دليل سريع للتقارب

إعادة توجيه العنوان الأصلي 'دليل 3 دقائق على Converge: إطلاق شبكة الاختبار قريبًا'

في 17 أبريل، قام مشروع العملات الرقمية Converge بإصدار المواصفات الفنية الأولية وخريطة الطريق للتطوير بالتعاون بين Ethena Labs و Securitize. كمنصة مبتكرة مصممة لربط التمويل التقليدي (TradFi) و DeFi، يركز Converge على الأداء العالي والأمان على مستوى المؤسسات وسهولة الاستخدام. يخطط لإطلاق الشبكة الرئيسية هذا العام وتعزيز تنفيذ تطبيقات مالية بمقياس كبير. سيقوم هذا المقال بتحليل المواصفات الفنية لـ Converge ونقاط الضوء في الخريطة الزمنية والتأثير المحتمل.

(اليسار هو الرئيس التنفيذي لشركة Securitize، اليمين هو الرئيس التنفيذي لشركة Ethena Labs)

1. تم تطويره بالتعاون بين Ethena Labs وشركة التكنولوجيا المالية Securitize

تعد Converge جهد تعاوني بين Ethena Labs وشركة التكنولوجيا المالية Securitize، وهي تعتبر شبكة بلوكشين عالية الإنتاجية تركز على دعم توريق الأصول الحقيقية وتطبيقات DeFi. يهدف المشروع إلى جذب رؤوس الأموال المؤسسية إلى النظام البيئي للعملات المشفرة من خلال الابتكار التكنولوجي والامتثال التنظيمي، مع تقديم تجارب DeFi فعالة للمستخدمين التجزئة. رؤيتها الأساسية هي كسر الحواجز بين التمويل التقليدي والتشفيري، وتعزيز تدفق رؤوس الأموال والتكامل العالمي لأسواق أسعار الفائدة.

لقد تراكمت لدى Ethena Labs خبرة غنية في مجال DeFi مع النمو السريع لـ USDe (حيث بلغت القيمة السوقية مرة واحدة أكثر من 6 مليارات دولار أمريكي، مما جعلها تحتل المرتبة الثالثة كأكبر عملة مستقرة)، بينما تتمتع Securitize بخبرة تقنية وامتثال عميقة في مجال توريق الأصول. تعطي التعاون بين الشركتين Converge ميزة فريدة: يمكنها ليس فقط تلبية متطلبات المؤسسات الصارمة بشأن الأمان والامتثال، ولكن أيضًا توفير الانفتاح والابتكار في مجال DeFi.

