggi, memenuhi permintaan akan aset yang aman di pasar kripto. Sebaliknya, saham-saham AS yang ditokenisasi menawarkan pertumbuhan tinggi dan diversifikasi, mencakup sektor-sektor seperti teknologi, energi, dan kesehatan, memenuhi kebutuhan investor dengan selera risiko yang berbeda.

Jika saham AS yang ditokenisasi berkembang lancar, ukuran pasar bisa mencapai ratusan miliar dolar dalam 5-10 tahun mendatang, menjadi pilar ketiga terbesar dari RWAs. Berikut adalah jalur kunci untuk mencapai tujuan ini:

Kematangan Teknologi: Solusi Layer 2 seperti Ethereum dan Polygon akan mengurangi biaya transaksi dan meningkatkan efisiensi on-chain dari aset ter-tokenisasi.

Ketegasan Regulasi: Regulasi yang jelas tentang aset yang ditokenisasi dari pasar global utama (misalnya, AS dan UE) akan sangat meningkatkan kepercayaan industri.

Integrasi Ekosistem: Jika saham U.S. yang ditokenisasi dapat terintegrasi dengan lancar ke dalam ekosistem DeFi dan NFT, itu akan mendorong lebih banyak skenario inovatif, seperti pinjaman yang dijamin oleh saham dan token indeks.

Dorongan Institusional: Kolaborasi yang dalam antara keuangan tradisional dan blockchain akan mempercepat proses tokenisasi, seperti yang terlihat pada perusahaan pialang yang meluncurkan platform perdagangan saham yang sudah ditokenisasi.

Kesimpulan

Dalam konteks perkembangan pesat blockchain dan cryptocurrency, tokenisasi aset dunia nyata (RWAs) muncul sebagai tren signifikan. Sebagai arah kunci dalam bidang ini, tokenisasi saham AS menunjukkan potensi pasar yang substansial dan peluang inovasi. Dengan teknologi blockchain, aset tradisional seperti saham AS dapat mencapai perdagangan global 24/7, ambang investasi yang lebih rendah, dan likuiditas yang meningkat.

Saat ini, saham U.S. yang ditokenisasi masih dalam tahap awal, dengan proyek-proyek representatif seperti EXOD memegang pangsa pasar kecil. Namun, potensi pertumbuhannya tidak boleh dianggap remeh. Seiring institusi keuangan tradisional semakin terlibat, skala dan skenario aplikasi dari saham U.S. yang ditokenisasi akan terus berkembang, berpotensi menjadi kelas aset RWA terbesar ketiga setelah stablecoin dan obligasi pemerintah.

Meskipun menghadapi berbagai tantangan, termasuk ketidakpastian regulasi, risiko teknis, masalah likuiditas pasar, dan risiko operasional, pasar ini diharapkan akan berkembang secara bertahap seiring dengan kemajuan teknologi dan peraturan yang semakin jelas, sehingga menjadi alat penting bagi investor global. Oleh karena itu, para investor sebaiknya menilai risiko dengan hati-hati dan membuat keputusan berdasarkan toleransi risiko mereka.

Secara keseluruhan, meskipun ada ketidakpastian dan risiko yang terkait dengan saham U.S. yang ditokenisasi, prospek pengembangan masa depan mereka cukup menjanjikan, sehingga layak untuk terus diperhatikan.