Predicción de precio de BCH: Un profundo análisis del futuro de Bitcoin Cash

Bitcoin Cash (BCH) es una de las principales altcoins que surgieron del legado de Bitcoin. Como una criptomoneda con su propia filosofía de escalabilidad y objetivos de eficiencia de transacciones distintos, BCH ha generado un gran interés entre inversores y comerciantes.

A largo plazo, el futuro de BCH está entrelazado tanto con las innovaciones tecnológicas como con la adopción del mercado en general. Aunque persisten incertidumbres y factores externos como los cambios regulatorios podrían perturbar incluso las mejores predicciones, los inversores que monitorean continuamente los indicadores técnicos y las tendencias fundamentales pueden posicionarse mejor para el éxito. En última instancia, las predicciones de precios de BCH sirven como una guía, una herramienta para ayudar a navegar por el mundo volátil pero emocionante del comercio de criptomonedas.

Se alienta a los inversores a permanecer diligentes, diversificar sus carteras y tomar decisiones basadas en un análisis exhaustivo tanto de datos técnicos como de desarrollos del mundo real. A medida que Bitcoin Cash continúa evolucionando, su trayectoria de precios puede ofrecer oportunidades de beneficios significativos para aquellos que estén preparados para su inherente volatilidad.

Image Source: Sitio web

Comprender Bitcoin Cash

Bitcoin Cash se creó en agosto de 2017 como resultado de una bifurcación dura de Bitcoin. Los partidarios de BCH imaginaron un sistema de efectivo digital con tarifas de transacción más bajas y tiempos de confirmación más rápidos, en respuesta a los desafíos de escalabilidad que Bitcoin había encontrado. Con el tiempo, BCH ha evolucionado su protocolo con tamaños de bloque más grandes, una mayor capacidad de transacción y mejoras de desarrollo continuas. A pesar de la volatilidad ocasional y la competencia de otras criptomonedas, BCH ha logrado mantenerse como una de las principales criptomonedas por capitalización de mercado.

Características clave de BCH

- Escalabilidad: BCH aumentó el límite del tamaño del bloque (inicialmente 8MB y luego se amplió) para manejar un mayor número de transacciones por segundo. Esto redujo la congestión de la red y disminuyó las tarifas.

- Velocidad y costo de transacción: Con una confirmación de bloque más rápida y tarifas minimizadas, BCH está diseñado para transacciones diarias entre pares.

- Descentralización: Al igual que otras redes blockchain, Bitcoin Cash está impulsado por una red descentralizada de mineros que validan transacciones utilizando un mecanismo de consenso de prueba de trabajo (PoW).

- Adopción en el mercado: Aunque la adopción de BCH por parte de comerciantes e inversores sigue siendo mixta en comparación con Bitcoin (BTC), sus características tecnológicas siguen atrayendo el interés entre los usuarios que valoran la utilidad y la velocidad.

Factores técnicos que impulsan la predicción del precio de BCH

La predicción del precio de cualquier criptomoneda depende tanto del análisis técnico como del análisis fundamental. Cuando se trata de BCH, varios indicadores técnicos son ampliamente utilizados por los analistas para predecir movimientos futuros de precios:

Promedios móviles

Los promedios móviles suavizan los datos de precios para resaltar tendencias. Los analistas suelen observar los promedios móviles simples de 50 días y 200 días (SMAs) para identificar niveles de soporte y resistencia:

- SMA de 50 días: Los traders a corto plazo utilizan la SMA de 50 días para medir el impulso. Una SMA de 50 días en ascenso puede indicar una tendencia alcista de precios, mientras que una en descenso puede sugerir debilidad.

- SMA de 200 días: Para las tendencias a largo plazo, la SMA de 200 días es crucial. El precio de Bitcoin Cash operando por encima de la SMA de 200 días a menudo se considera una señal alcista, mientras que operar por debajo de ella puede indicar una tendencia bajista a largo plazo.

Índice de Fuerza Relativa (RSI)

El RSI mide el impulso en una escala de 0 a 100:

- Condiciones de sobrecompra: RSI por encima de 70 sugiere que BCH podría estar listo para una corrección.

- Condiciones de sobreventa: RSI por debajo de 30 indica que el activo podría estar subvaluado. Típicamente, un RSI en el rango neutral (30–70) sugiere que el activo está bastante valuado, pero la divergencia o condiciones extremas podrían señalar futuras reversas.

MACD (Convergencia y Divergencia de Medias Móviles)

El indicador MACD ayuda a los traders a identificar la dirección de la tendencia y los cambios de momentum al comparar EMAs a corto plazo y a largo plazo. Cuando la línea MACD cruza por encima de la línea de señal, se considera alcista; un cruce en la dirección opuesta es bajista.