2. سلسلة EVM عالية الأداء مع USDe و USDtb كرسوم غاز

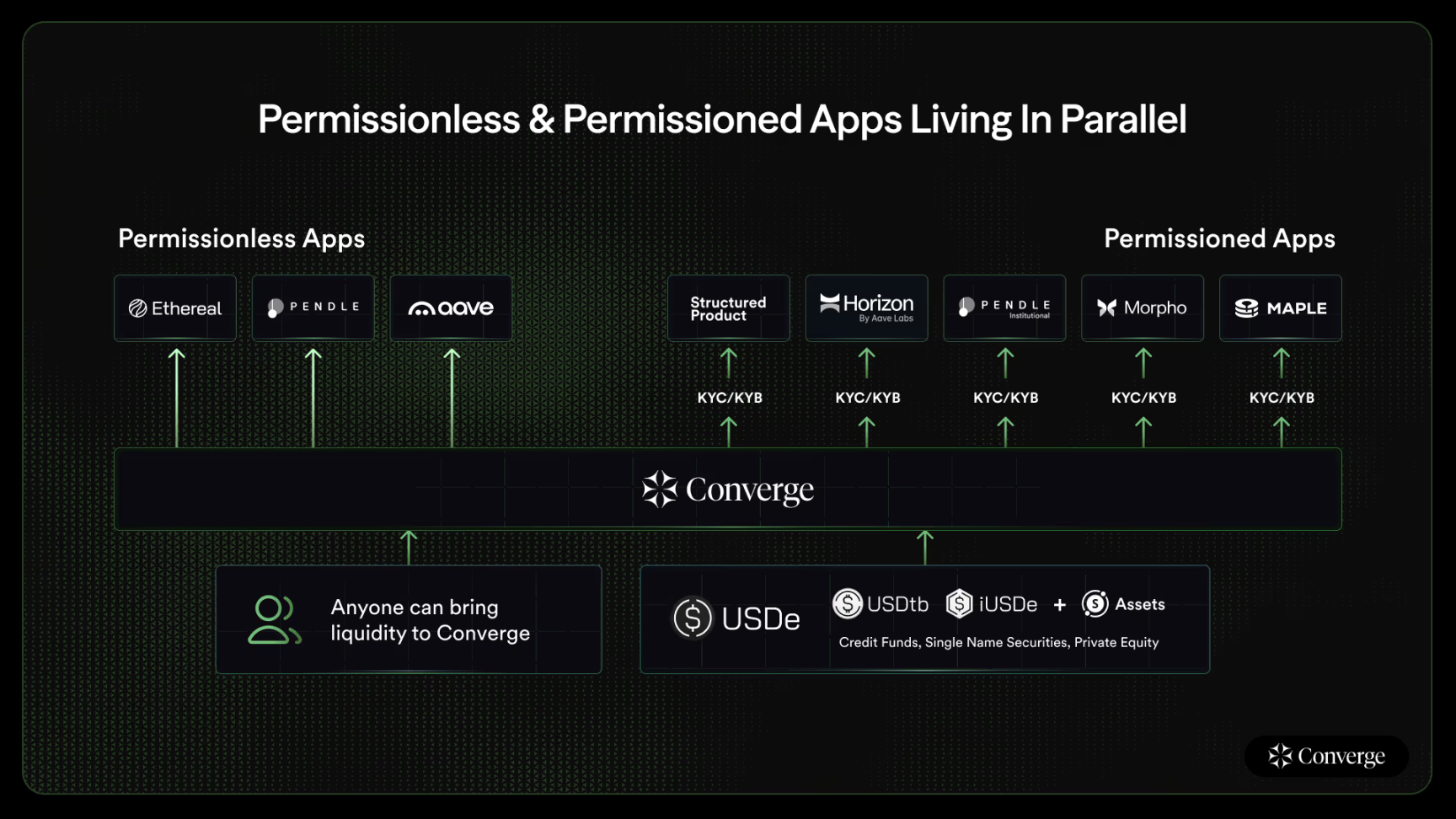

سيدعم شبكة Converge كل من تطبيقات DeFi غير المرخصة ومنتجات مؤسسية عالية الجودة المرخصة، محققةً تكامل البنية التحتية المالية التقليدية والتشفيرية على نفس السلسلة. تم تصميم الهندسة المعمارية الفنية لـ Converge حول ثلاثة أركان هي الأداء والأمان وتجربة المستخدم. التالي هو تفسير مفصل لمواصفاتها التقنية الأساسية:

أداء عالي EVM

تعتمد Converge على معمارية تعتمد على آلة الحسابات الظاهرية (EVM) لضمان التوافق مع النظام البيئي DeFi الحالي، مع تحقيق أداء فائق عالي من خلال الأمثلة المخصصة. ستحقق الشبكة أوقات كتل أصلية تبلغ 100 مللي ثانية عند الإطلاق وأقصى قدر من الإنتاجية يصل إلى 100 مليون غاز/ثانية (Mgas/s). يوضح الخريطة الزمنية أنه بحلول الربع الرابع من عام 2025، ستتم تقليل أوقات الكتل إلى 50 مللي ثانية بشكل أكبر، ومن المتوقع أن يصل الإنتاجية إلى 1 مليار غاز/ثانية (Gigagas/s). تتجاوز هذه المقاييس الأداء معظم الشبكات الحالية في الطبقة 1 والطبقة 2 وتكفي لدعم المعاملات المالية على نطاق واسع وتنفيذ العقود الذكية المعقدة.