Niveles de soporte y resistencia

Los niveles horizontales clave actúan como barreras donde el precio de BCH tiende a encontrar soporte (cuando el precio está cayendo) o encontrar resistencia (cuando el precio está subiendo). Para BCH, los datos históricos muestran que ciertos rangos de precios han actuado repetidamente como pisos o techos. Observar estos niveles ayuda a predecir la probabilidad de reversión de precios.

Factores Fundamentales que Impactan BCH

El análisis técnico proporciona una instantánea del sentimiento del mercado, pero los factores fundamentales también moldean las perspectivas a largo plazo de BCH:

Adopción de la red y volumen de transacciones

El crecimiento en el número de comerciantes y usuarios que aceptan BCH como pago es crucial. El aumento del volumen de transacciones y de direcciones activas indica un mayor uso en el mundo real, lo que potencialmente impulsa la demanda.

Desarrollo y Actualizaciones Tecnológicas

Las mejoras en curso, como las funciones mejoradas de privacidad, los protocolos de tamaño de bloque optimizados y las integraciones con soluciones de capa-2, pueden hacer que BCH sea más atractivo. Las actualizaciones exitosas pueden aumentar la confianza de los inversores, lo que se traduce en aumentos de precios.

Sentimiento del mercado y tendencias macroeconómicas

Las condiciones económicas globales, los desarrollos regulatorios y las tendencias del mercado de criptomonedas influyen fuertemente en el precio de BCH. Por ejemplo, en períodos de mayor riesgo o volatilidad, los inversores podrían acudir a criptomonedas más establecidas o 'más seguras', mientras que los ciclos alcistas del mercado podrían beneficiar a altcoins como BCH.

Actividad de ballenas e interés institucional

Grandes inversores o "ballenas" que poseen cantidades significativas de BCH pueden impactar el precio a través de grandes operaciones. El interés institucional, especialmente si las grandes firmas financieras incorporan BCH en sus carteras de inversión, puede llevar a flujos sustanciales y respaldar el precio.

Tendencias históricas de precios de BCH

Observar la historia de precios de BCH proporciona contexto para su potencial futuro:

- 2017: En su inicio, BCH tenía un precio similar al de Bitcoin, pero rápidamente se distanció a medida que el mercado probaba sus afirmaciones de escalabilidad.

- 2020: BCH experimentó volatilidad con períodos de máximos significativos y fuertes declives, en medio de fluctuaciones más amplias en el mercado de criptomonedas.

- 2021-2022: Los inversores presenciaron aumentos de fluctuaciones mientras BCH intentaba establecerse en medio de presiones regulatorias e incertidumbres del mercado.

- 2023–Principios de 2024: BCH experimentó consolidación, con rangos de negociación relativamente estrechos, antes de que catalizadores recientes (como actualizaciones de protocolo o anuncios institucionales) despertaran un interés renovado.

La historia muestra que, a pesar de los períodos de estancamiento, BCH tiene el potencial de recuperarse rápidamente. Estos ciclos son importantes para predecir hacia dónde podría dirigirse el precio a continuación.

Predicción del precio de BCH a corto plazo (2025)

Las predicciones de precios a corto plazo para BCH en 2025 varían entre plataformas, pero generalmente sugieren movimientos significativos:

- Rango esperado: Los analistas pronostican que BCH operará entre $300 y $800 durante 2025. Incluso algunas fuentes predicen que, en condiciones alcistas, BCH podría acercarse o superar la marca de $1,000.

- Niveles clave de soporte: Un piso alrededor de $300 es crucial. Si BCH se mantiene por encima de este nivel y experimenta indicadores técnicos positivos, podría ver un impulso al alza.

- Catalizadores: Las próximas actualizaciones tecnológicas o el aumento en el uso de la red a mediados de 2025 podrían llevar los precios al extremo superior del rango predicho.

Por ejemplo, herramientas técnicas como TradingView y CoinCodex muestran niveles de RSI y medias móviles en equilibrio dinámico. Esto indica un mercado equilibrado listo para una corrección al alza si los catalizadores se alinean favorablemente.

Predicción del precio de BCH a medio plazo (2026-2027)

Extendiendo la vista aún más:

- 2026 Pronóstico: Los analistas esperan que BCH experimente ganancias moderadas en 2026, con un precio promedio potencial en el rango de $700 a $900. Esta predicción se basa en las actualizaciones de la red previstas y un aumento gradual en la adopción.