تكامل Arbitrum و Celestia

تحقق Converge منخفض التأخير ومقياسية عالية من خلال دمج تكنولوجيا Arbitrum's rollup وطبقة توافر البيانات Celestia. يوفر Arbitrum معالجة معاملات فعالة وبيئة تنفيذ عقود ذكية، بينما تقلل Celestia من تكاليف الشبكة من خلال فصل تخزين البيانات، مما يضمن استقرار وتوقع رسوم المعاملات. يسمح هذا التصميم النمطي لـ Converge بتحقيق توازن بين الأداء والتكلفة، مما يجعله مثاليًا للتطبيقات المؤسسية.

العملة المستقرة كرسوم الغاز

لتعزيز تجربة المستخدم، تستخدم Converge العملات المستقرة مثل USDe و USDtb لرسوم الغاز بدلاً من الرموز الأصلية المتقلبة التقليدية. يتيح هذا التصميم للمستخدمين تقدير ودفع رسوم المعاملات بتعبيرات الدولار الأمريكي، مما يقضي على عدم اليقين الناتج عن تقلب أسعار العملات الرقمية. بالإضافة إلى ذلك، يدعم الشبكة معيار الانحياز الحسابي ERC-7702، مما يبسط عمليات المحفظة ويقضي على نقاط الألم المتعلقة بموافقات الرموز ERC-20 وإدارة الغاز المعقدة.

شبكة تحقق الكاشف (CVN)

تقدم Converge شبكة محققة فريدة من نوعها (CVN) التي تأمن الشبكة من خلال رهن رموز ENA التابعة لـ Ethena. تعتمد CVN نموذج تحقق مصرح به (PoS، مجموعة إذن)، مع آلية KYC/KYB (معرفة العميل/العمل) لضمان أن المحققين يلبون متطلبات الامتثال. تستهدف هذه التصميم بشكل خاص المستخدمين المؤسسيين لتلبية احتياجات إدارة المخاطر والامتثال الخاصة بهم. في الوقت نفسه، تعتمد الشبكة بنية ذات طبقتين: تحكم الشبكة الأساسية بحقوق الوصول بشكل صارم، وتدعم الطبقة التطبيقية واجهات بدون إذن اختيارية لتوفير مرونة للمطورين. من أجل المشاركة في CVN، يجب على المحققين رهن رمز حوكمة Ethena، ENA. أعلن الفريق أن CVN سيتم إطلاقه قريبًا بعد إطلاق الشبكة الرئيسية.

جهاز تسلسل G2 مخصص

يستخدم Converge متسلسل G2 المخصص بواسطة Conduit، مدمجًا مع مجموعة تقنيات Arbitrum، لتوفير تسلسل وتأكيد فعال للمعاملات. يعتبر هذا المتسلسل جزءًا أساسيًا في تحقيق أوقات كتل بمدة 100 مللي ثانية ونفاذية فائقة، مما يضمن استقرار الشبكة تحت سيناريوهات الحمل العالي.

3. سيتم إطلاق شبكة الاختبار في الأسابيع القادمة، ومن المخطط أن يكون الشبكة الرئيسية في الربع الثاني

أعلنت Converge أيضًا خارطة طريقها لعام 2025، التي توضح بوضوح الأهداف الرئيسية من نشر الشبكة التجريبية إلى إطلاق الشبكة الرئيسية، مقسمة إلى المراحل التالية:

2025 الربع الثاني: إطلاق شبكة الاختبار

من المتوقع أن يتم إطلاق شبكة الاختبار في الأسابيع القليلة القادمة لتوفير فرص الوصول المبكر للمطورين لاختبار أداء الشبكة ونشر العقود الذكية ووظائف تفاعل المستخدمين. ستركز شبكة الاختبار على التحقق من الأداء الفعلي لأوقات الكتلة 100 مللي ثانية ورسوم الغاز للعملة المستقرة.

2025 الربع الثاني: إطلاق الشبكة الرئيسية

قال الرئيس التنفيذي لشركة Securitize كارلوس دومينغو في مقابلة إن Converge تخطط لإطلاق الشبكة الرئيسية قبل نهاية الربع الثاني. ستدعم الشبكة الرئيسية المستخدمين المؤسسيين والتجزئة، مع التركيز الأولي على تعزيز توزيع USDe على مستوى مؤسسي (مثل من خلال الهيئات ذات الغرض الخاص SPV) وتطوير تطبيقات DeFi.

2025 الربع الرابع: ترقيات الأداء

بحلول نهاية عام 2025، تخطط Converge لتقليل أوقات الكتل إلى 50 مللي ثانية وزيادة الإنتاجية إلى 1Gigagas/s لتلبية احتياجات الأصول المرمزة والمعاملات المالية في الوقت الحقيقي. بالإضافة إلى ذلك، ستقوم الشبكة بتقديم المزيد من أدوات المطورين، مثل وظائف التجريد المحسنة للحسابات وقوالب العقود الذكية، لتقليل حواجز التطوير.

4. الاستنتاج

تأتي إطلاق Converge في وقت تتلاقى فيه المالية التقليدية و DeFi. تمنحه البنية المعمارية عالية الأداء والتصميم المركز على الامتثال مزايا مميزة لاعتماد المؤسسات. على سبيل المثال، ذكرت الرئيس التنفيذي لـ Franklin Templeton، جيني جونسون، في يناير 2025 أن الأطر التنظيمية الواضحة ستدفع إلى تكامل TradFi و DeFi، وآليات Converge للمعرفة المسبقة للعميل (KYC/KYB) ونموذج العارض المصرح به يتناولان مباشرة هذا الاتجاه.

ومع ذلك، تواجه Converge أيضًا تحديات. قد يثير نموذج المحقق المصرح به مخاوف المجتمع حول مخاطر التمركز. على الرغم من أن طبقة التطبيق الخاصة بها تدعم واجهات غير مصرح بها، إلا أن التحكم في الشبكة الأساسية لا يزال مركزًا في أيدي عدد قليل من المحققين. بالإضافة إلى ذلك، يعتمد تحقيق أهداف الأداء العالي على استقرار Arbitrum و Celestia، وقد تؤثر أي عقبات تقنية على تقدم خريطة الطريق.

تمثل Converge فرصة تجمع بين الابتكار التكنولوجي والإمكانيات التطبيقية العملية. ومع ذلك، لا تزال نجاحها بحاجة إلى وقت ليتم اختباره، خاصة فيما يتعلق بالبيئة التنظيمية والاستقرار التقني والتنافس في النظام البيئي. أداء Converge في العام القادم سيكون بالتأكيد يستحق المتابعة عن كثب.

تنصل المسؤولية:

تم نقل هذه المقالة من [Gateأخبار الرؤية]. إعادة توجيه العنوان الأصلي 'دليل سريع للتقاء: إطلاق شبكة الاختبار قريبًا'. حقوق النشر تنتمي إلى الكاتب الأصلي [1912212.eth، Foresight News]. If you have any objections to the reprint, please contact بوابة تعلمسيتولى الفريق التعامل معه في أقرب وقت ممكن وفقًا للإجراءات ذات الصلة.

إخلاء المسؤولية: تعبر الآراء والآراء المعبر عنها في هذه المقالة عن آراء الكاتب فقط ولا تشكل أي نصيحة استثمارية.

تُترجم النسخ الأخرى من المقال بواسطة فريق Gate Learn. قد لا يُسمح بنسخ أو توزيع المقال المترجم أو نسخه دون ذكر Gate.io.