- 2027 Pronóstico: Los escenarios más alcistas prevén que BCH pruebe niveles de resistencia significativos, posiblemente alcanzando o superando los $1,100. En un escenario donde el sentimiento general del mercado sigue siendo positivo y la adopción institucional se expande, los inversores podrían ver que el valor de BCH supera máximos anteriores. Sin embargo, se debe tener precaución dada la volatilidad inherente de las altcoins.

Las líneas de tendencia técnica, combinadas con las tendencias más amplias del mercado de criptomonedas, sugieren que 2026 podría servir como un período de consolidación, sentando las bases para una carrera alcista en 2027. Una ruptura exitosa de estos niveles serviría como un momento crucial para la trayectoria de precios de BCH.

Predicción del precio a largo plazo de BCH (2030 y más allá)

Mirando más adelante, las predicciones de precio a largo plazo de BCH dependen de las tendencias macro y de la capacidad de BCH para capturar cuota de mercado:

- Perspectivas para 2030: Algunos analistas a largo plazo proyectan que BCH podría tener un promedio entre $1,200 y $2,000 para 2030. Esta previsión optimista depende de que BCH mantenga su proposición de valor única, progreso tecnológico y aumento en la adopción global. La idea fundamental es que a medida que las monedas digitales se convierten en un medio de pago aceptado en todo el mundo, el papel de BCH en transacciones rápidas y de bajo costo podría generar un crecimiento sustancial.

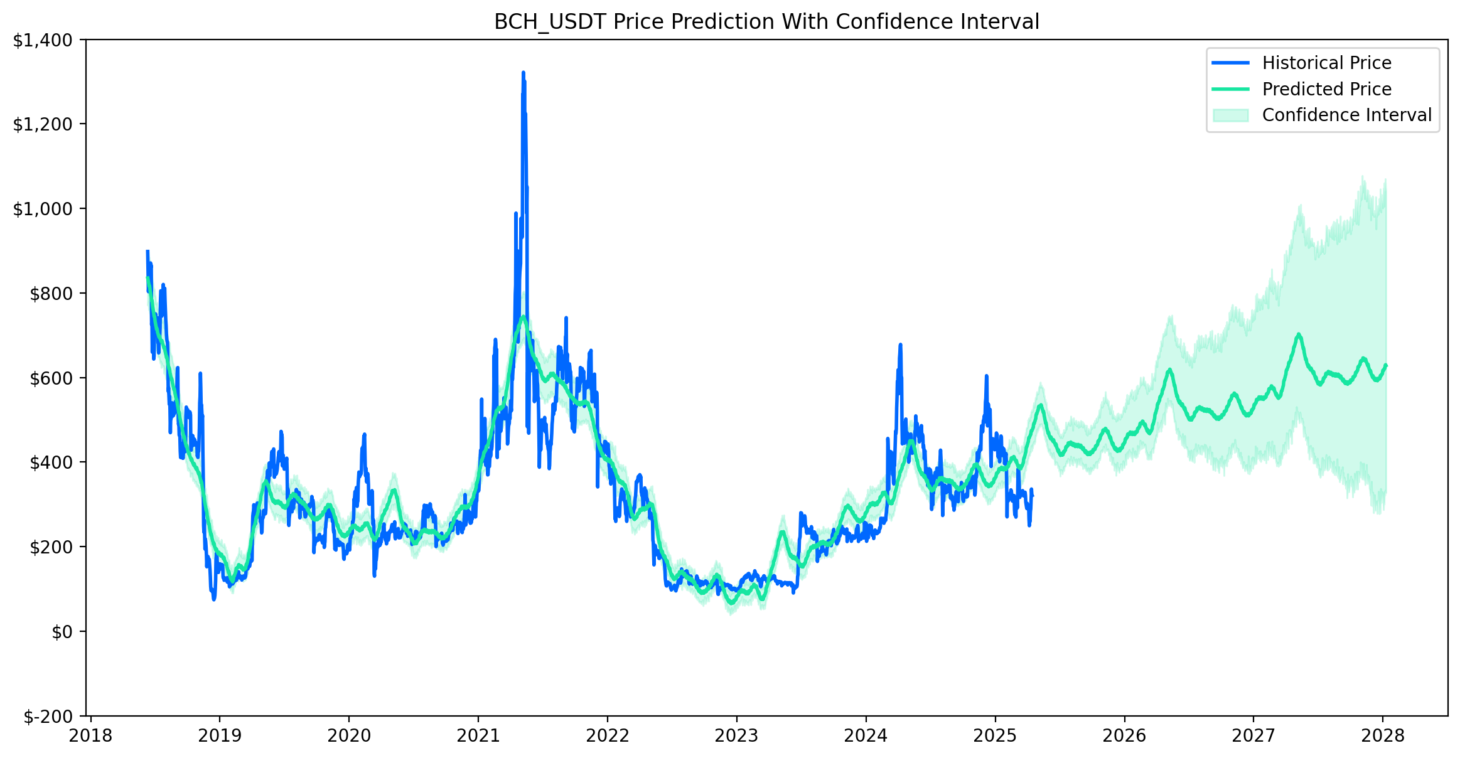

El modelo de IA Prophet proyecta que BCH en un futuro cercano tendrá un movimiento ascendente. Imagen :Predicción de precio BCH_USDTCon Intervalo de Confianza

Impulsores clave: La amplia aceptación institucional, la integración en sistemas de pago y las mejoras en escalabilidad y privacidad podrían impulsar BCH al alza. Sin embargo, la competencia de otras criptomonedas y posibles cambios regulatorios podrían moderar las expectativas.

Riesgos potenciales: Factores macroeconómicos, como recesiones o represiones regulatorias, podrían frenar o revertir las tendencias de crecimiento a largo plazo. Los inversores deben ser conscientes de que estas previsiones a largo plazo conllevan una considerable incertidumbre.

Cómo comprar $BCH en Gate.io

Paso 1: Regístrese para obtener una cuenta

Comience visitando Gate.ioy haga clic en “Registrarse” para crear su cuenta. Ingrese su dirección de correo electrónico, cree una contraseña segura y siga las instrucciones de registro.

Paso 2: Completa la Verificación KYC

Para asegurar que su cuenta sea segura y cumpla con las regulaciones globales, complete el proceso de Conozca a su Cliente (KYC, por sus siglas en inglés). Esto suele implicar enviar un documento de identidad emitido por el gobierno y posiblemente un autorretrato. Una verificación adecuada aumenta la seguridad de su cuenta y desbloquea todas las funciones de negociación.

Paso 3: Depositar Fondos

Una vez que tu cuenta esté verificada, deposita fondos en tu monedero de Gate.io. Puedes utilizar varios métodos, como transferencias bancarias, tarjetas de crédito o débito, e incluso otras criptomonedas. Asegúrate de depositar suficientes fondos para cubrir tu inversión deseada, así como cualquier tarifa aplicable.

Paso 4: Localice $BCH

En la sección de trading de la plataforma, utiliza la barra de búsqueda para encontrar $BCH. Gate.io suele listar $BCH con varios pares de trading, como $BCH/USDT. Revisa el precio de mercado actual y las opciones de orden disponibles antes de proceder.

Paso 5: Coloque su orden

Decida si desea realizar una orden de mercado o una orden limitada. Una orden de mercado se ejecutará inmediatamente al precio actual, mientras que una orden limitada le permite establecer su propio precio. Ingrese la cantidad de $BCH que desea comprar, revise detenidamente los detalles de la orden y luego confirme la transacción.

Cómo utilizar esta predicción para tomar decisiones de inversión

Las predicciones de precios de BCH son una herramienta útil para planificar estrategias de entrada y salida, pero no deben tomarse como consejos de inversión. Los inversores siempre deben realizar su propia investigación y considerar tanto el análisis técnico como el fundamental. Aquí hay algunos consejos:

Diversifique su cartera: no confíe únicamente en las predicciones de precio de BCH. Una cartera de criptomonedas diversificada puede mitigar riesgos.

Indicadores Clave de Monitoreo: Mantenga un ojo vigilante en promedios móviles, niveles de RSI e indicadores MACD. Estos pueden proporcionar señales tempranas de cambios de tendencia inminentes.

Ver noticias fundamentales: Mantente informado sobre actualizaciones de blockchain, anuncios regulatorios e indicadores de sentimiento del mercado.

Establecer órdenes de stop-loss: En un mercado tan volátil como el de criptomonedas, proteger su capital con órdenes de stop-loss es esencial.

Sé paciente: las predicciones de precios ofrecen una visión general, pero pueden no capturar fluctuaciones a corto plazo. Una perspectiva a largo plazo es crucial para las inversiones en criptomonedas.

Conclusión

Bitcoin Cash sigue siendo un activo convincente en el diversificado panorama criptográfico, con su enfoque en la escalabilidad y las bajas comisiones de transacción que le otorgan una ventaja única sobre sus competidores. Si bien las previsiones a corto plazo del precio de BCH para 2025 sugieren un rango de negociación potencial de $300 a $800, con perspectivas de superar los $1,000 en condiciones ideales, las previsiones a medio plazo para 2026-2027 insinúan un crecimiento moderado y consolidación, sentando potencialmente las bases para ganancias más sólidas para 2030.

Descargo de responsabilidad: Las inversiones en criptomonedas conllevan riesgos. Siempre realice una investigación exhaustiva antes de invertir.

Compartir

Contenido